Ethereum Layer 2 Networks’ Total Value Locked Hovers at Near-Record High, Data Shows

Featured SpeakerJenny Johnson

President and CEOFranklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

:format(jpg)/www.coindesk.com/resizer/KnsJr2e_U9xZpD2ZQMUcfS-ZspM=/arc-photo-coindesk/arc2-prod/public/ZEPFGG2W5BBFRJUO5WS4CTRCPA.jpeg)

Jocelyn Yang is a markets reporter at CoinDesk. She is a recent graduate of Emerson College’s journalism program.

Featured SpeakerJenny Johnson

President and CEOFranklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

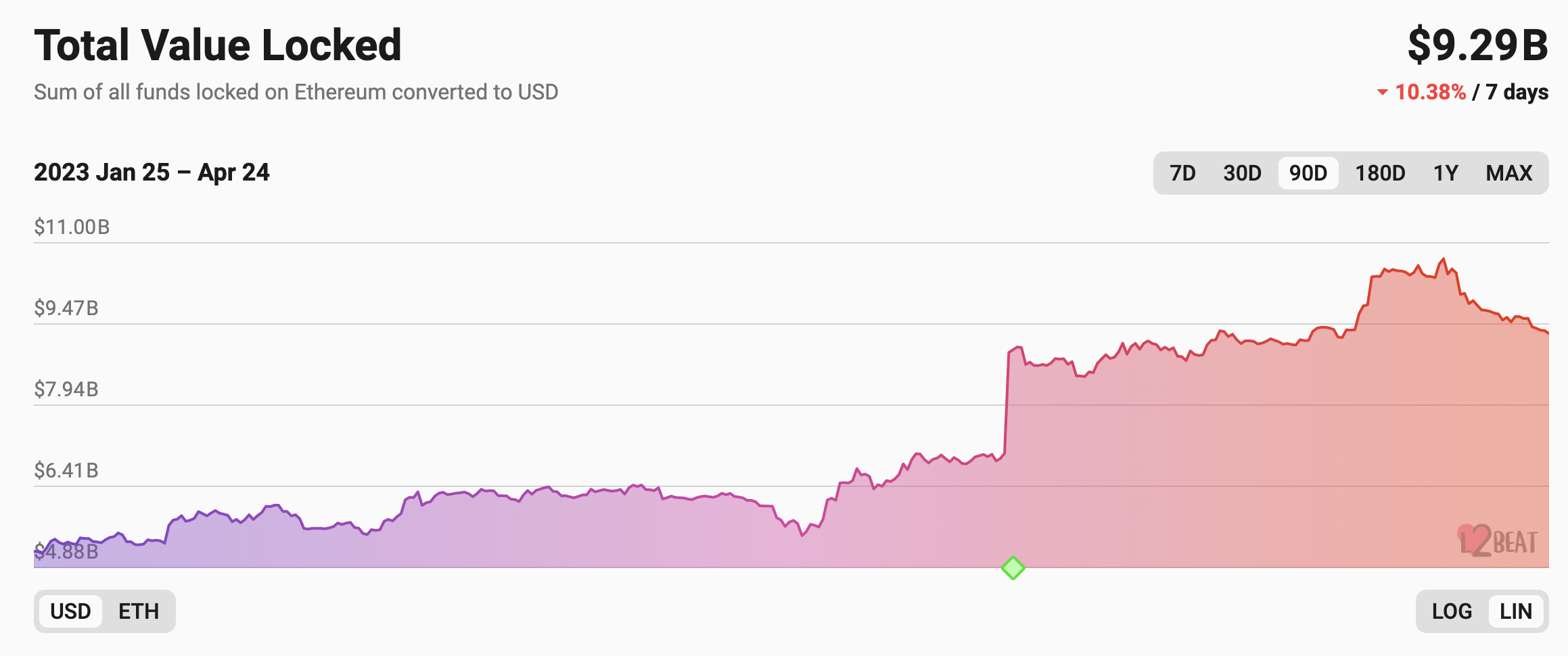

As ether’s price rose in April, so did the total value locked (TVL) of Ethereum layer 2, or companion, networks, reaching $10 billion on April 14, its highest level yet. TVL has subsequently declined amid a swoon in crypto prices but remains at around $9.29 billion, more than double where it stood at the start of the year, data from layer 2 analytics site L2Beat shows.

TVL represents the overall value of crypto assets deposited in a decentralized finance (DeFi) protocol or in DeFi protocols generally. The rising TVL reflects a growing interest in scaling systems.

L2Beat data shows that some five million ether (ETH) worth over $10 billion were locked on the Ethereum blockchain in mid-April as ETH rose above $2,100. TVL has dropped 10% over the past five days to its current level as ETH sank below $1,900. On Jan. 1, with ETH below $1,200, TVL was just $4.1 billion.

Ethereum layer 2 networks’ total value locked(TV) hovered at around $9.29 billion on Monday. (L2Beat)

Messari Research Analyst Stephanie Dunbar told CoinDesk in an email that layer 2 networks’ recent TVL spike has come as users grow weary of Ethereum’s hefty fees during peak network demand periods and opt for less-expensive platforms, many of which have sprouted in recent months.

Arbitrum One dominates the layer 2 scaling landscape, accounting for more than 66% of the market share, according to L2Beat. Optimism follows with over 20% of the market share. Both Arbitrum and Optimism are Optimistic rollups designed to reduce transaction costs.

This year, Arbitrium, the fourth-largest blockchain in TVL, has surpassed Ethereum for daily transactions, averaging about 1.2 million in March compared to the latter platform’s 1.1 million transactions, according to block explorer Arbiscan and Etherscan.

Riyad Carey, research analyst at crypto data firm Kaiko, also sees potential airdrops and enthusiasm for new chains driving layer 2 initiatives, including Arbitrum’s own airdrop of its ARB token last month. He told CoinDesk that he was “curious to see how sticky Arbitrum’s users and transactions will be now that its airdrop has happened.”

Carey added that he considers TVL to be a flawed metric because it depends on the token’s price shifts. Historically, TVL and token prices rise in tandem.

Despite the price fluctuation issue, Messari’s Dunbar sees TVL as a “legitimate mechanism” for gauging “network usage, interest, as well as value considering it is representative of the market’s valuation of the network.”

Pedro Lapenta, head of research at crypto asset manager Hashdex, suggested that, besides TVL, investors should analyze a network along with other metrics such as transaction volumes because “in any analysis, one isolated (metric) can not tell you the whole picture.”

“While TVL can be an easy-to-understand metric (especially for DeFi), it can also be misleading,” Lapenta told CoinDesk, pointing to a Sybil attack on Solana last year that created $7.5 billion of fake TVL.

Rising interest in ZK-rollups

Newly unveiled zero-knowledge (ZK) rollups zkSync Era and Polygon zkEVM have registered the fastest-growing TVL over the past month, with TVL rising on the latter to $5.18 million, a 14% increase over the past seven days. ZkSync Era accounted for $240 million in TVL, up 0.2% during the same period, according to L2Beat data.

ZK rollups generate cryptographic proofs to validate the authenticity of transactions. They differ from Optimistic rollups that can be challenged and assess fraudulent transactions through fraud proofs.

According to Dunbar, ZK rollups are generally considered “top-notch for scaling” because of their “high-security guarantees and fast finality times,” but the challenge remains to achieve EVM-equivalence – meaning that the experience of developing on Arbitrum and Optimism is 100% identical to the experience of developing on Ethereum – given ZK rollups’ complex technical design.

“Imagine being able to deploy an app on a ZK rollup using the same tooling, infrastructure and smart contract code, or as a user being able to use the same wallets you already use,” Dunbar said.

“This is what the race for zkEVMs is all about: scaling Ethereum with the benefits of zk tech, but sticking as closely as possible to the Ethereum experience,” she added.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/KnsJr2e_U9xZpD2ZQMUcfS-ZspM=/arc-photo-coindesk/arc2-prod/public/ZEPFGG2W5BBFRJUO5WS4CTRCPA.jpeg)

Jocelyn Yang is a markets reporter at CoinDesk. She is a recent graduate of Emerson College’s journalism program.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/KnsJr2e_U9xZpD2ZQMUcfS-ZspM=/arc-photo-coindesk/arc2-prod/public/ZEPFGG2W5BBFRJUO5WS4CTRCPA.jpeg)

Jocelyn Yang is a markets reporter at CoinDesk. She is a recent graduate of Emerson College’s journalism program.