Ether Jumps to Nine-Month High Ahead of Shapella, Liquid Staking Tokens Jump

Deep Dive: Ethereum

Protocol Village

Austin Convention Center

Join an hour long exploration of the advancements defining the Ethereum community in 2023.

Deep Dive: Ethereum

Protocol Village

Austin Convention Center

Join an hour long exploration of the advancements defining the Ethereum community in 2023.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Co-Leader of the CoinDesk tokens and data team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

Deep Dive: Ethereum

Protocol Village

Austin Convention Center

Join an hour long exploration of the advancements defining the Ethereum community in 2023.

Deep Dive: Ethereum

Protocol Village

Austin Convention Center

Join an hour long exploration of the advancements defining the Ethereum community in 2023.

An upcoming upgrade on the Ethereum network is funneling capital to ether (ETH) and staking-focused tokens as traders likely expect higher prices for these assets in the future.

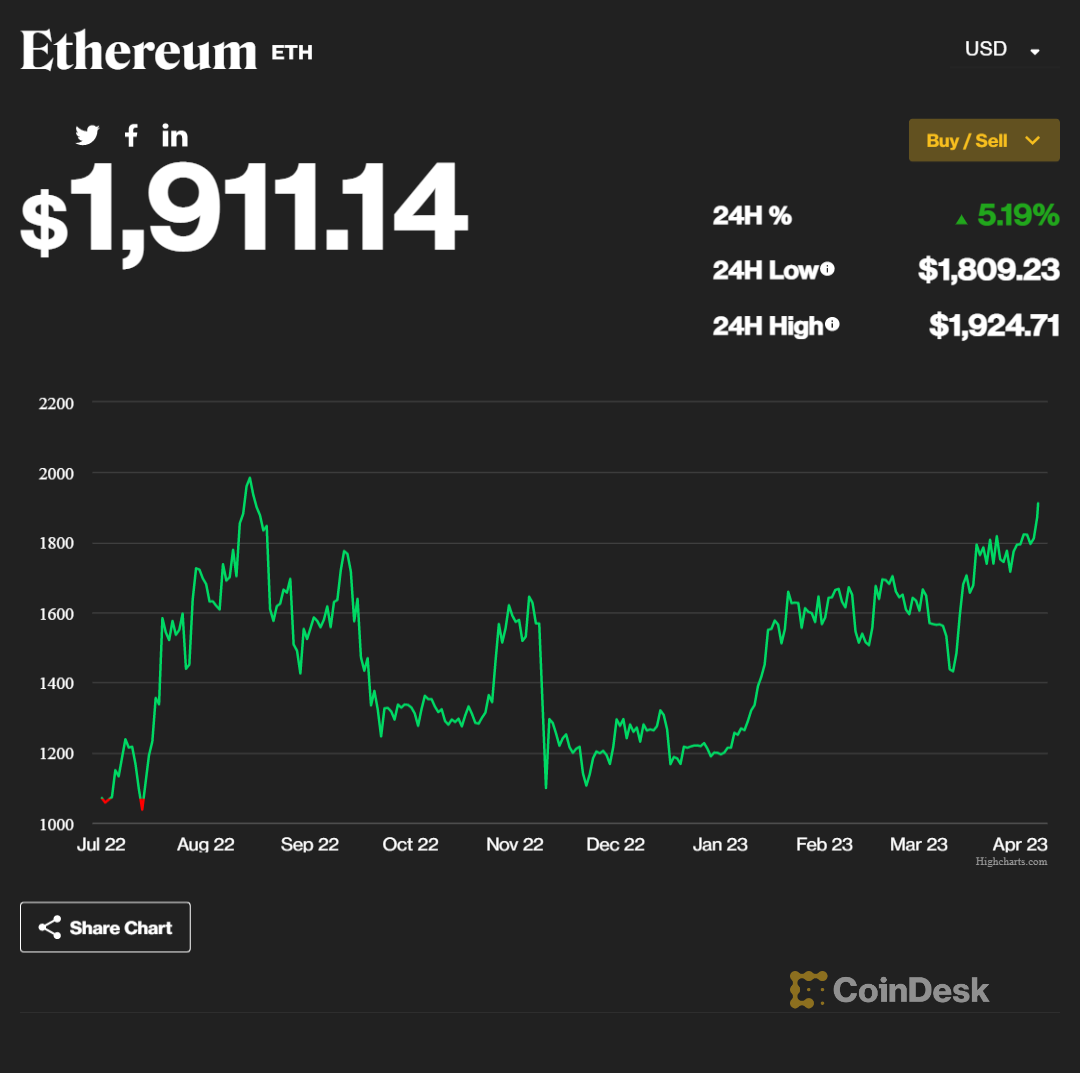

Ether jumped 5% in the past 24 hours, a top performer among major tokens, to over $1,920 on Wednesday morning. That’s the highest price level for the token since August 2022, CoinDesk data shows.

Ether has set a nine-month price high. (CoinDesk)

Open interest, or the number of unsettled derivative contracts, for ether futures rose to $5.6 billion in the past 24 hours with over $23 billion worth of these products traded on crypto exchanges.

The interest in ether trading comes ahead of Shapella, a portmanteau of Shanghai and Capella, two major Ethereum network upgrades that are expected to occur simultaneously on April 12. Shapella will allow investors to withdraw their ether staked on the Ethereum blockchain – as staked ether cannot be withdrawn or freely traded currently.

Some say the event could prove bullish for ether in the future, as staking and capturing yields directly from the blockchain becomes more accessible to users.

“Allowing withdrawals, boosted by the recent popularity of liquid staking platforms, will make ETH staking much more accessible to retail investors who were previously unwilling to stake ETH for an undetermined amount of time,” said Chen Zhuling, CEO at staking service RockX, in a note to CoinDesk.

So far, investors have relied on liquid staking platforms such as Lido and Rocketpool, which issue the LDO and RPL tokens respectively, to capture yields from staking ether on Ethereum nodes while freeing up capital for other uses. Uses range from using these tokens as collateral for loans or margin trading to earning additional yield.

This has culminated in the liquid staking derivatives (LSD), a term for tokens issued by such platforms, emerging as one of the strongest investor plays in 2023.

Liquid staking tokens jumped overnight as investors bet on growth in decentralized staking products ahead of Shapella, data shows.

The liquid staking sector jumped 6% on average, CoinGecko data shows, while the broader crypto market capitalization rose a relatively lesser 3%.

LDO and RPL led gains in this sector with a 5% rise each, while tokens with a smaller market capitalization, such as Stader’s SD, surged 22%.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Co-Leader of the CoinDesk tokens and data team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Co-Leader of the CoinDesk tokens and data team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.