Ethereum Reaches ATH of $1,700: Economist Predicts $20k by Year-End

In early Thursday trading on the Asian session, Ethereum prices hit a new peak price of $1,700 marking a gain of 8% on the day. ETH is now 17% higher than its previous all-time high three years ago and could easily go further if the momentum continues.

It has positioned the asset firmly above its previous and 2018 high of $1,450 as it moves ever closer to the $2,000 level. Since the beginning of the year, ETH prices have surged a whopping 130%. By comparison, Bitcoin has made just 30% over the same period.

At the time of press, Ethereum had retreated slightly and was trading at $1,665 according to Binance. Momentum is likely being driven by the Ethereum futures that will debut on the Chicago Mercantile Exchange on Feb. 8.

Ethereum to $20,000?

As with any crypto asset that surges to a new all-time high, longer-term price predictions start emerging and there has been a huge one from economist and Global Macro Investor CEO Raoul Pal. The investment strategist sees big things for Ethereum with a bold $20,000 price prediction;

“I still expect it to hit $20k by around the turn of the year.”

ETH is up 126% YTD. Its Feb 3rd, FFS! I still expect it to hit $20k by around the turn of the year.

The entire DA space is going to consume the performance of everything else, with BTC as the flag carrier as The Big Asset. It is up 30% YTD hugely beating every other major asset

— Raoul Pal (@RaoulGMI) February 4, 2021

$20k maybe a little on the optimistic side but ETH prices could easily reach $5k when ETH 2.0 scaling is rolled out with Phase 1 of the Serenity upgrade.

At current prices, around $4.9 billion in ETH has currently been locked into the Beacon Chain contract, immobile for at least a year. There is almost 3 million ETH staked now which will not be available to investors until Phase 1.5 merges the two blockchains together.

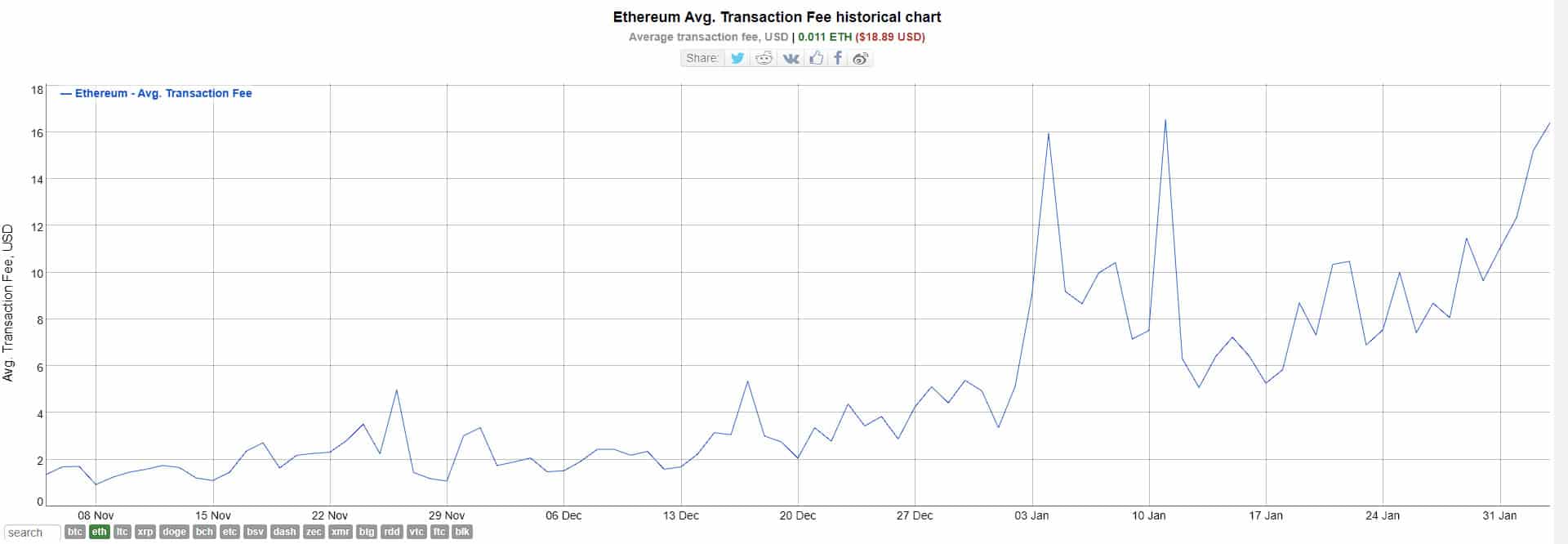

Gas Crisis Worsens

Scaling has been a major thorn in the side of the world’s largest smart contract network which is buckling under the pressure at the moment. Ethereum transaction prices have spiked to their highest ever levels of almost $20.

This has basically rendered micro-transaction DeFi unsustainable as moving anything less than $1,000 in ERC-20 tokens is going to sting. Industry expert Anthony Sassano commented on the surge in DEX volume for ETH which is compounding the demand on the network;

“Decentralized exchange volume on Ethereum was $63 billion in January – smashing September 2020’s all time high of $29 billion.”

DeFi farmers are currently switching to Layer 2 exchanges such as Loopring or alternative chains such as NEO’s Flamingo Finance and Binance Smart Chain, both of which have seen a surge in volume recently.