Ether Holders Embrace Near Month-Long Wait for Staking ETH

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

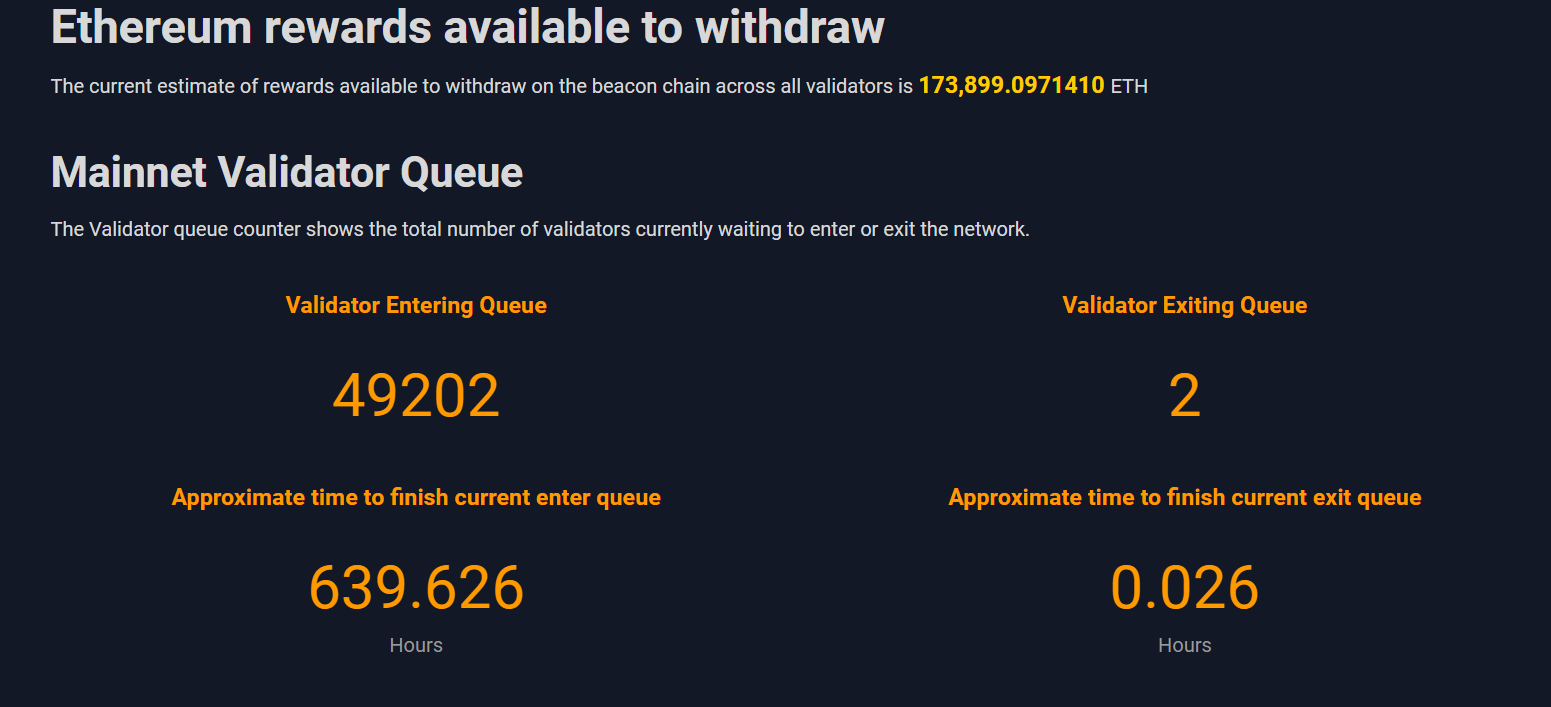

Crypto investors looking to earn yields on their ether (ETH) holdings have to wait nearly a month before they can be set up as network validators on Ethereum.

Data from two sources show waiting times for staking ether lingers at 640 hours, or about 26 days. Exiting the network, on the other hand, takes just 0.013 hours, or less than a minute.

Validators are entities in a proof-of-stake blockchain, such as Ethereum, that process transactions and help maintain the overall security of such networks. As of May, nearly 50,000 validators are waiting in a “queue” to be able to enter the network, data shows.

The data indicates the demand for validators to enter the network and earn the nearly 5% annual yield. Such strong demand is likely stemming from large ether holders, who do not want to cash out and instead just want to earn some passive income on their holdings.

Some market watchers say these upcoming validators could be a mix of both new market entrants as well as stakers who previously unstaked ether from the network to test if the process works seamlessly and are now entering again.

“Immediately following the Shapella upgrade, a significant amount of demand pressure was exerted by stakers who had been locked up for 18+ months and may have wanted to exit their staked ETH position,” explained Matt Leisinger, co-founder at staking protocol Alluvial.

“This demand has since subsided as those stakers have all exited their position, and we are now seeing an increase in demand for staking from what we can infer are new participants entering the market for the first time,” Leisinger added.

Shappella – a portmanteau of Shanghai and Capella, two major Ethereum network upgrades that occurred simultaneously on April 12 – gave investors the ability to withdraw their staked ether at will for the first time.

As such, staking deposits have surged in the past few weeks. More than 200,000 ether were deposited to the network last week, data from the on-chain analytics tool Nansen show, marking the first time deposits had outpaced withdrawals since Shapella went live last month.

These additions have brought the number of ether locked for staking purposes to over 19 million tokens – about 15% of the total circulating supply.

Edited by Parikshit Mishra.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.