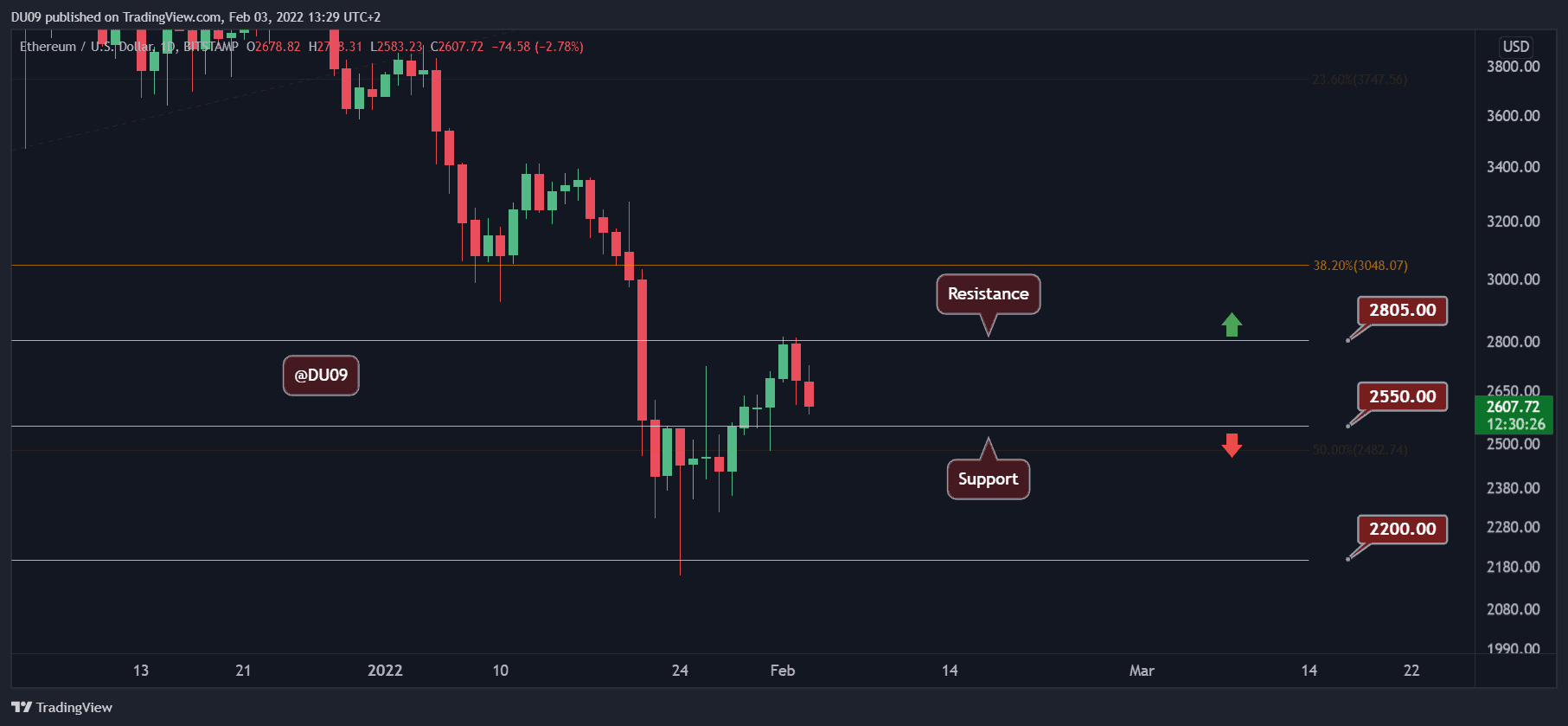

Ethereum Price Analysis: ETH Rejected at $2.8K, Here’s the Key Support

Key Support levels: $2,550, $2,200

Key Resistance levels: $2,800, $3,000

Despite a worthy attempt by ETH to move higher, the sellers stood firm at the $2,800 resistance, which rejected the price and propelled it into a pullback.

The buyers will have to defend the support at $2,500 to avoid further losses as the next key support is found at $2,200. So long the current support holds, this can be an expected pullback after a 30% rally.

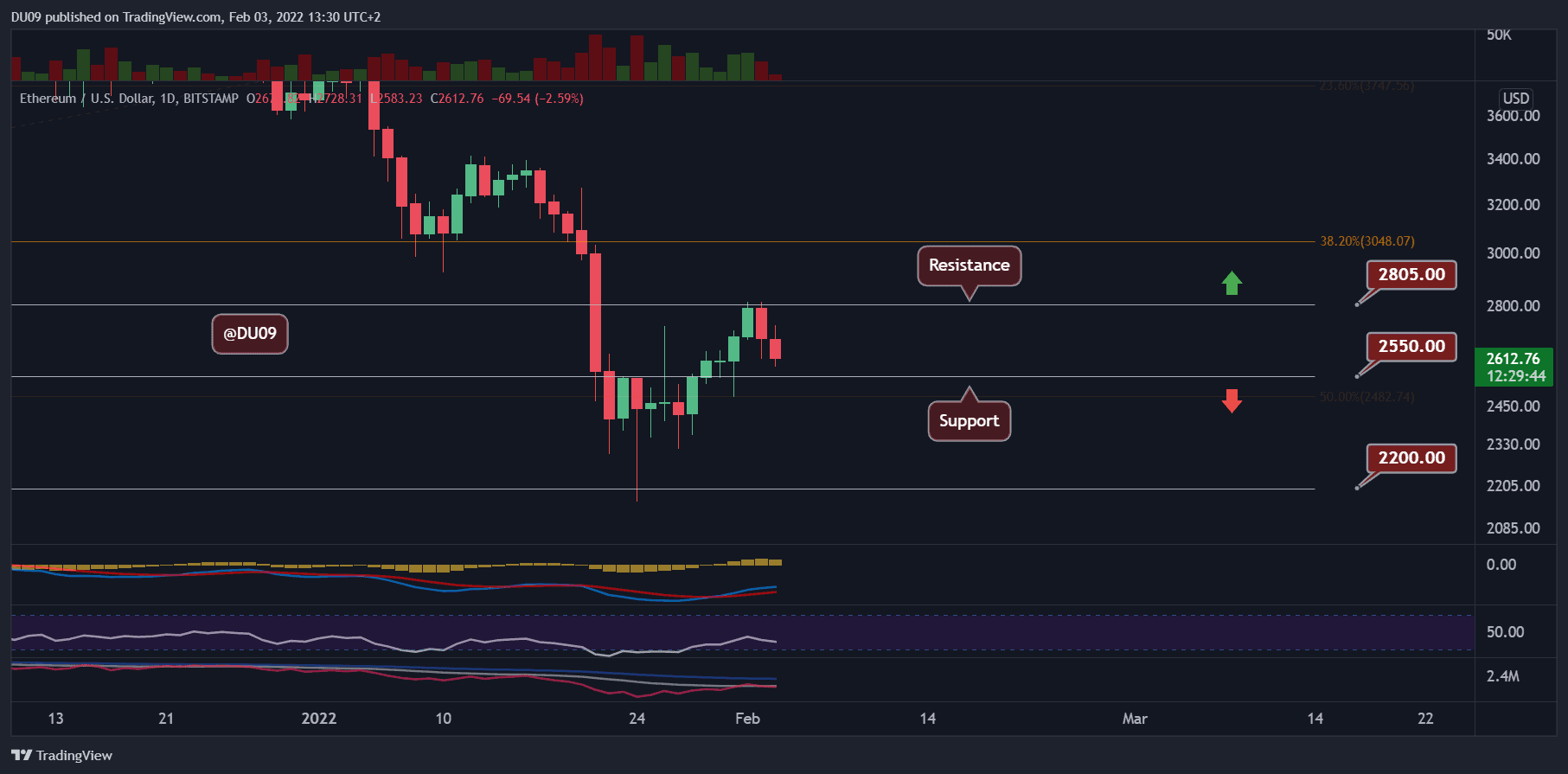

Technical Indicators

Trading Volume: Despite the fall in price, the selling volume has been weak. This gives bulls a good chance to defend ETH at $2,500.

RSI: After making a higher high, the RSI has turned down due to the rejection at resistance. Nevertheless, this pullback could be temporary, particularly if the RSI makes a higher low.

MACD: The daily MACD remains bullish even if the histogram has made a lower high. Bears have to push ETH under $2,500 to seriously challenge the latest price increase.

Bias

The current bias for ETH is neutral. The strength of buyers faded as the price approached $2,800. Thus, ETH may consolidate in a range before a new trend emerges.

Short-Term Price Prediction for ETH

ETH failed to break the key resistance at $2,800 and has been falling back towards the key support at $2,500. Considering the volume profile, the sellers may not be too interested in pushing prices much lower. For this reason, the cryptocurrency may consolidate in this range between the key levels.