Ethereum Shanghai Upgrade Leads to Huge Influx of ETH at Exchanges

Featured SpeakerDeep Dive: Ethereum

Protocol VillageAustin Convention Center

Join an hour long exploration of the advancements defining the Ethereum community in 2023.

:format(jpg)/www.coindesk.com/resizer/imb09KsNh9afdgQ4P24gQvq559Y=/arc-photo-coindesk/arc2-prod/public/DMIIPXHVZFBCPMOBTSEJ2YYG6U.png)

Krisztian Sandor is a reporter on the U.S. markets team focusing on stablecoins and institutional investment. He holds BTC and ETH.

Featured SpeakerDeep Dive: Ethereum

Protocol VillageAustin Convention Center

Join an hour long exploration of the advancements defining the Ethereum community in 2023.

Crypto exchanges received a net inflow of 179,500 ether (ETH), worth some $375 million in the four days after Ethereum’s Shanghai upgrade went live, according to crypto data firm CryptoQuant.

CryptoQuant data shows that traders deposited 1,101,079 ETH to exchanges between April 13 and April 16, while only removing 921,579 tokens. This was the largest four-day net inflow in a month.

Investors transferring tokens to exchanges usually indicates they are preparing to sell, which may lead to a price decline.

On April 12, Ethereum successfully implemented a long-awaited tech upgrade, also known as Shanghai. The upgrade has enabled withdrawals for the first time from Ethereum’s proof-of-stake blockchain, which has some 18 million ETH, worth $36 billion, locked in staking contracts.

Before the upgrade, some crypto watchers worried that the event would flood the market with millions of unlocked ETH and crash the second largest cryptocurrency’s price, although others predicted little impact or that the price would rise. News of a seamless implementation pushed ETH’s price above $2,100 the day following, its highest level since May 2022. ETH outperformed bitcoin (BTC) in that 24-hour period. ETH was recently trading at about $2,070, down more than 2% over the past 24 hours.

Data suggest that some traders have sold ETH during the price rally post-Shanghai.

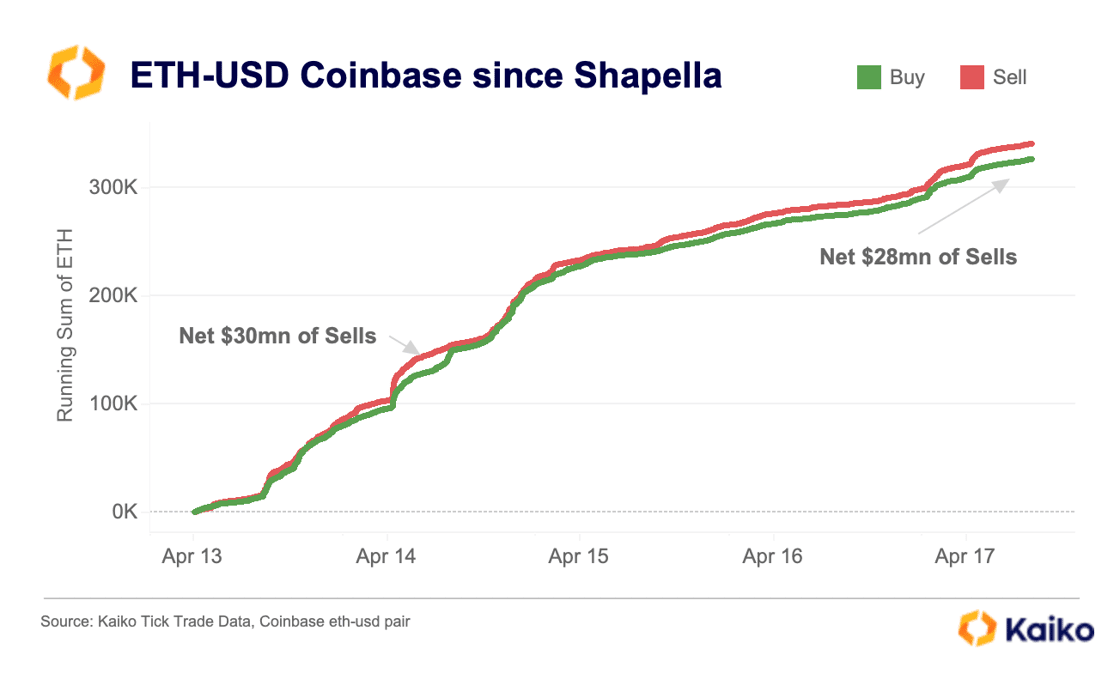

Since the upgrade, the ETH-USD trading pair on crypto exchange Coinbase recorded $28 million more sell orders than buy orders, crypto market research platform Kaiko reported Monday.

ETH-USD buy and sell orders since Shanghai upgrade. (Kaiko)

Coinbase was one of the first exchanges that let users immediately unlock and withdraw their staked ETH via its platform. Binance, the world’s largest crypto exchange by volume, will follow suit on April 19, which “could result in more sell pressure for ETH,” Kaiko wrote.

ETH pared some of its earlier gains, and recently has been changing hands at $2,079, per CoinDesk data.

Edited by James Rubin.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/imb09KsNh9afdgQ4P24gQvq559Y=/arc-photo-coindesk/arc2-prod/public/DMIIPXHVZFBCPMOBTSEJ2YYG6U.png)

Krisztian Sandor is a reporter on the U.S. markets team focusing on stablecoins and institutional investment. He holds BTC and ETH.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/imb09KsNh9afdgQ4P24gQvq559Y=/arc-photo-coindesk/arc2-prod/public/DMIIPXHVZFBCPMOBTSEJ2YYG6U.png)

Krisztian Sandor is a reporter on the U.S. markets team focusing on stablecoins and institutional investment. He holds BTC and ETH.