Ethereum (ETH) Is Undervaluead: These 4 Metrics Explain Why

By examining numerous aspects of the Ethereum network since its launch in 2014, a cryptocurrency research firm concluded that the asset price is significantly undervalued.

Ethereum Developments

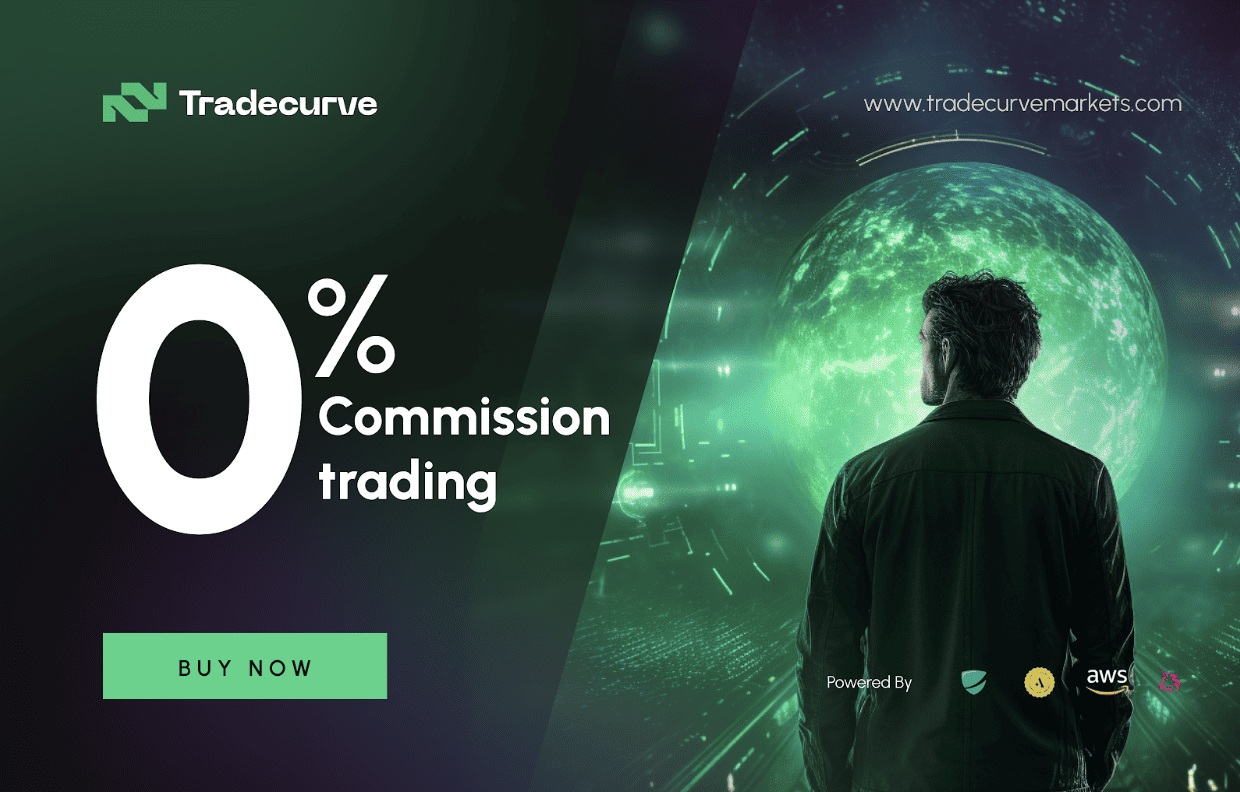

Blockfyre based the analysis on several core features of the Ethereum network and its performance in the past six years. Firstly, the company examined the development activities, saying that they have been continuously increasing, regardless of how the price has acted.

While the research firm hasn’t disclosed the precise meaning of “development activities,” the graph above illustrates that Ethereum has been implementing the most substantial number of improvements long after the ETH price plummeted after the $1,400 peak in early 2018.

Nevertheless, some of those developments could be linked with the recent hard forks from Ethereum. Those include 2019’s Istanbul and the 2020 Muir Glacier.

Arguably the most anticipated network improvement, Ethereum 2.0, should arrive at some point by the end of the year. By implementing it, Ethereum will switch from the current proof-of-work consensus algorithm to proof-of-stake. With the network upgrade, the company aims to address current scaling and security issues.

Ethereum Gas And HODLers

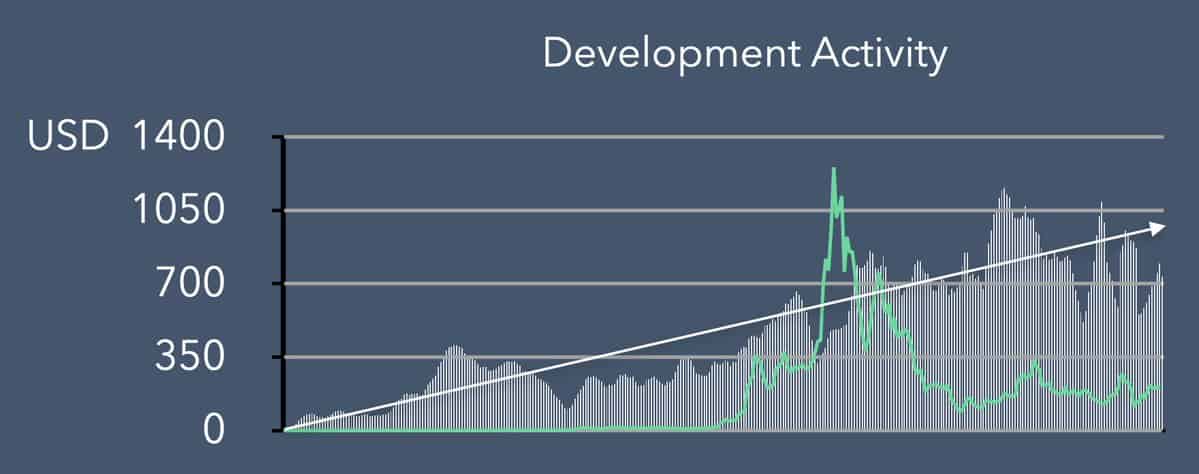

The second measurement of Blockfyre’s analysis takes into consideration the gas used. This is the fee, or pricing value, required to successfully conduct a transaction or execute a contract on the Ethereum blockchain platform.

“The amount of Gas Used on the network is constantly increasing and even hitting ATHs at the moment, indicating the growing adoption of the Ethereum network.” – notes the report.

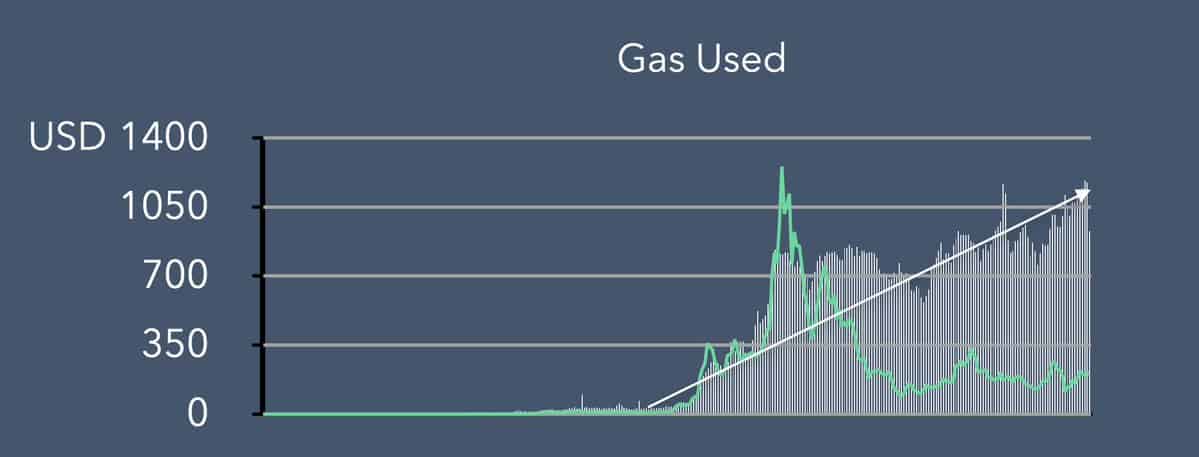

Thirdly, the analysis informs that Ethereum investors prefer holding their assets. The metric shows that since 2018, ETH accumulation and hold levels have been continuously surging and reached a fresh all-time high just recently.

Another similar report from CryptoPotato supported this by indicating that 77% of all ETH in externally owned accounts (EOAs) has been dormant for the past six months. Also, the number of non-zero addresses holding ether has skyrocketed by 350% since the ATH in January 2018.

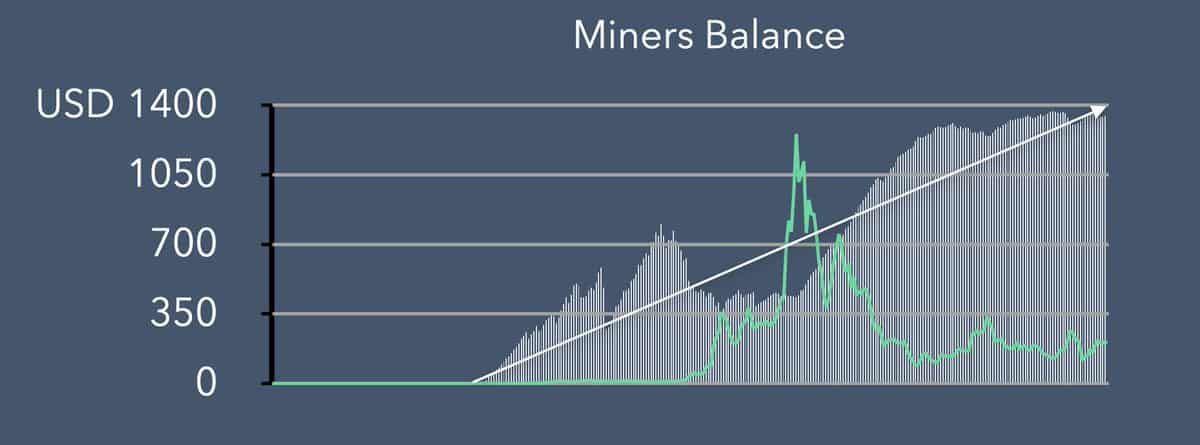

According to Blockfyre, Ethereum miners are also demonstrating a strong holding mentality. The ETH Miner’s Balance, the measurement following their behavior, illustrates that miners, “who actually need to sell their mining rewards to cover their expenses, prefer to hold at current price levels.”

Ultimately, the conclusion from the report outlines that the price of the second-largest cryptocurrency by market cap is “significantly undervalued.” It added that “Ethereum’s progress and several further indicators are very promising” for the future of the network and the asset price.

The post Ethereum (ETH) Is Undervaluead: These 4 Metrics Explain Why appeared first on CryptoPotato.