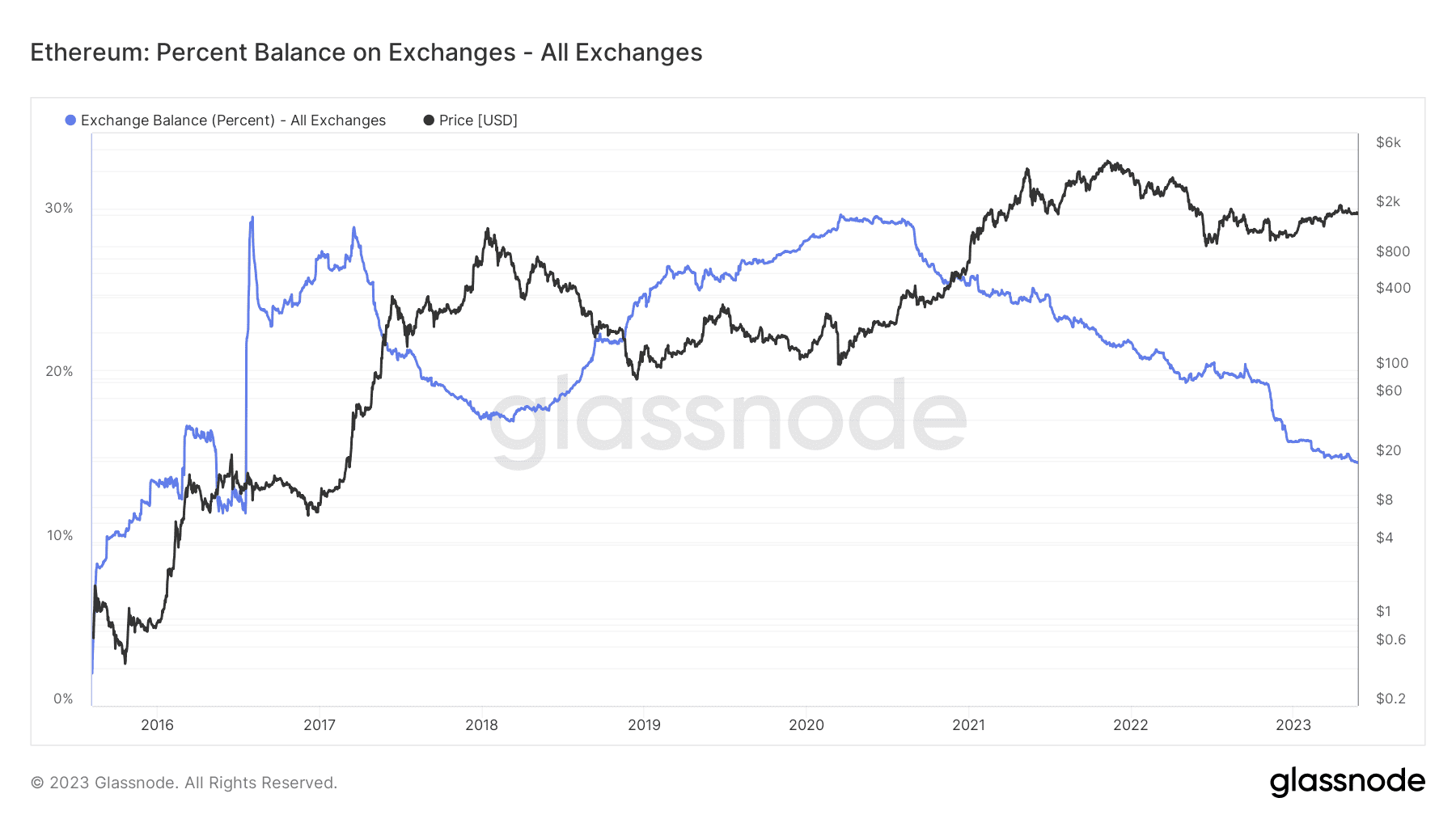

Ether (ETH) Stored on Centralized Exchanges Hits 5-Year Low: Data

Ether balance on the centralized crypto exchanges has reached a five-year low. According to the latest data from Glassnode, there are currently 17.8 million ETH on exchanges – a level not seen since July 2016.

- This figure essentially represents less than 15% of the Ethereum network’s total token supply. To put things into perspective, the exchange balance was recorded to be around 26% during 2021’s bull market.

- Such a trend is typically deemed bullish as it means the supply of the crypto-asset available for purchase is limited. Additionally, there’s not a lot of ETH ready to be sold immediately on CEXs.

- ETH supply on exchanges began dropping in September 2022. The decline was even more pronounced after FTX slid into bankruptcy two months later as the subsequent events shook investor confidence in centralized custodians.

- However, the decreasing ETH balances on exchanges this month coincides with a rise in staking. As such, the figures for staked ETH have increased from 19.3 million before the Shapella upgrade to more than 21.3 million since the beginning of May.

- The upgrade on April 12 essentially enabled validators to withdraw their staked Ether from the Beacon Chain after three years. Notably, more and more validators have re-staked their ETH, thereby triggering a decline in the supply of the token can be considered bullish for its price trajectory.

- CryptoPotato earlier reported that the Ether staking volume exceeded the amount of the crypto-asset being withdrawn within the week after the Shapella upgrade.

- The influx appears to have been driven by institutional staking service providers and investors reinvesting rewards after withdrawal.

The post Ether (ETH) Stored on Centralized Exchanges Hits 5-Year Low: Data appeared first on CryptoPotato.