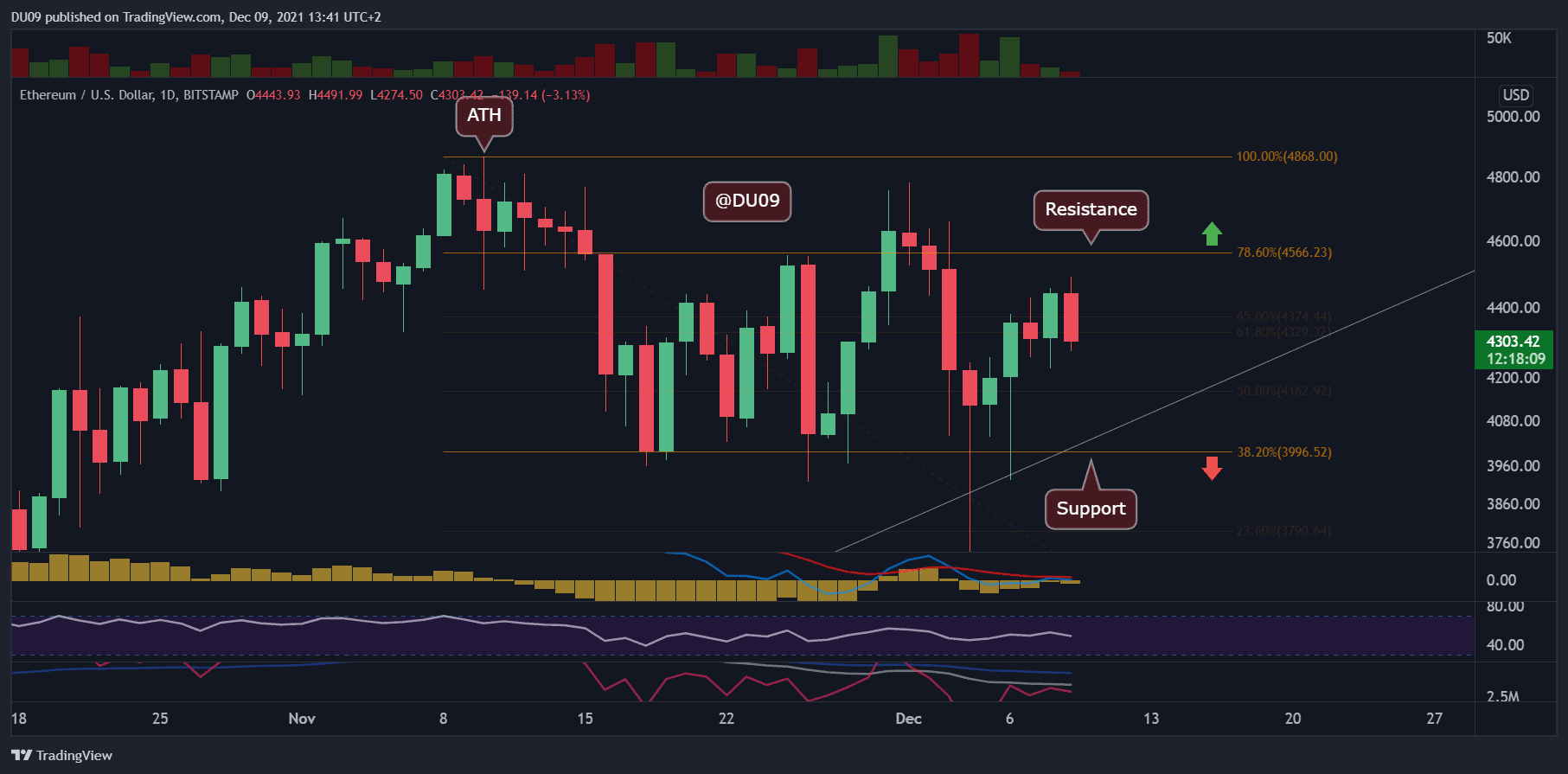

Ethereum Price Analysis: ETH Rally Stalls After Rejection at $4,500, What’s Next?

Key Support levels: $4,000

Key Resistance levels: $4,566, $4,868 (ATH)

ETH rallied after touching the key support level at $4,000 and came close to reaching $4,500, where bears stepped up. It appears the resistance at $4,566 will be a hard one to crack, as the bulls don’t seem to have sufficient momentum at the time of this writing.

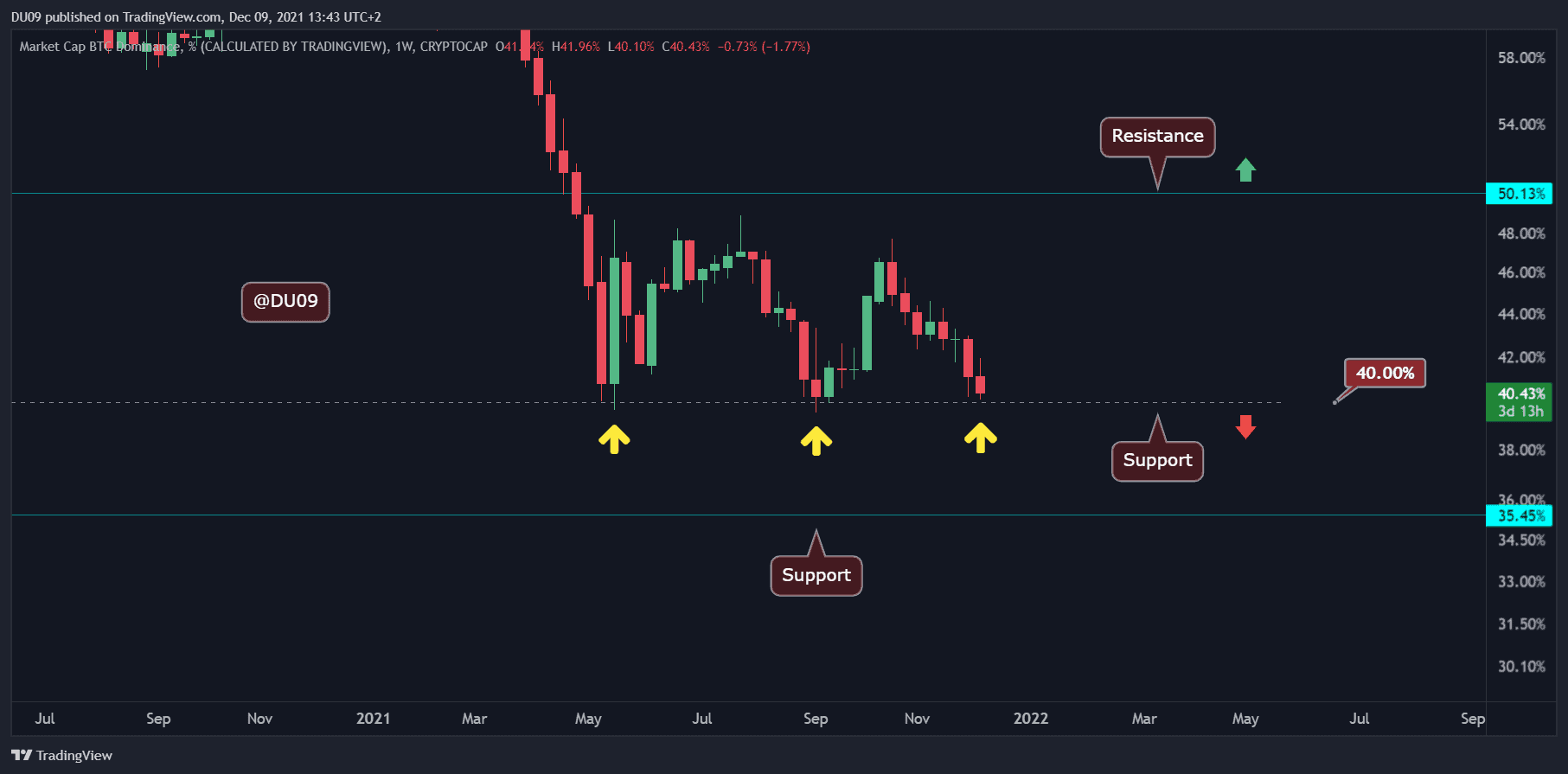

On the ETH/BTC chart, the situation is looking better, and the price made a new local high at 0.088 BTC before retracing. Bitcoin’s market share dropped to 40%, which is a crucial support level. If BTC falls lower, it might catapult ETH higher. However, a reversal from BTC here would make it difficult for ETH to sustain the current gains unless momentum returns.

Technical Indicators

Trading Volume: The volume disappeared as ETH’s price went higher, which was a bearish signal. Following the rejection at $4,500, the bulls appear to be on the defensive.

RSI: The RSI is curving back down. Unless momentum returns, ETH seems more likely to retest the key support level at $4,000.

MACD: The MACD was preparing for a bullish cross on the daily timeframe, which was delayed by this loss of momentum. The histogram continues to make higher lows, but the current price action does not favor the bulls.

Bias

The bias for ETH has turned neutral due to this loss of momentum. Previously, the bias was bullish.

Short-Term Price Prediction for ETH

Ethereum appears unlikely to break above $4,500 in the near future, and it may even dip further before gathering enough strength to renounce meaningfully. The bears appear to be more in control at the time of this writing. The current daily candle is red and has engulfed the previous bullish candle from yesterday.