Ethereum Taps Highest Levels Against Bitcoin Since January Amid Market Downturn (ETH Price Analysis)

The crypto market is heavily influenced by events attributed to the Luna ecosystem. Investors are depositing their assets into exchanges with fear caused by the possible sell-off continuation.

Technical Analysis

By Grizzly

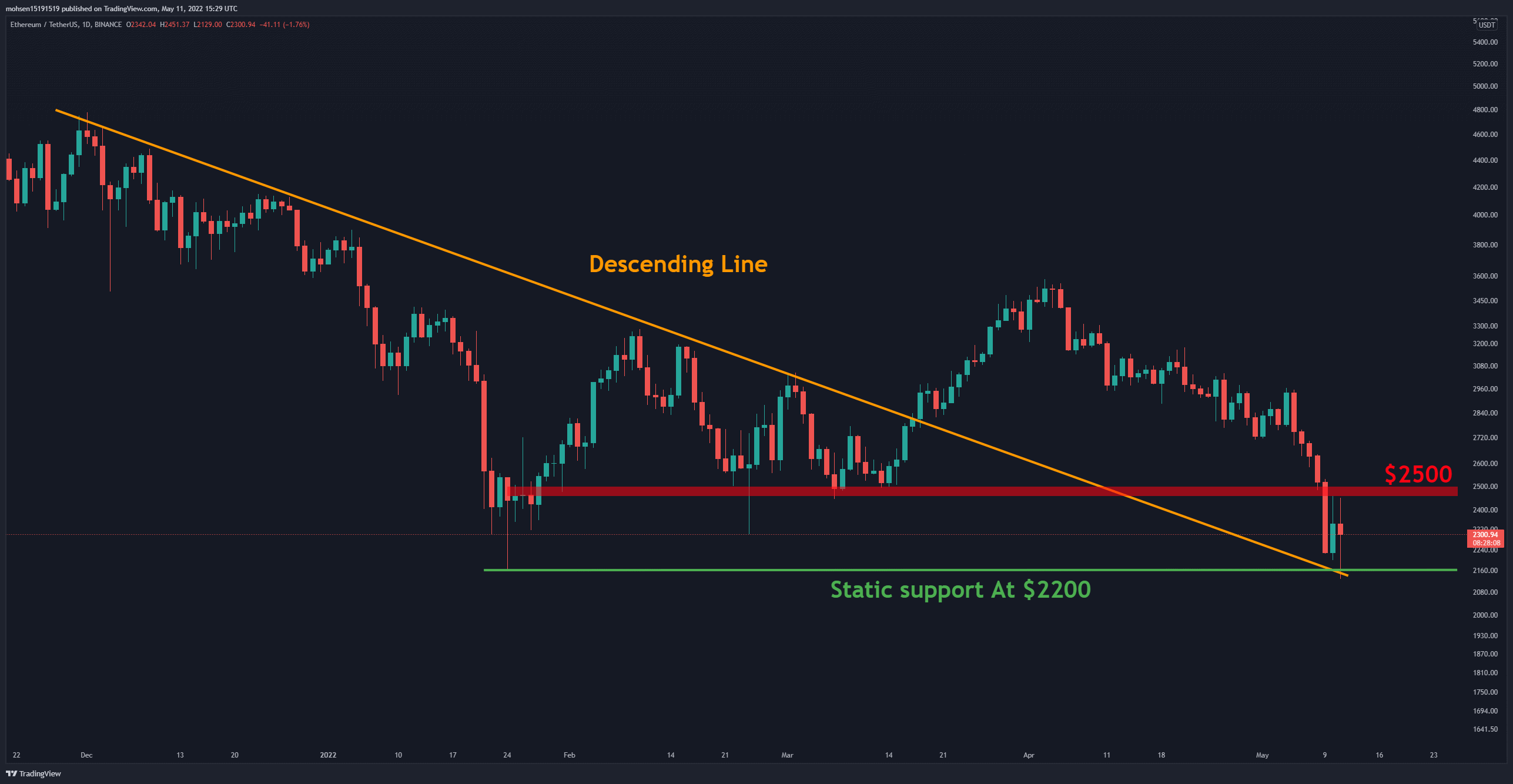

The Daily Chart

ETH stands on horizontal support (in green) on the daily timeframe last touched in January. This level intersects with the descending line (in orange), which may have persuaded some participants to buy at this point.

This technical structure has caused a price increase. ETH has recently lost significant levels, the first of which is $2,500 (in red). Until the price reclaims this level, the current upward movement can be technically considered a bounce.

On the other hand, the last price high on the daily timeframe is relatively far from the current price. ETH needs to confirm a possible uptrend through a closing above $3,000 – only then can the trend be considered reversed.

Key Support Levels: $2200 & $1700

Key Resistance Levels: $2500 & $3000

Moving Averages:

MA20: $2748

MA50: $3018

MA100: $2912

MA200: $3390

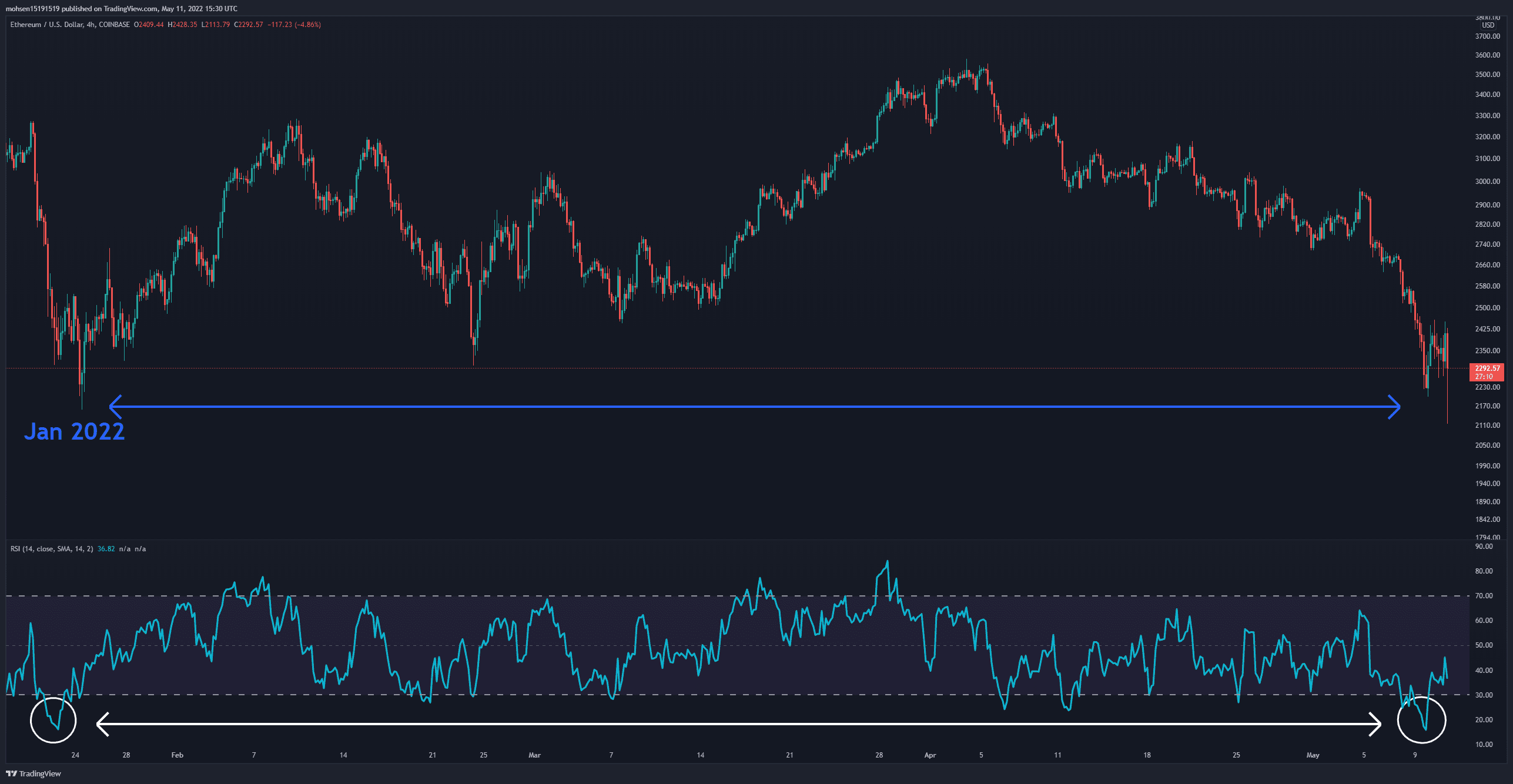

The 4-Hour Chart

On the 4-hour timeframe, the RSI indicator has entered the oversold zone – unprecedented since January. ETH can be expected to recover slightly in this area. But whether the price can move as strongly as in January is unclear because the macroeconomic conditions are very different from then.

The ETH/BTC Chart

Unlike most BTC pair charts, ETH/BTC chart is technically bullish and moves upward within an ascending channel. But the recent ascending leg that starts from the bottom of the channel is not as strong as the previous ones.

Weakness is observed in the upward movement, and the horizontal support at 0.07 BTC is likely to be retested. Therefore, as long as the price moves inside this channel and above the horizontal support at 0.064, one can have bullish insight.

On-chain Analysis

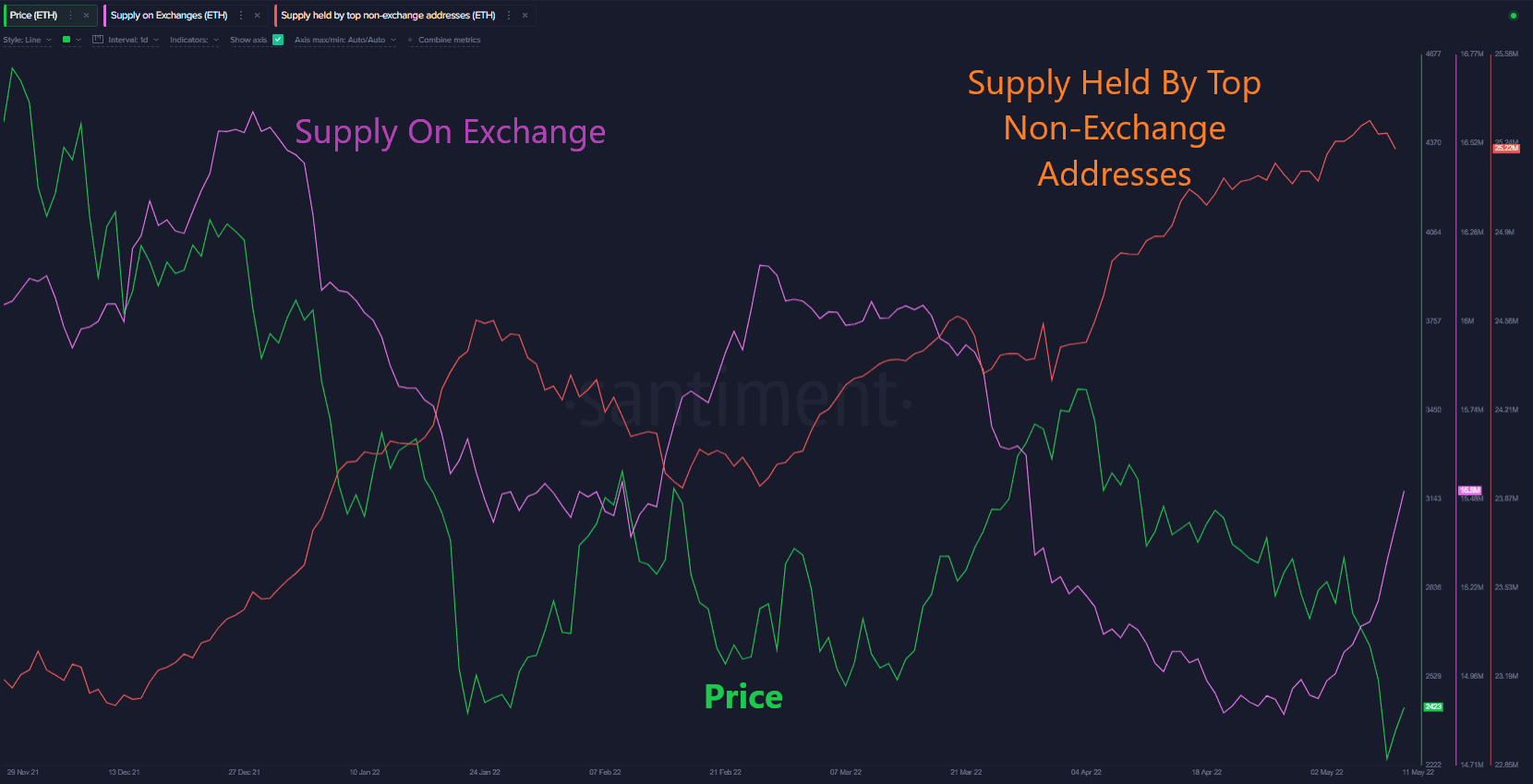

Supply On Exchange vs Supply Held By Non-Exchange Addresses

As mentioned in the technical analysis, the selling pressure in the market is high, and the participants have deposited their assets aggressively into the exchanges over the last 72 hours.

This behaviour is specified in the Supply On Exchange metric. This metric has recently spiked sharply, which usually indicates an increase in the selling pressure. On the other hand, the supply held by non-exchange addresses has decreased slightly. It remains to be seen whether this increase in supply on exchanges will cause the price to drop further.