Ethereum Price Analysis: ETH at Critical Support, Breakdown Can Quickly Lead to $1200

Despite the ongoing bearish sentiment among market participants following the recent turmoil of SVB bank and its effect on USDC, Ethereum’s price has found substantial support amid the $1450 price range.

The upcoming days will be crucial to see whether ETH can hold the critical level or continue its negative sentiment.

Technical Analysis

By Shayan

The Daily Chart

After breaking above the upper trend-line of the symmetrical triangle and consolidating for an extended period, the price of Ethereum has declined and is currently retesting the previous breakout level at $1450.

If ETH sustains this level, traders can expect another bullish leg toward the crucial resistance level of $1700K.

However, if the price drops below the trend line, a plunge toward the $1.2K support level may be imminent. Nevertheless, the upper trend-line of the triangle aligns with the 200-day moving average at $1450, providing a solid support level.

The 4-Hour Chart

The price of ETH has been following an ascending price channel (as shown below). However, it recently dropped below the middle equilibrium line, resulting in a cascade. Nevertheless, the price has now reached the channel’s lower boundary, temporarily finding support.

The price is ‘stuck’ in a tight range between the lower threshold at roughly $1410 and the static resistance region at $1500. ETH is likely to break out of this range in the coming days, and the direction of the breakout will determine the direction of the next short-term for ETH.

On-chain Analysis

By Shayan

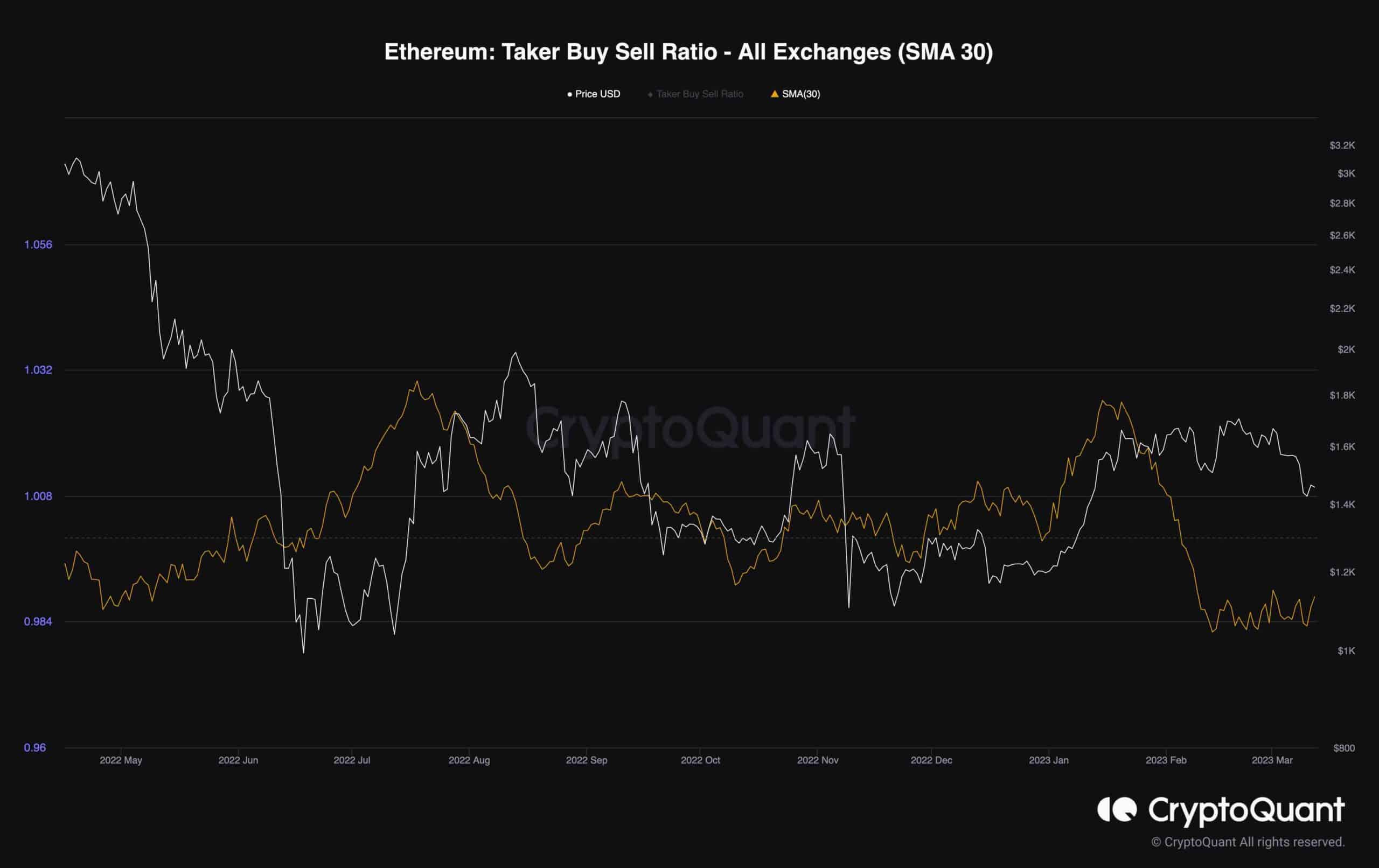

The Taker Buy/Sell Ratio is an indicator that helps understand market sentiment by indicating whether there is more buying or selling activity.

During ETH’s recent bullish leg, we observed a spike in this metric, confirming a positive market sentiment. However, when the price entered a consolidation phase and declined significantly after that, the metric dropped below one, indicating a change to a strong bearish sentiment.

Consequently, the metric plummeted to a new multi-month low, suggesting that the market is unlikely to enter a bullish stage unless the metric reclaims a value above one.

The post Ethereum Price Analysis: ETH at Critical Support, Breakdown Can Quickly Lead to $1200 appeared first on CryptoPotato.