Ethereum Price Analysis: ETH Retakes Key Resistance at $3.5K, Can it Go for $4K Next?

Ethereum has recently experienced a surge in buying activity, finding robust support at the critical $3.5K level, triggering a bullish rebound.

Despite this recovery, the $4K resistance remains a significant barrier that ETH buyers aim to overcome in the mid-term.

Technical Analysis

By Shayan

The Daily Chart

Ethereum’s price action has been characterized by a notable rebound after encountering support at the decisive $3.5K level. This region served as a pivotal accumulation zone, fostering increased buying pressure and a subsequent upward surge. As the price climbs, the $4K resistance emerges as a critical psychological and technical barrier, requiring a decisive breakout to establish a sustained upward trajectory.

Currently, Ethereum is consolidating within the $3.5K-$4K range, indicating a potential breakout in either direction. A successful breach of the $4K threshold could set the stage for a fresh rally and affirm bullish sentiment. Conversely, a rejection at this level may lead to further consolidation or retracement within the existing range.

The 4-Hour Chart

On the lower timeframe, Ethereum’s decline found solid support within the key 0.5 ($3.2K)–0.618 ($3K) Fibonacci retracement levels. This support zone attracted substantial buying interest, halting the downtrend and sparking a bullish recovery.

The subsequent accumulation phase has transitioned into a bullish spike, with Ethereum now eyeing the critical $4K resistance. This level, coinciding with a previous significant swing high, is expected to be a strong selling pressure zone.

Ethereum’s price action at the $4K level will determine its future trajectory. A successful breakout above this resistance could lead to a robust rally, while a failure might result in prolonged consolidation or a potential retest of lower support levels near $3.5K.

Onchain Analysis

By Shayan

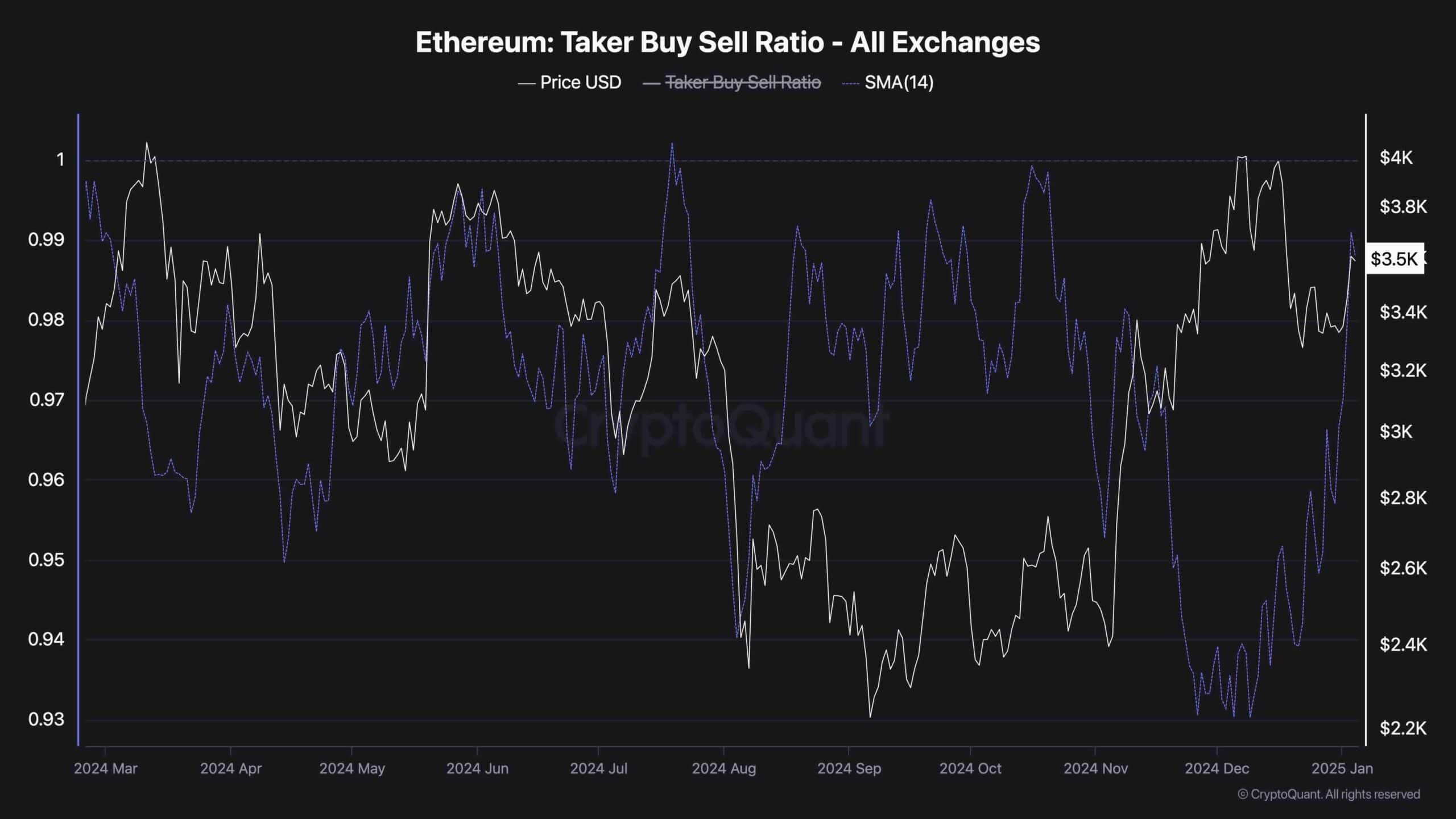

The Taker Buy Sell Ratio, a pivotal metric for assessing sentiment in the futures market, provides insights into whether buyers or sellers are more aggressive in executing market orders. Following Ethereum’s bullish rebound near the $3K support, this metric has exhibited a notable uptick, indicating a surge in market buy orders within the futures market.

This trend suggests that futures market participants are increasingly optimistic about Ethereum’s short-term price trajectory, expecting the asset to push toward the $4K resistance.

Takers’ Buy/Sell Ratio exceeding 1 means buyers are overwhelmingly dominant, often aligning with the onset of a bullish trend. The current data underscores this sentiment shift, reflecting heightened confidence among traders and an expectation of continued upward momentum.

The post Ethereum Price Analysis: ETH Retakes Key Resistance at $3.5K, Can it Go for $4K Next? appeared first on CryptoPotato.