Ethereum Addresses With More Than 0.1 ETH At an All-Time High

Ethereum’s popularity continues to grow among investors as the number of EOA addresses holding at least 0.1 ETH recently recorded an all-time high by surpassing the three million mark.

Ethereum Addresses On The Rise

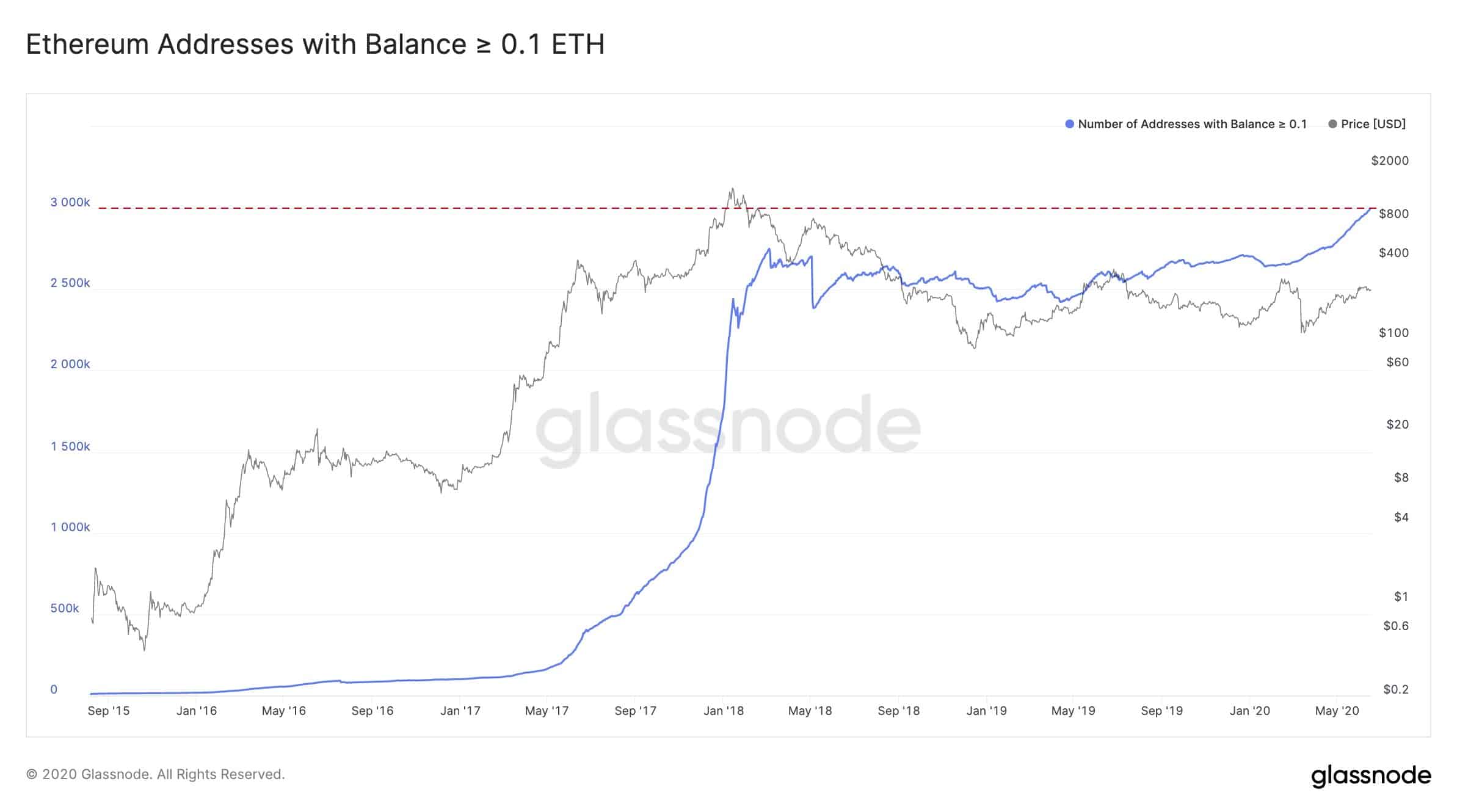

The cryptocurrency analytics company Glassnode displayed the data regarding the number of Ethereum addresses containing at least 0.1 ETH. According to the information, such addresses have spiked since the start of the year by 10.9%. Hence, they have “just crossed the three million mark for the first time.” It’s worth noting that this applies only to externally owned accounts (EOAs).

The graph above demonstrates that the most significant surge of such addresses came from mid-2017 to early 2018 skyrocketing from below 500k to around 2.5 million. During that period, Ethereum was becoming especially popular among cryptocurrency investors because of the ICO boom.

Another compelling correlation occurred at the time between the rapid increase of Ethereum addresses with balances of at least 0.1 ETH and the asset price. During the parabolic price increase of late 2017 and early 2018 and amid the growth of such addresses, Ethereum reached its all-time high of approximately $1,400.

Interestingly, despite its price falling substantially since then, the number of these addresses remained relatively stable for a few years before beginning to increase again in 2020.

The number of non-zero Ethereum addresses has been skyrocketing as well since the price peak of January 2018. A recent report informed of an increase of over 350% in a little over two years.

Institutional Investors Agree

Grayscale Investments, the company serving primarily institutional investors, has also presented data confirming the increasing interest towards the second-seeded cryptocurrency by market cap.

Firstly, recent research indicated that the firm had purchased nearly 50% of all mined ethers in 2020 to cope with the demand from their clients. Interestingly, Grayscale customers don’t mind paying significantly more for the service.

As reported by CryptoPotato, the company sells ETH shares at a 750% premium. In other words, institutional investors purchasing through Grayscale prefer buying Ethereum for more than $2,000, while its spot price is hovering at $235, and avoid having to store, transfer, or manage the funds.

All of this data raises the question of whether Ethereum investors expect serious developments to occur soon as the network is preparing for the launch of ETH 2.0. The release of the long-anticipated upgrade will signify the transition from the current proof-of-work consensus algorithm to proof-of-stake. Thus, Ethereum aims to fix some ongoing issues with scaling and security.

The post Ethereum Addresses With More Than 0.1 ETH At an All-Time High appeared first on CryptoPotato.