Ethereum Price Analysis Dec.5: $85 is Closer Than Ever?

The Crypto market couldn’t find enough strength to go any higher.

At the moment of writing this post, the Bitcoin price is trading at the $3700 price level, below the symmetrical triangle formation boundaries (as we discussed in our last post) and is about to retest the previous lows for a possible continuation of the downward move.

If the bulls start setting buy orders at those levels, then the BTC chart has a chance to bounce upward from those support level, and fulfill the ABC correction analysis toward the $4200-$4600 targets.

But on the other hand, if the bears keep on pushing the price downward aggressively as they currently do, then we could witness a new yearly low with possible targets at the $3500- $3000 – $2500 price levels.

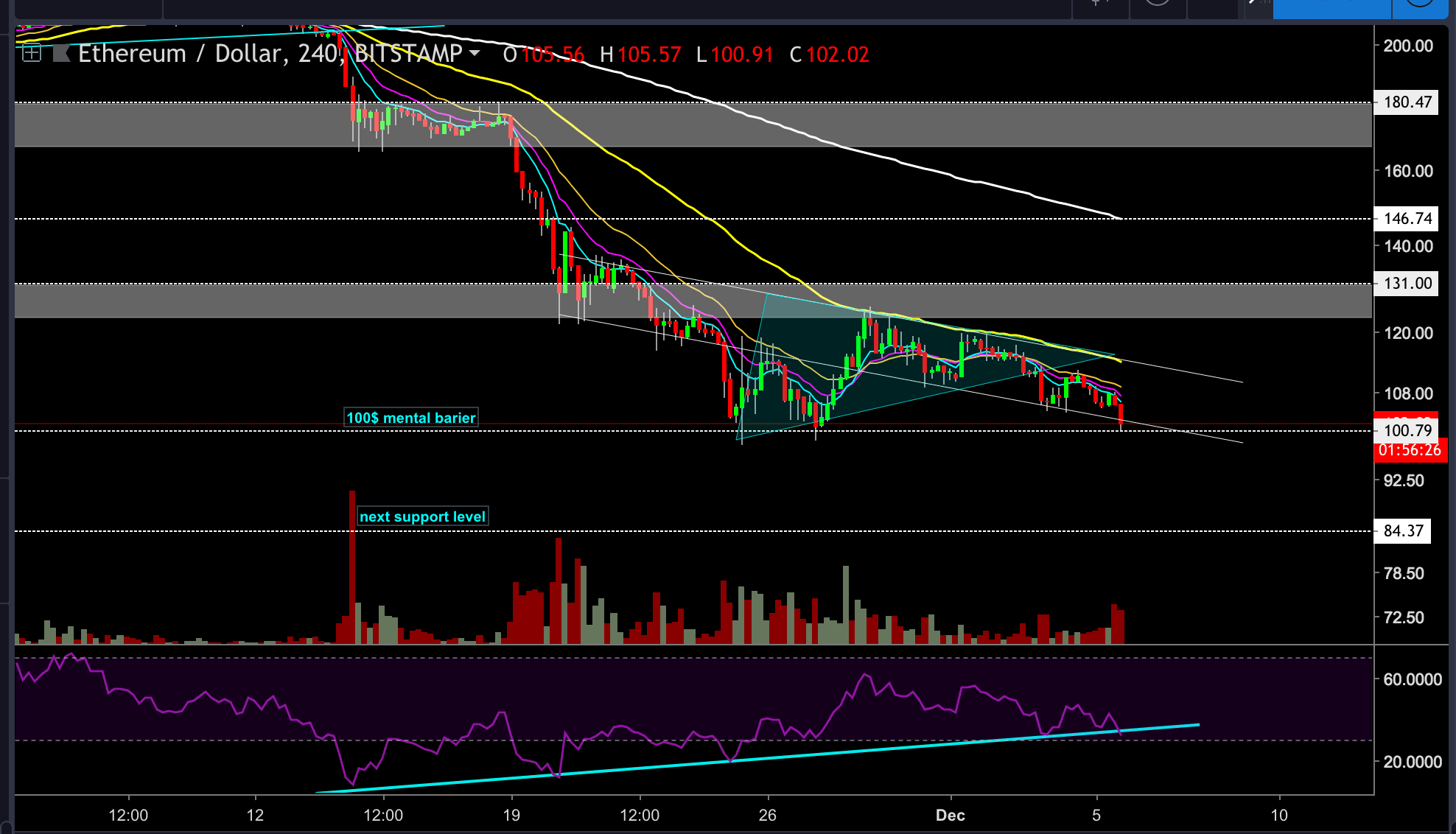

Ethereum chart, like all the other significant Altcoins, is moving with correlation to the BTC price, and as we explained in our last post, a failure to climb above the symmetrical triangle formation trend line will lead to a hard break downward and a retest of the $100 price level.

As for now, the ETH price is set at $103 and facing down.

ETH/USD BitStamp 4-Hour Chart

Cryptocurrency charts by TradingView. Technical analysis tools by Coinigy.

- If the BTC chart does not find the support needed for a bounce upward, then the overall market will head to new lows, and ETH will likely break below the $100 level.

- The next possible target could be found at the $85-$84 price level.

- If this historical price level doesn’t hold as a strong support, then the $50 area is ETH next mental support level.On the other hand, if the market does find a temporary bottom and the talked about bounce will take place from the current support levels, then we could still see an ABC upward (Elliott wave theory) correction forming with possible targets at the $113 and $125 price levels.

But with that said, at the moment, we are favoring the bear’s side of the equation due to the lack of volume in the market and very low buying power to protect the current price levels.

The post Ethereum Price Analysis Dec.5: $85 is Closer Than Ever? appeared first on CryptoPotato.