Ethereum Shanghai Upgrade Brings Record Inflow of 572k ETH Staked in a Week

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

:format(jpg)/www.coindesk.com/resizer/imb09KsNh9afdgQ4P24gQvq559Y=/arc-photo-coindesk/arc2-prod/public/DMIIPXHVZFBCPMOBTSEJ2YYG6U.png)

Krisztian Sandor is a reporter on the U.S. markets team focusing on stablecoins and institutional investment. He holds BTC and ETH.

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

Ethereum’s Shanghai upgrade brought a record-breaking weekly inflow of ether (ETH) deposits for staking last week, mainly driven by institutional staking service providers and investors reinvesting rewards after withdrawal, crypto analysts said.

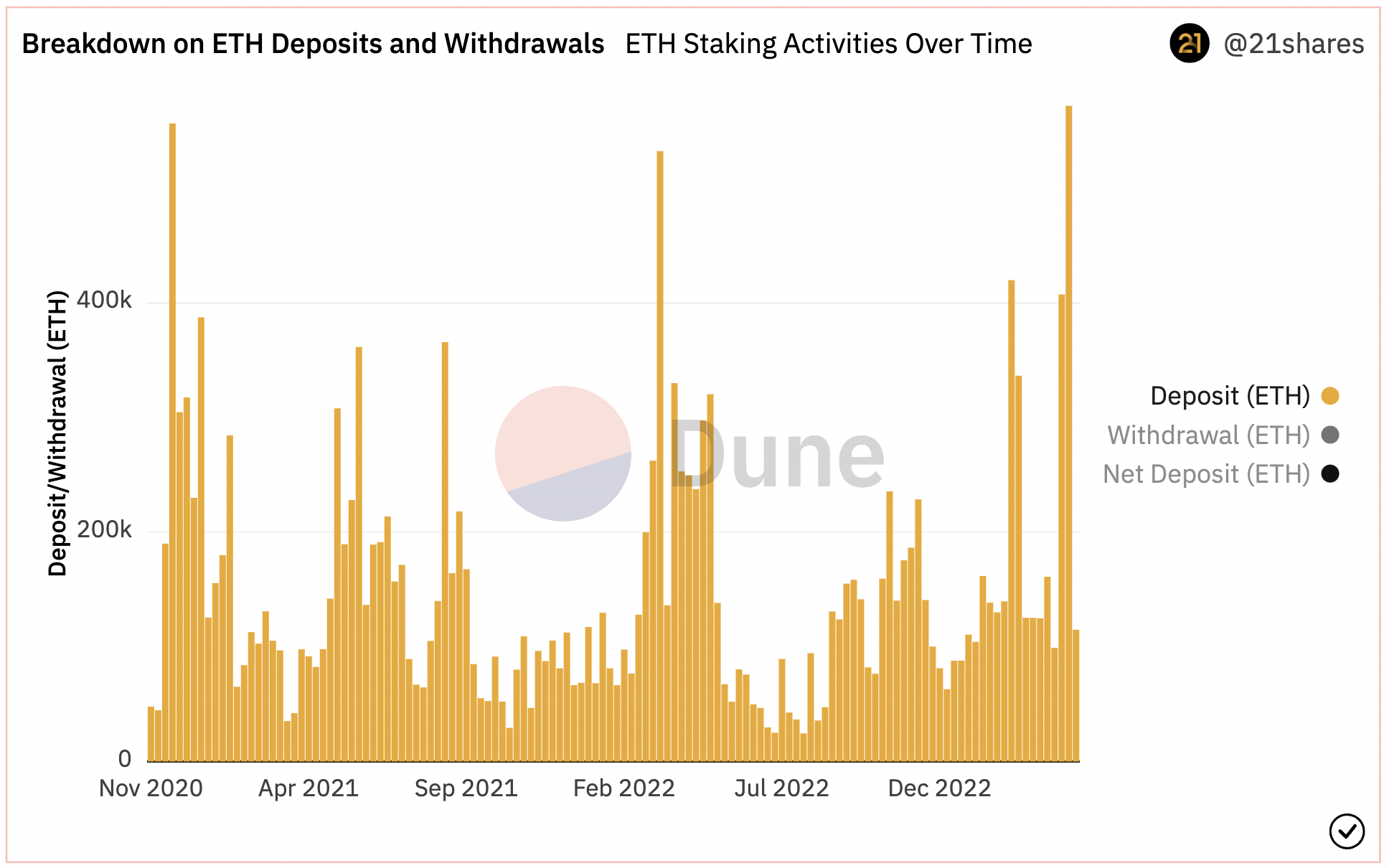

Investors deposited some 571,950 ETH tokens into staking contracts, worth more than $1 billion, according to a Dune Analytics data dashboard created by Tom Wan, an analyst of digital asset investment firm 21Shares.

This was the largest weekly token inflow in ether staking’s almost two-and-a-half-year history, per blockchain data provided by 21Shares.

The Ethereum blockchain completed its highly anticipated tech upgrade, often called Shanghai or Shapella, on April 12. The initiative enabled the withdrawal of tokens previously locked-up in staking contracts for the first time. It was the last key step after last year’s Merge to complete the network’s transition to validating transactions through staking from a mining-based system.

ETH, the network’s native token and the second largest cryptocurrency by market capitalization after bitcoin (BTC), surged following the successful implementation of the upgrade, but relinquished all its gains last week in a broader crypto market sell-off, caused mostly by macroeconomic concerns about inflation and a looming recession.

ETH staking deposits (Dune Analytics, 21Shares)

Institutional ETH staking

Institutional staking services drove the deposit surge in ETH staking, Wan tweeted.

Since the Shanghai upgrade went live, the top five institutional-grade staking service providers – Bitcoin Suisse, Figment, Kiln, Staked.us and Stakefish – staked a total of 235,330 ETH combined, worth some $450 million, according to 21Shares’ Dune dashboard.

CoinDesk reported last week that the Shanghai upgrade boosted demand for ETH staking among institutional investors, including traditional finance firms.

The increased interest also highlights that enabling withdrawals from Ethereum’s proof-of-stake chain has significantly reduced the liquidity risk associated with locking up tokens, Wan added in a separate tweet.

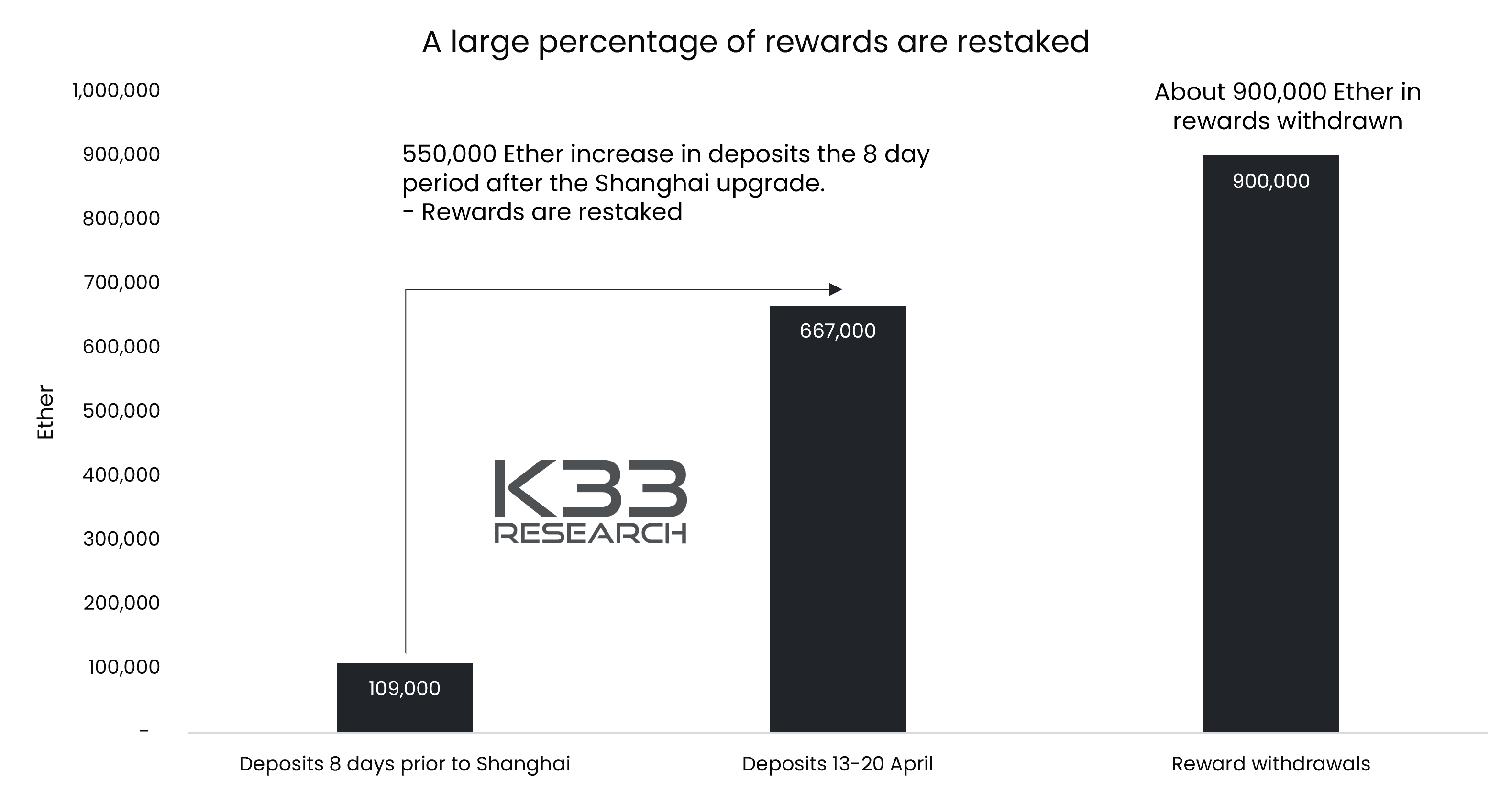

Another likely catalyst for the record inflow has been investors choosing to reinvest their previously earned and withdrawn rewards from staking, Anders Helseth, vice president of digital asset market research firm K33 Research, explained in an emailed note.

Through the first eight days after the upgrade, investors withdrew some 900,000 ETH in staking rewards. Meanwhile, staking deposits totaled some 667,000 tokens, which was six times larger than the amount deposited during the last eight days before allowing withdrawals.

The dynamic indicates that investors decided to restake a large part of the withdrawn rewards, Helseth wrote.

(K33 Research)

The Shanghai upgrade was a “net positive” in terms of total staking inflows, Noelle Achison, a market analyst and former head of research at Genesis Trading and CoinDesk (both subsidiaries of Digital Currency Group), wrote in a newsletter Monday.

“So far, the rhythm of new deposits has exceeded the amount leaving the network, if rewards can be excluded,” she said.

The reason for differentiating reward withdrawals from full exits comes from how Ethereum’s staking system works. Individual stakers or staking services have to lock up exactly 32 ETH to open a node and earn rewards for securing the network. Keeping the accrued rewards in the validator node does not improve the node’s return. Acheson explained that it’s logical for stakers to withdraw rewards, bundle the tokens and establish new nodes to increase potential returns.

“It seems this is what is happening,” she said. “Overall net inflow has been positive, which suggests that a significant portion of these rewards are being restaked.”

The trend of reinvesting rewards is also potentially a positive sign for ETH price as it reduces sell pressure, according to Acheson, “which is likely to end up being much less than many feared.“

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/imb09KsNh9afdgQ4P24gQvq559Y=/arc-photo-coindesk/arc2-prod/public/DMIIPXHVZFBCPMOBTSEJ2YYG6U.png)

Krisztian Sandor is a reporter on the U.S. markets team focusing on stablecoins and institutional investment. He holds BTC and ETH.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/imb09KsNh9afdgQ4P24gQvq559Y=/arc-photo-coindesk/arc2-prod/public/DMIIPXHVZFBCPMOBTSEJ2YYG6U.png)

Krisztian Sandor is a reporter on the U.S. markets team focusing on stablecoins and institutional investment. He holds BTC and ETH.