Ethereum ETH Price Analysis Sep.20: Back to Stability?

Back in January (2018), with ETH prices nearing $1400, no one ever thought prices would return down to sub $200 levels. However, the current bear market that’s lasted most of 2018, has seen the entire altcoin market take a beating.

Many people are speculate that ICOs may be dumping the ETH they raised during the bull market, in order to stay in business during this bear market, which may have lasted longer than first expected. Others speculate that ETH may be dumping due to Bitmex introducing a new, highly liquid option to short ETH, along with their blog post about shorting ETH.

Seeing as how the entire crypto market currently reacts Bitcoin’s price action, it may be difficult to trade alts separately. However, here are some important current aspects for ETH, based on technical analysis.

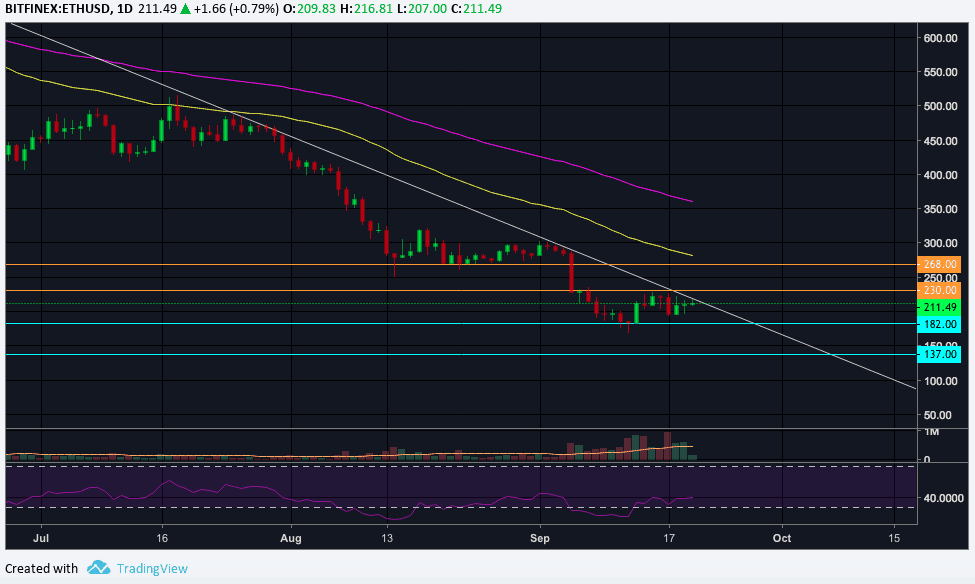

BTC/USD BitFinex 1 Day Chart

- Important support levels (blue lines) for ETH seem to be around $182 and $137. These levels are based on price action dating all the way back to the summer of 2017, the last time ETH prices were this low.

- Resistance levels (yellow lines) appear to be around $230 and $268.

- ETH price is also quite a bit below the 50 (yellow line) and 100 (pink line, around $350) exponential moving averages (EMAs).

- As it sits right now, the 50 EMA would act as resistance at roughly the $270 zone, this is the same range as the $268 resistance level listed above. Hence, a strong resistance zone for ETH.

- Volume has picked up quite a bit the last several days, comparative to previous weeks.

- RSI is still low, close to the oversold region.

- ETH is now reaching the white long-term descending trend-line, possibly at a point of decision; rejection or break through to the upside.

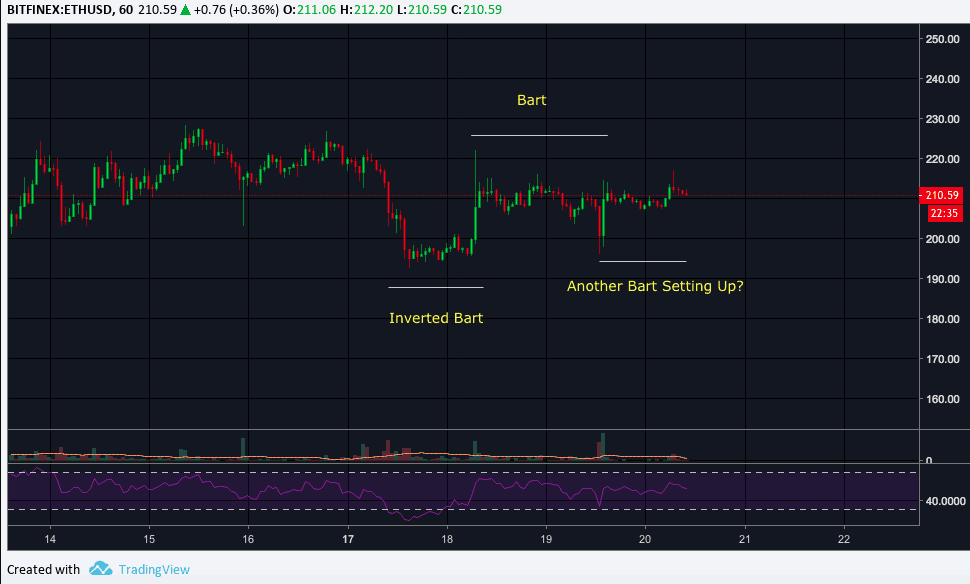

BTC/USD BitFinex 1 Hour Chart

On the 1 hour chart for ETH, we seem to be in “Bart Simpson” territory. Bart territory can often mean that there is not much true liquidity, with most trading being the result of bots, algorithms, and high leverage. Volume also correlates to the Bart patterns and another Bart might be setting up till decision, as seen below:

To Sum Up

The path of least resistance for ETH would be most likely bearish on the short-term, with only a few notable support zones left before a possible free fall capitulation potential to $100. One also must consider whether ICOs need more FIAT to keep their developments going on.

Cryptocurrency charts by TradingView. Technical analysis tools by Coinigy.

The post Ethereum ETH Price Analysis Sep.20: Back to Stability? appeared first on CryptoPotato.