Ethereum Transaction Cost FUD Spiraling Upward: Is ETH in Danger?

Concerns are starting to mount surrounding Ethereum and its blockchain as the cost of processing transactions may be getting too expensive for some users. Such concerns were recently voiced by none other than Vitalik Buterin, the co-founder of Ethereum. What could this mean for Ethereum, the second-largest cryptocurrency by market value with a market cap upwards of $20 billion?

Is the Ethereum Blockchain in Danger?

According to Buterin, the fact that the network’s utilization has already risen to 90% may keep organizations from joining the network.

If you’re a bigger organization, the calculus is that if we join, it will not only be more full but we will be competing with everyone for transaction space. It’s already expensive and it will be even five times more expensive because of us. There is pressure keeping people from joining, but improvements in scalability can do a lot in improving that. – He said.

Even though the hype surrounding ICOs which clogged up the Ethereum network last year is long gone, reports have it that a new tenant is taking over its blockchain – the most popular stablecoin, Tether (USDT).

Tether’s current market cap is upwards of $4 billion and it’s currently the sixth largest cryptocurrency by market value. According to Tether’s transparency page, approximately $1.5 billion worth of USDT is circulating on Ethereum’s network, which is a little bit less than 40% of Tether’s entire circulating supply. As the stablecoin takes up more and more capacity, this leaves a lot less room for other developers to join the network, hence Buterin’s concerns.

Apparently, some developers are already delaying work, as noted by Jeff Dorman, CEO of an LA-based asset management fund that invests in cryptocurrencies.

So the biggest implication today is simply that developers may be incentivized to wait until this transition happens before fully committing to build on Ethereum. […] Tether isn’t helping. – Dorman said.

It’s worth noting that Ethereum is currently making efforts to transition to a Proof-of-Stake consensus algorithm which is different from the Proof-of-Work protocol that the network uses presently. It is also working on implementing scalability improvements known as “Sharding” and “Plasma”, but until that happens, it’s unclear how the team will handle their imminent capacity and scalability issues.

What Does This Mean for the Price?

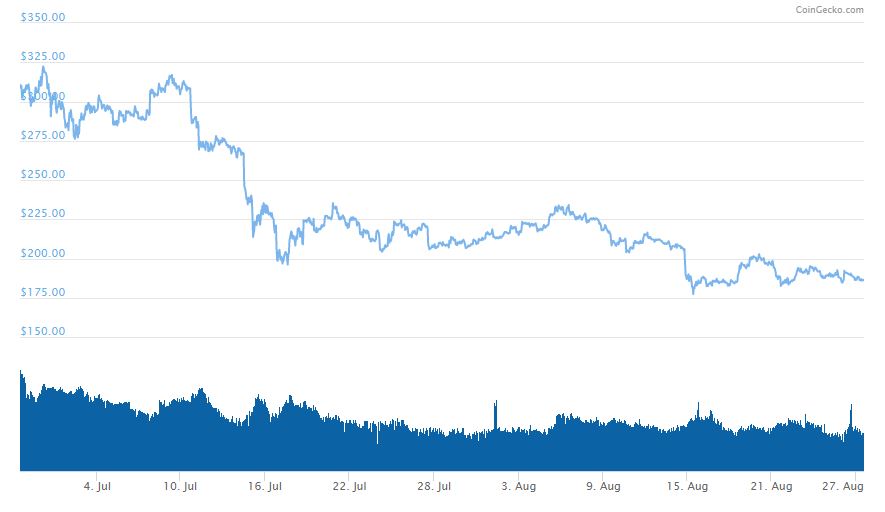

While it is challenging to determine how all of this is affecting Ethereum’s price, one thing is clear – the past couple of months have been rather tough. In the last 60 days, ETH lost around 40 percent of its value and currently trades around $186.

Year-to-date, though, the cryptocurrency is still looking good, as it’s up about 40% since January 1. It’s worth noting, though, that the utilization of the network back in January was around 20% lower than today – approximately 70%.

It’s also significant that the FUD is piling up in advance of a major conference set to take place in September, namely Ethereal.

The post Ethereum Transaction Cost FUD Spiraling Upward: Is ETH in Danger? appeared first on CryptoPotato.