Ether Staking Deposits Top Withdrawals for First Time Since Shapella Upgrade

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

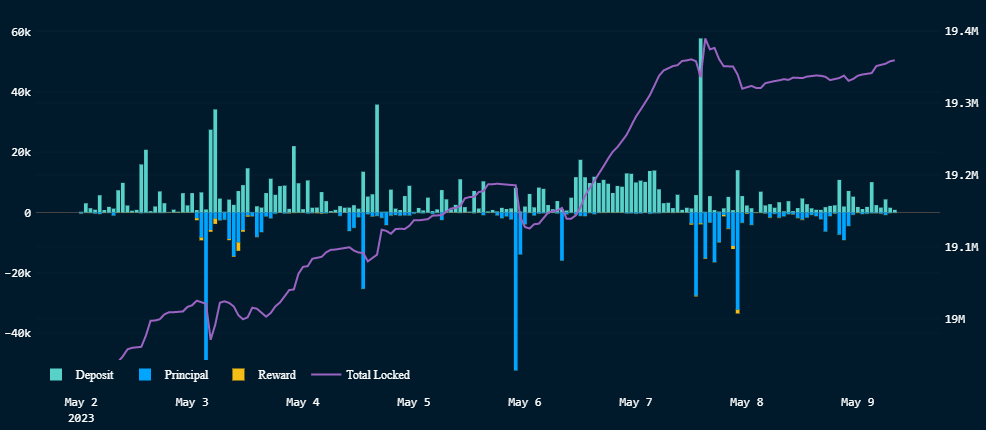

Ether (ETH) holders are rushing to stake their tokens with network validators, pushing deposit activity to the highest level since the Shapella upgrade earlier this year.

More than 200,000 ether have been deposited to the network since the start of the week, data from the on-chain analytics tool Nansen show, marking the first time deposits have outpaced withdrawals since Shapella went live last month. The additions bring the number of ether locked for staking purposes to over 19 million tokens – about 15% of the total circulating supply.

The influx comes as traders flock to meme coins such as pepecoin (PEPE), which has strained the Ethereum network and sent transaction fees to a 12-month high.

Ether staking deposits are booming. (Nansen)

Over 6 million staked ethers are held on Lido Finance, a protocol that issues depositors with alternative tokens representing the amount they’ve locked up. Those alternatives can then be used as liquidity in the broader decentralized finance (DeFi) ecosystem.

Shappella – a portmanteau of Shanghai and Capella, two major Ethereum network upgrades that occurred simultaneously on April 12 – gave investors the ability to withdraw their staked ether at will for the first time.

In a proof-of-stake blockchain such as Ethereum, users stake, or lock, cryptocurrency – ether in this case – to help secure and confirm new data blocks. These stakers receive network rewards in the form of tokens, creating a form of passive investing strategy.

Platforms such as Lido pay out 6.6% in annualized yield rewards to stakers. More complex strategies involving staked ether and other tokens can yield up to 21%, data from Defillama shows.

Edited by Sheldon Reback.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.