Ethereum Blasts Bitcoin In Terms Of New Active Addresses Since The Start Of 2020

Ethereum has seen its active addresses count explode by nearly 150% since the start of the year. Its addresses are also massively outperforming Bitcoin’s despite being up by 50% YTD.

Ethereum Outperforms BTC In New Active Addresses

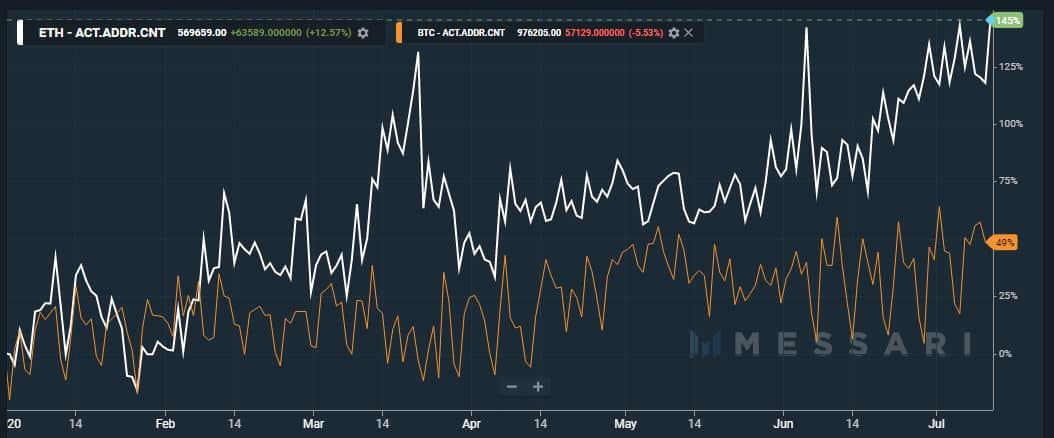

According to data provided by the blockchain monitoring company Messari, the number of Ethereum active addresses year-to-date has surged by 145%.

The chart illustrates a couple of significant surges. The first one occurred in the days following the price plunges in mid-March. At the time, the ETH token, following the increasing threat of the COVID-19 pandemic, nosedived to its yearly low beneath $100.

The second massive increase came in early June. This one can be attributed to the sudden popularity boost of the decentralized finance sector. As Ethereum is the underlying technology behind the DeFi field, it has prompted investors to create more active addresses in order to participate in the latest trend in the cryptocurrency scene.

Additionally, the number of Ethereum addresses with more than 0.1 ETH reached a new all-time high in June. And, the non-zero Ethereum addresses had skyrocketed by more than 350% since January 2018, when the asset price was at its highest level of over $1,400.

Bitcoin, on the other hand, has performed more modest, according to the data from Messari. Nevertheless, despite having a largely lower number of new active addresses, BTC is still up by almost 50% since the start of the new decade.

ETH Vs. BTC Fees

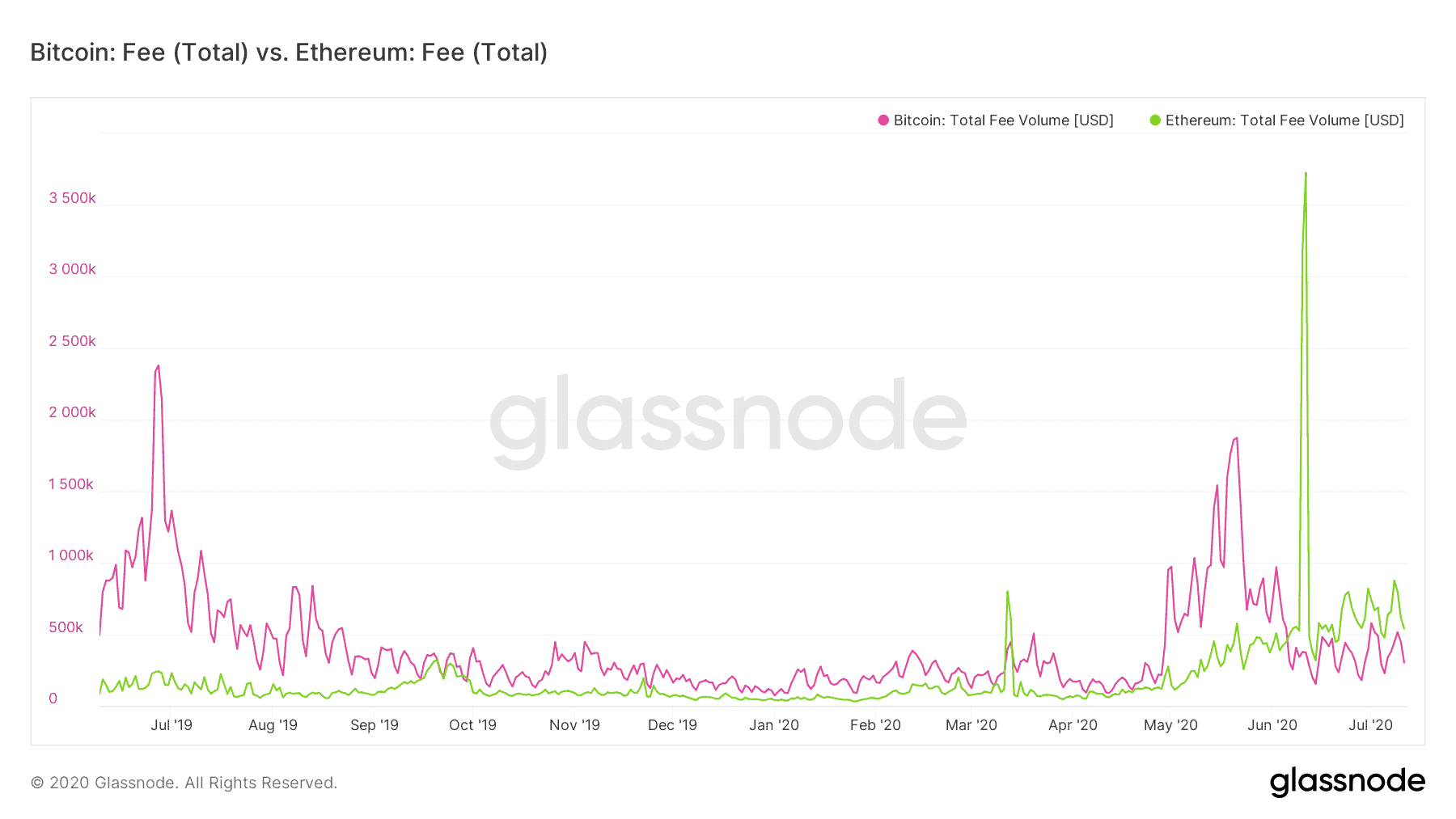

Another metric that Ethereum has surpassed Bitcoin lately is the total fee volume. As CryptoPotato reported before, this “feepening” occurred in early June. The fees on the Ethereum network exploded at the time when several consecutive suspicious transactions took place., A small South Korean cryptocurrency exchange transferred in total 350.55 ETH but paid about $5.2 million in fees.

Although the fees on the ETH blockchain have normalized after this unexpected spike, their volume is still higher than Bitcoin’s, as data from Glassnode displays. On July 8th alone, for instance, the total volume fee on Ethereum amounted to $875k, while the metric for BTC indicated $445k.

The post Ethereum Blasts Bitcoin In Terms Of New Active Addresses Since The Start Of 2020 appeared first on CryptoPotato.