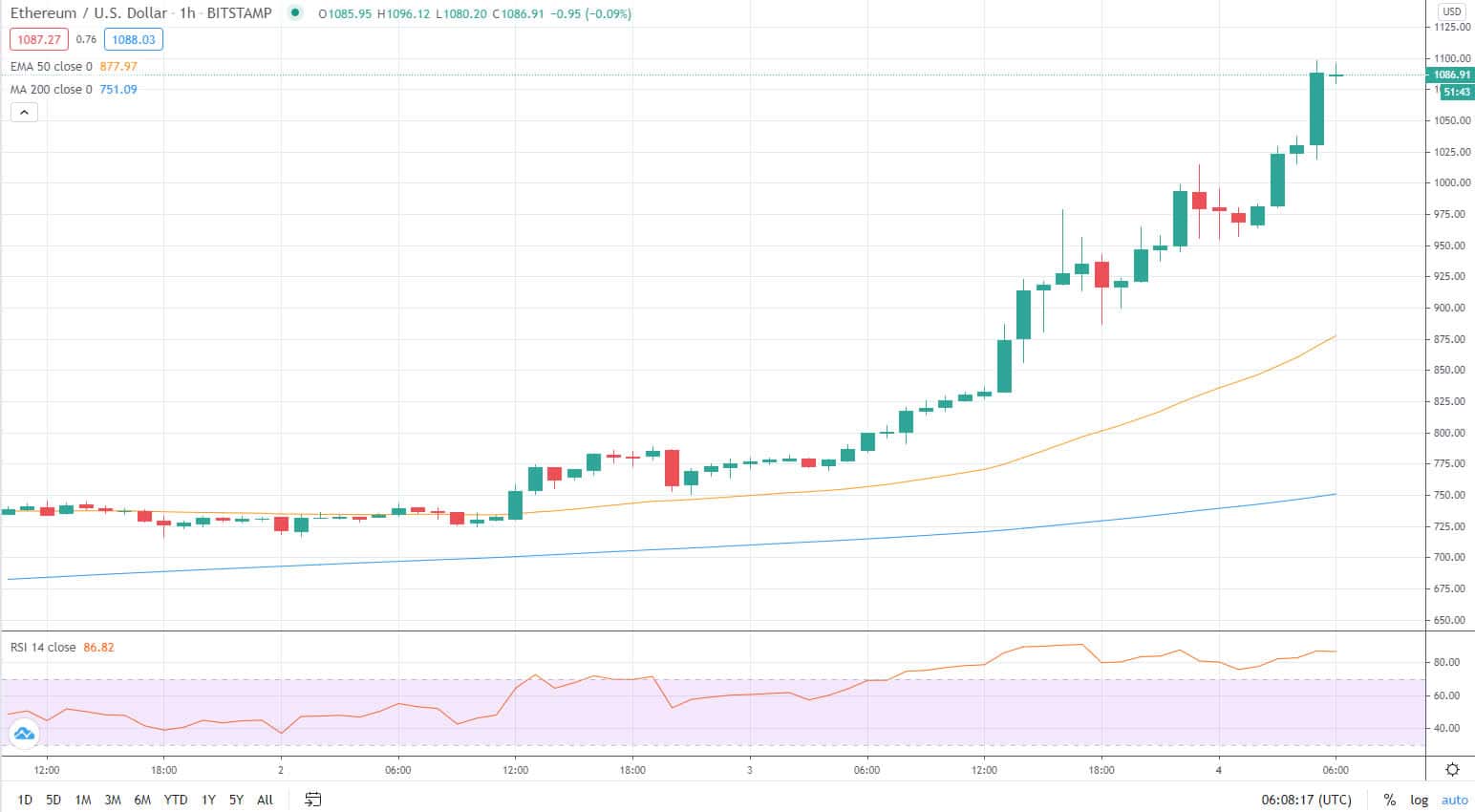

Ethereum Prices Surge to $1,100 in Massive 35% Move

The epic price pump has added over 35% in under 24 hours as Ethereum makes one of its largest single-day moves in history. ETH is the top-performing crypto asset in the top 80 altcoins, beaten only by Loopring’s Layer 2 DEX token.

ETH prices topped out at $1,100 around an hour ago, adding around $330 since the same time yesterday.

Analyst and trader Alex Krüger noted that three months of negative movements against the price of Bitcoin has been wiped out in just a day.

Ethereum undid a three month slide against bitcoin … in one day. pic.twitter.com/3HROibA0s7

— Alex Krüger (@krugermacro) January 4, 2021

Ethereum Market Cap Tops $120 Billion

The big pump has pushed the market capitalization for Ethereum over $100 billion for the first time since it hit its all-time high three years ago.

Coingecko reported the figure at $120 billion, 500% higher than the next closest digital asset which is Tether with a market cap of just over $20 billion.

Industry analyst, Luke Martin, commented on the arrival of altseason adding that longs on many of the underperforming altcoins such as EOS would make a good move.

You know it’s altseason when you can long $EOS and that swing actually starts outperforming $ETH for the day.

We are not in 2020 anymore boys…this is alt season.

Strap in. Move slow. And adjust that target just a little bit higher.

— Luke Martin (@VentureCoinist) January 4, 2021

The only other high cap altcoins coming close to Ethereum’s performance at the time of writing include Cardano and Chainlink. More altseason narrative is starting to appear on crypto Twitter;

$2.4 Billion in ETH 2.0 Staking, Gas Skyrockets

Ethereum’s big move has had two side effects. Firstly, the amount of ETH staked on the Beacon Chain deposit contract is now worth $2.4 billion at current prices of just below $1,100.

According to the ETH 2.0 Launchpad, there are 2.2 million ETH staked on the Beacon Chain and locked away for at least a year. It equates to just under 2% of the entire supply which doesn’t sound a lot.

However, this ETH cannot be sold in the meantime and has been effectively removed from circulation until Phase 1.5 merges the ETH 1.0 chain with ETH 2.0.

Another side effect, which is less than ideal, is a surge in gas prices as the network feels the strain of increased demand. According to Bitinfocharts.com, the average transaction fee has skyrocketed to its third-highest level at over $13.

This makes any smaller transactions on the network economically unfeasible, though the whales will not be affected. Doing DeFi on Ethereum has now slipped back into the realms of the big bag holders only as transaction fees may dwarf any sums below $50.