Ethereum Prices Set to Surge as Beacon Chain Genesis Nears

The primary catalyst could be just around the corner, however, as ETH 2.0 genesis inches ever closer.

Since the beginning of this year, Ethereum prices have gained 170% from below $140 on New Year’s Day to current levels of around $380. There is no doubt that the primary driver of demand has been the DeFi sector which has surged itself by 200% in terms of Ethereum locked up.

Today, there are almost 9 million ETH, or nearly 8% of the entire supply, locked across various DeFi protocols according to DeFi Pulse. That demand for yield farming has driven ETH prices this year as they outperform Bitcoin which has only made around 62% over the same period.

Beacon Chain a Bigger Driver

A bigger move could be on the cards for Ethereum before this year is out as lead developers have hinted at a Beacon Chain genesis in around six weeks’ time. As recently reported by CryptoPotato, ETH 2.0 testing phases are coming to an end as the launch of the real thing nears.

Commenting on the dwindling participation on the Medalla testnet, ConsenSys developer Ben Edgington stated that this is unlikely to be the case on Beacon Chain when it delivers real staking rewards;

“To be fair, I don’t expect this situation to arise on a network with real value at stake. People will be working hard to keep the network finalising. It’s exactly why we need to move on from the testnets now.”

When people asked if the testnet was ‘broken’ he added it has low participation because people are bored of testnets. At the time of writing, there was just over 50% network participation and it needs 66% to reach finality.

It is for this reason that the teams behind the testing and development of ETH 2.0 want to push out the real thing within the next six weeks or so. Edgington has already stated that the deposit contract is good to go and may even launch this week.

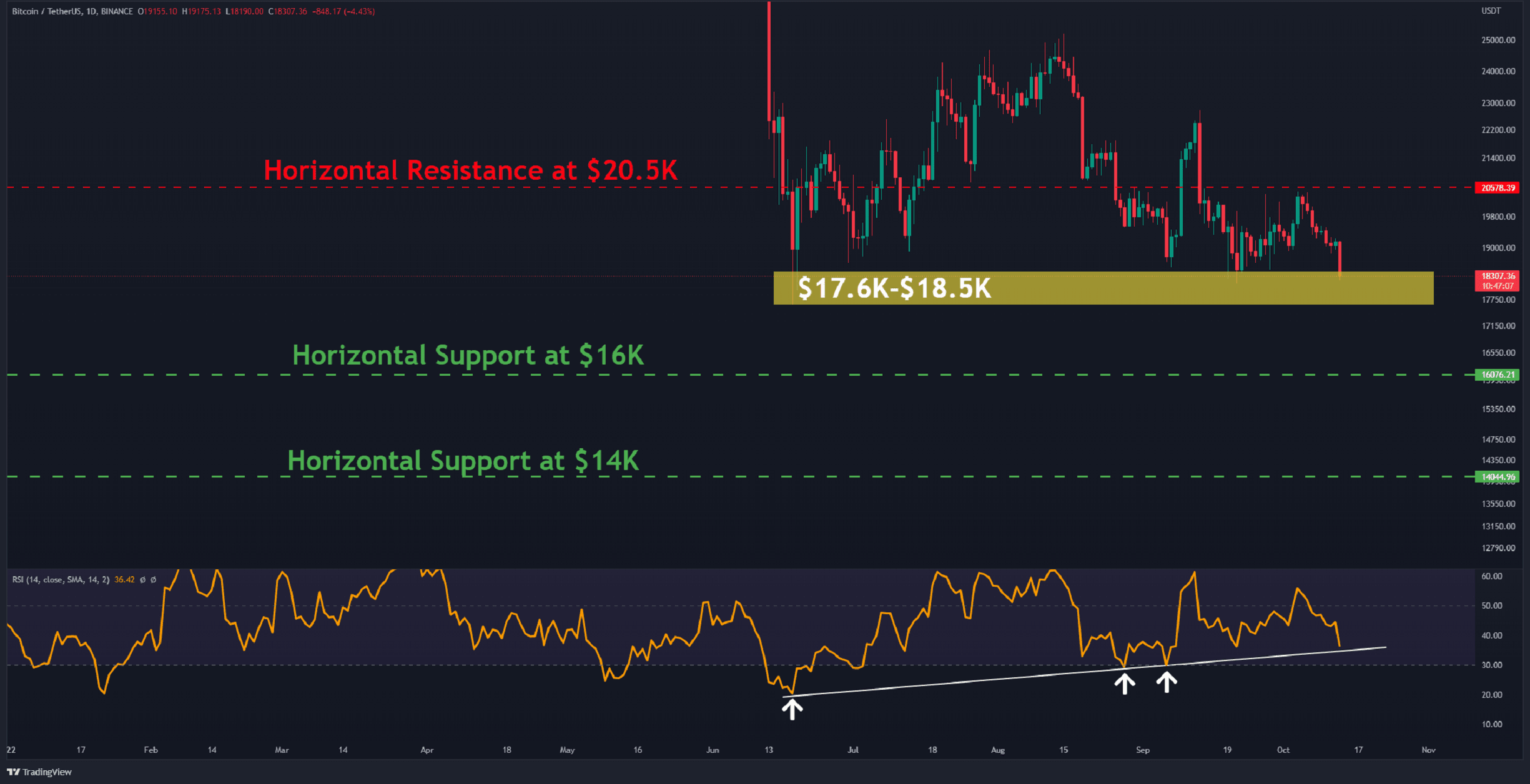

ETH Price Outlook

Industry observers and crypto traders have labeled this an accumulation phase for Ethereum, which is still 73% down from its all-time high.

I would not bet against #ETH over the long-term. Sure, #Bitcoin will outperform #Ethereum at certain times, but I anticipate the ROI being higher for Ethereum: pic.twitter.com/W0HaI1LxRI

— intothecryptoverse (@intocryptoverse) October 20, 2020

On-chain metrics suggest that a large amount of it has not moved in over a year which indicates that investors are hodling in anticipation of the Phase 0 launch. The bullish case for Ethereum is mounting; and even the CFTC Chairman Dr. Heath Tarbert recently said how impressed he was with the asset.

Once the ETH 2.0 genesis date is made official, a rapid move back into the $400 zone is highly likely.

The post Ethereum Prices Set to Surge as Beacon Chain Genesis Nears appeared first on CryptoPotato.