Ethereum (ETH) a ‘Golden Opportunity’ Below $1,800?

TL;DR

- ETH has followed the overall decline of the cryptocurrency market, entering red territory again.

- However, the RSI’s lowering ratio and other factors indicate the pullback could be near its end.

Rebound Incoming?

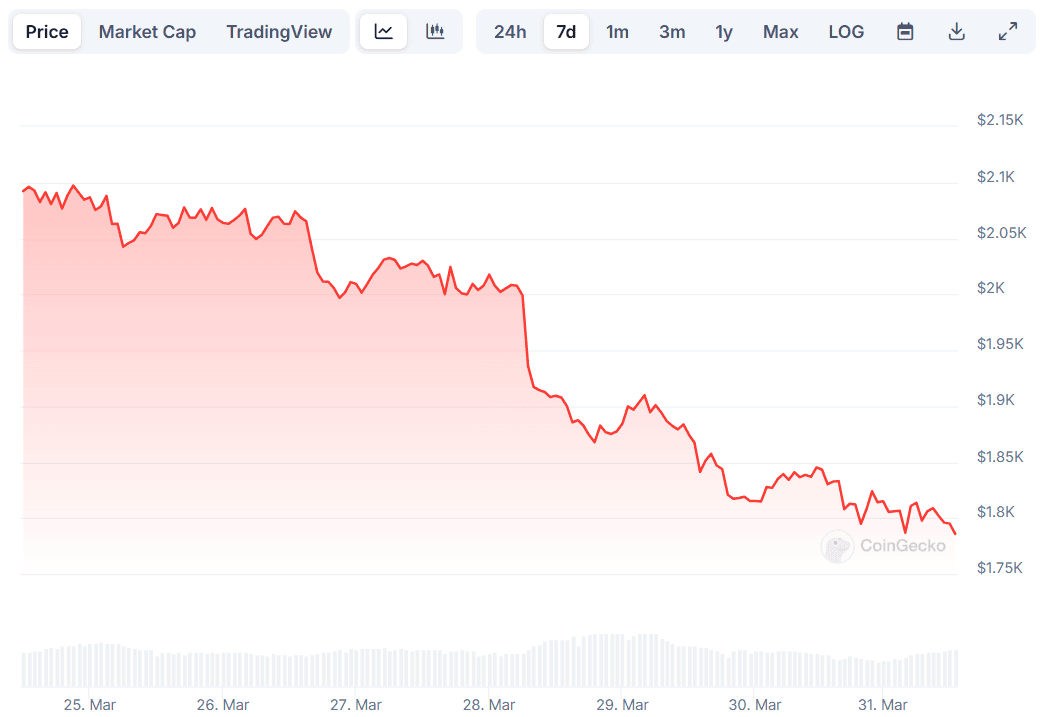

Ethereum bulls suffered another blow in the past several hours, with ETH’s price dipping below $1,800. This represents a substantial 14% weekly decline and comes as the entire cryptocurrency market bleeds out heavily again.

Despite the negative environment, some factors signal a potential resurgence for ETH in the short term. The asset’s Relative Strength Index (RSI) has fallen to around 20, registering its lowest point since the beginning of February.

The technical analysis tool measures the speed and change of price movements and helps traders asses possible reversals. Readings below 30 typically suggest that ETH has entered oversold territory, indicating a potential bounce ahead. Conversely, anything above 70 is considered a bearish sign.

Ethereum’s exchange netflow also signals that the correction could be nearing its end. In the past week, more ETH has been withdrawn from exchanges than deposited, hinting that investors are moving their assets to self-custody. This trend typically lowers the immediate selling pressure.

Price Predictions

ETH has been one of the biggest disappointments of the latest bull cycle, and in fact, Q1 2025 has been among the worst quarters of the cryptocurrency’s history. Recall that at the start of the year, the price stood above $3,300, while the current level represents a 45% decline from New Year’s Eve.

However, some market observers remain optimistic that ETH can get back on the green track soon. The X user Crypto General expects “a bullish momentum” if the price reclaims $2,000.

“For long-term people, it’s a golden opportunity to add at such cheap prices. These zones don’t come very often,” they argued.

On the other hand, the analyst envisioned a further breakdown to $1,500 if the price remains below “the skeptical zone” of $1,800.

Michael van de Poppe also chipped in. He reminded that gold has had a highly successful quarter compared to the devastating one witnessed by ETH. Nonetheless, he believes the ongoing week “might be a big one,” pointing to Donald Trump’s upcoming tariffs, which are scheduled to come into effect on April 2 and may trigger another doze of uncertainty in the financial and crypto markets.

The renowned analyst even suggested that the “Sell the rumor, Buy the news” phenomenon might be in play. This is a twist of the common trading phrase “Buy the rumor, sell the news” and means that people may sell early based on negative speculation. When the actual news turns out not as bad as feared, the prices bounce, and savvy traders buy the dip.

The post Ethereum (ETH) a ‘Golden Opportunity’ Below $1,800? appeared first on CryptoPotato.