Ethereum Price Analysis: ETH Drops Below Long-Term Support, $250 In Sight?

Ethereum recently dropped beneath a long term support trend line as the cryptocurrency drops by 7.24% over the past week to bring the price for the coin down to $268.83. The price drop follows Ethereum creating fresh multi-year lows against Bitcoin at the 0.023 BTC level.

Ethereum remains the second-largest cryptocurrency by market value, with a market cap of $28.91 billion. The cryptocurrency is still up by a total of 61% over the past 3 months, however, if Ethereum does not show any signs of recovering against BTC, we could see ETHUSD fall further lower toward $200.

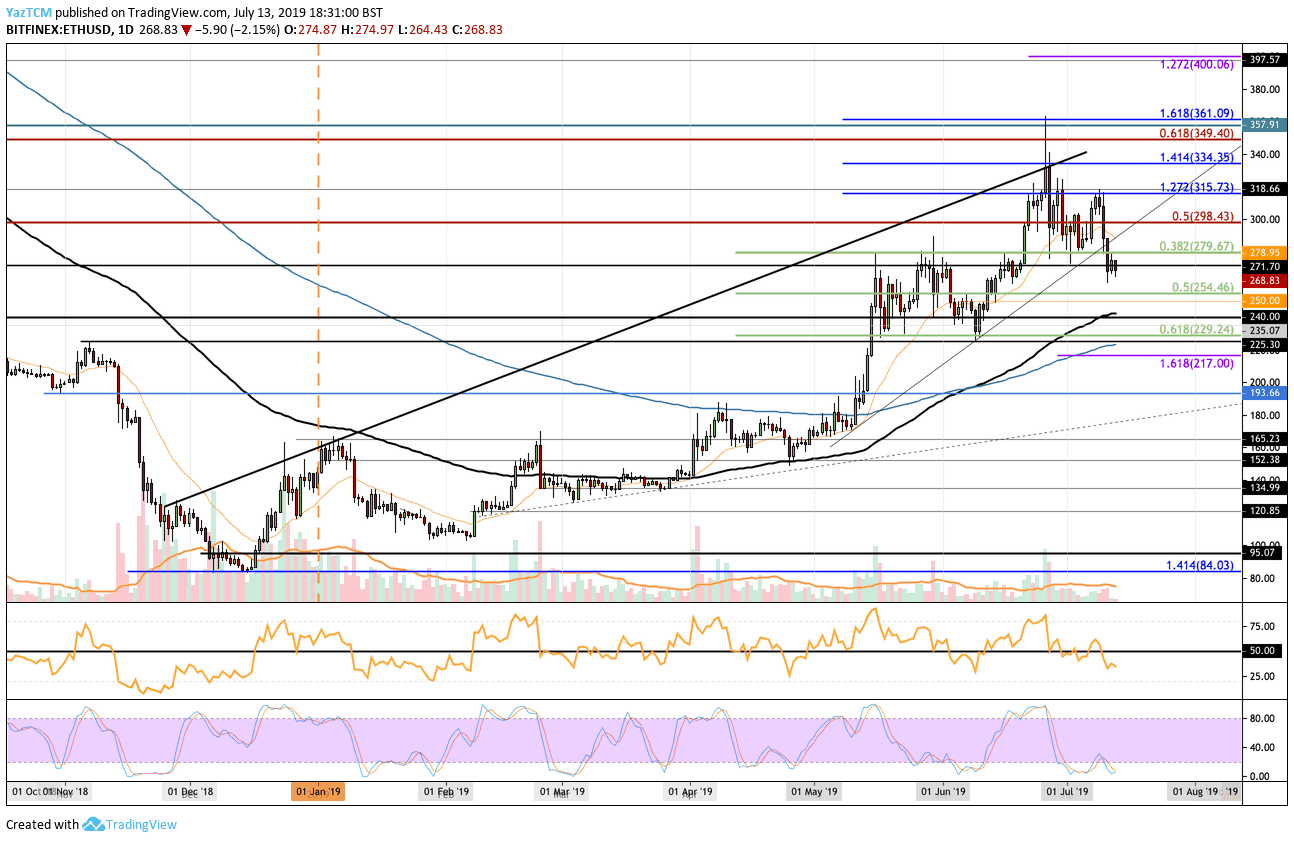

Looking at the ETH/USD 1-Day Chart:

- Since our previous ETH/USD analysis, we can see that Ethereum fell beneath the rising 2-month-old rising trend line into support at the $270 level. This now marks a significant break in the trend as we wait to see if ETHUSD will consolidate or continue to head lower.

- From above: The nearest levels of resistance toward the upside lie at $280 and $300. If the buyers break above the $300 level, further higher resistance lies at $315, $334 and $350.

- From below: If the selling continues further beneath $265, the next level of support lies at $254, which is provided by the short term .5 Fibonacci Retracement level. Beneath this, further support lies at $250 and $240 (which also contains the 100 day EMA). Support below $240 is located at $229 (short term.618 Fib Retracement) and $225 (200 day EMA).

- The trading volume still remains very low relative to the rest of the year.

- The RSI slipped below the 50 level which shows the bears in control of the market momentum.

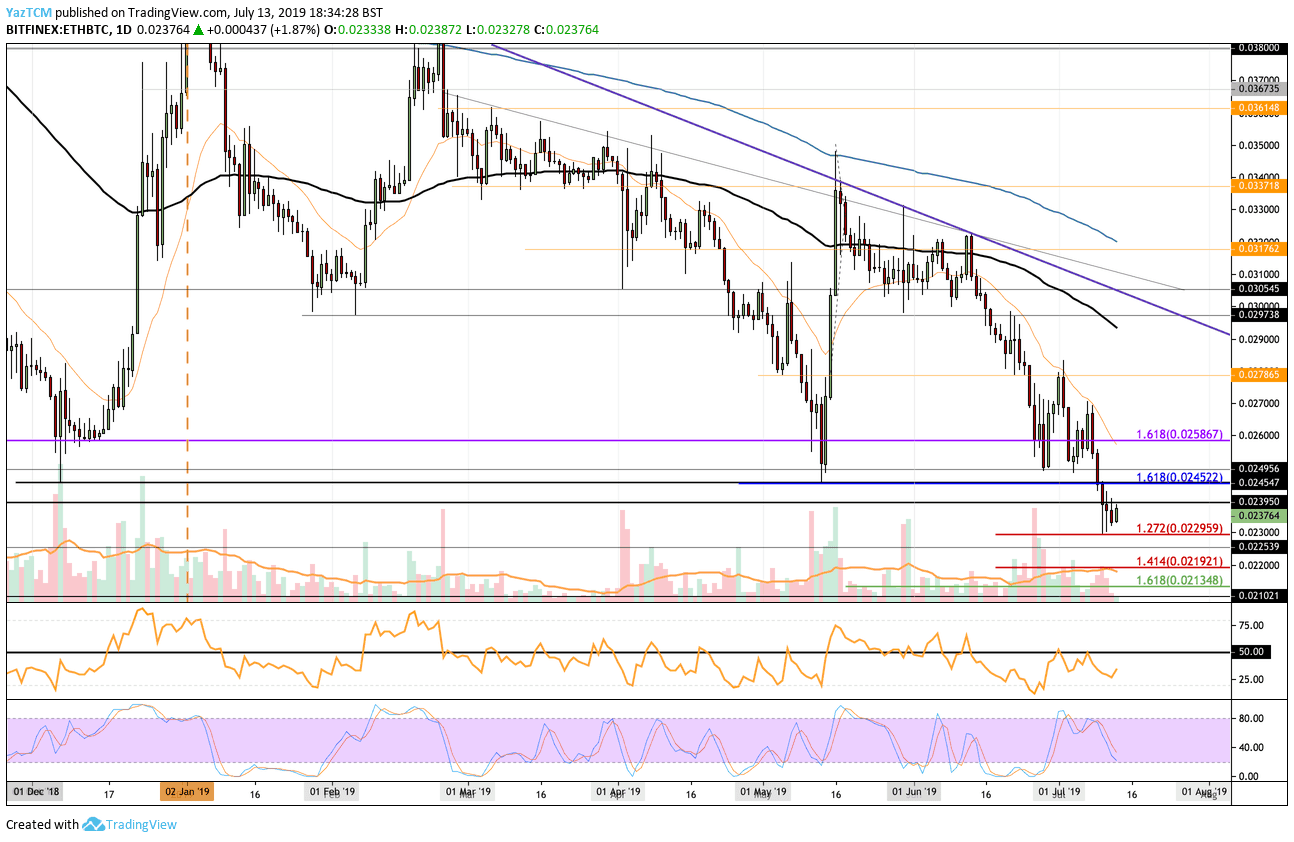

Looking at the ETH/BTC 1-Day Chart:

- Against Bitcoin, we can see that the market has somewhat stabilized at the 0.023 BTC level after breaking through long term major support around the 0.0245 BTC level. ETHBTC is currently trading at 0.02376 BTC as it looks for a small bounce higher.

- From above: The nearest level of resistance lies at 0.024 BTC. Above this, higher resistance lies at 0.0245 BTC, 0.025 BTC and 0.026 BTC. The resistance at 0.026 BTC is further bolstered by the 20 day EMA.

- From below: The nearest level of support now lies at 0.023 BTC. If the sellers push beneath here, further support then lies at 0.0225 BTC, 0.022BTC and 0.02192 BTC.

- The trading volume remains close to the average for the trading year.

- The RSI has started to rise toward the 50 level which is a sign that the selling pressure may be diminishing. However, we will need to see the RSI break above 50 for any form of recovery.

The post Ethereum Price Analysis: ETH Drops Below Long-Term Support, $250 In Sight? appeared first on CryptoPotato.