Ether Options Trading Volume Surpasses Bitcoin As Shanghai Upgrade Drives Demand for Bullish Bets

Featured SpeakerDeep Dive: Ethereum

Protocol VillageAustin Convention Center

Join an hour long exploration of the advancements defining the Ethereum community in 2023.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

Featured SpeakerDeep Dive: Ethereum

Protocol VillageAustin Convention Center

Join an hour long exploration of the advancements defining the Ethereum community in 2023.

The options market tied to ether (ETH) has seen more activity than bitcoin (BTC) in the past 24 hours, the first such instance of 2023.

Major exchanges, including industry leader Deribit, have seen ether options contracts worth $1.23 billion exchange hands in the past 24 hours. That is nearly 60% of the global crypto options activity and 50% more than bitcoin’s notional trading volume of $823.7 million, according to Swiss-based data tracking website Laevitas.

Options are derivative contracts that give the purchaser the right but not the obligation to buy the underlying asset at a predetermined price on or before a specific date. A call option gives the right to buy while a put option confers the right to sell. Traders use call and put options to hedge their spot/futures market exposure and to acquire an asymmetric payout.

The latest pick-up in activity in the ether options market comes on the heels of Ethereum’s successful implementation of the highly-anticipated Shanghai upgrade on Wednesday. The upgrade has opened withdrawals of over 18 million ether staked in the network since December 2020, de-risking staking – the process of locking coins in the blockchain to boost network security in return for rewards.

Since then, CoinDesk’s ether price index (ETX) has rallied by over 10% to an eight-month high of $2,115, defying fears of a post-upgrade price swoon and outperforming market leader bitcoin. The double-digit gain has revved up investor interest in ether call options.

“We have seen strong demand for OTM [out-of-the-money] calls in ETH,” Chris Newhouse, an OTC trader at crypto market maker GSR, wrote in an analysis published on Deribit.

Calls at strike prices above ether’s going market rate are called out-of-the-money. Those are cheap compared to calls at strikes below the current spot price.

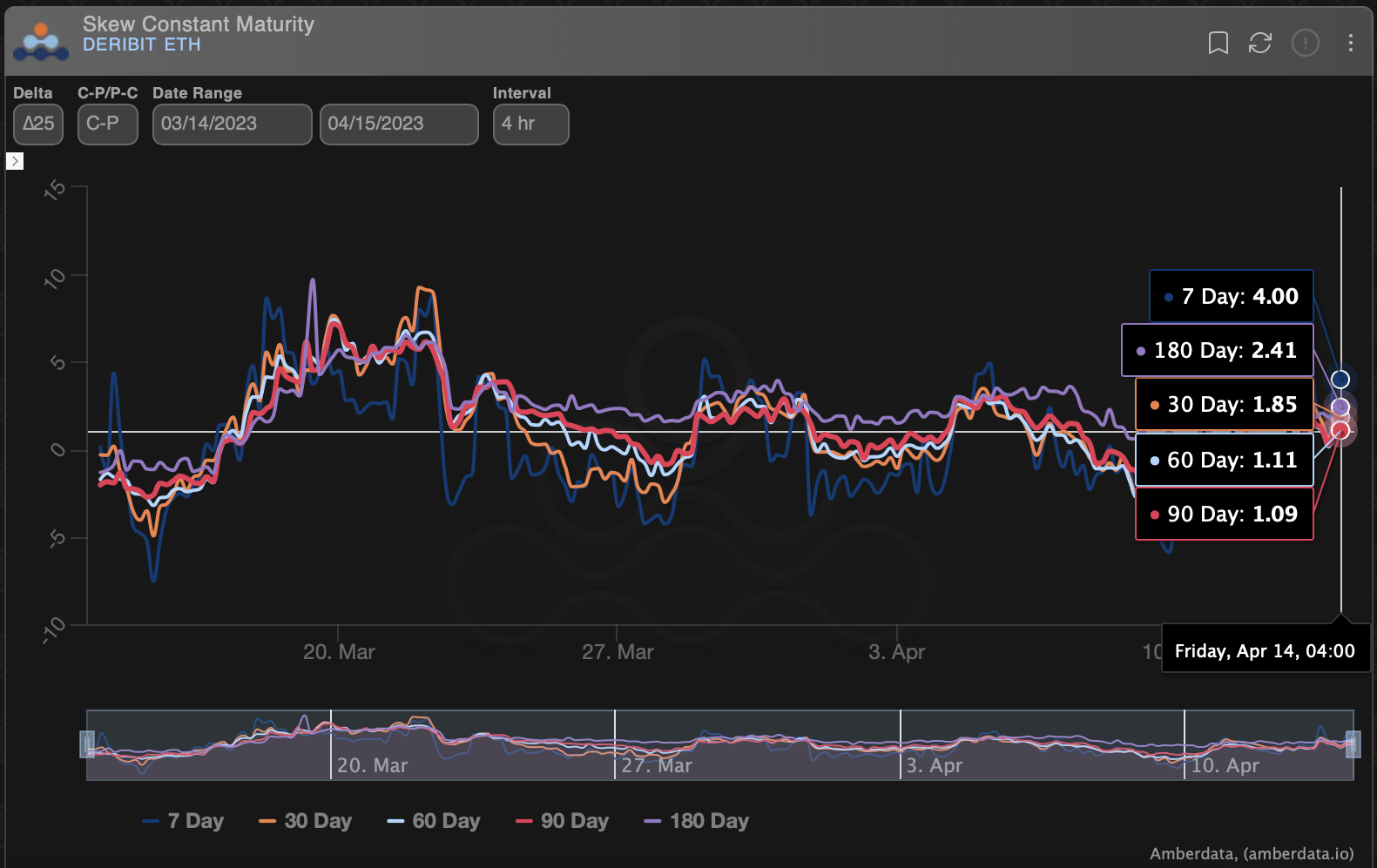

The increased demand for ether calls is evident from the short-term and long-term options skew, which have flipped positive. The skew measures the spread between the implied volatility premium or prices for calls and puts.

The call-put skews have flipped positive, signaling a renewed bias for bullish call options. (Amberdata, Deribit) ((Amberdata, Deribit))

Edited by Shaurya Malwa.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.