ETH Still Bullish Despite Drop to $2.5K, What’s the Next Target? (Ethereum Price Analysis)

Ethereum’s price has encountered a substantial obstacle following a significant surge last week.

The market is currently correcting, and traders are wondering whether a reversal is on the horizon.

Technical Analysis

By TradingRage

Ethereum Price Analysis: The Daily Chart

On the daily chart, the price has been very bullish over the last quarter of 2023, increasing by more than $1,000. Recently, ETH has experienced an aggressive rally toward the $2,700 resistance zone. However, this level has decisively rejected the price, and a correction toward the $2,400 area has begun.

Meanwhile, the Relative Strength Index still demonstrates values above 50%, indicating that the momentum is still bullish and the price is likely to continue its uptrend after the correction is done.

The 4-Hour Chart

Looking at the 4-hour chart, it is clear that ETH’s price has formed a double-top pattern at the $2,700 resistance level. The relative strength index also signaled that the asset is overbought in this timeframe.

Currently, the price is forming lower highs and lows, potentially targeting the $2,400 level in the short term. Yet, this level seems likely to hold the price and initiate a rebound back toward the $2,700 level afterward, as the overall market structure is still bullish.

Sentiment Analysis

By TradingRage

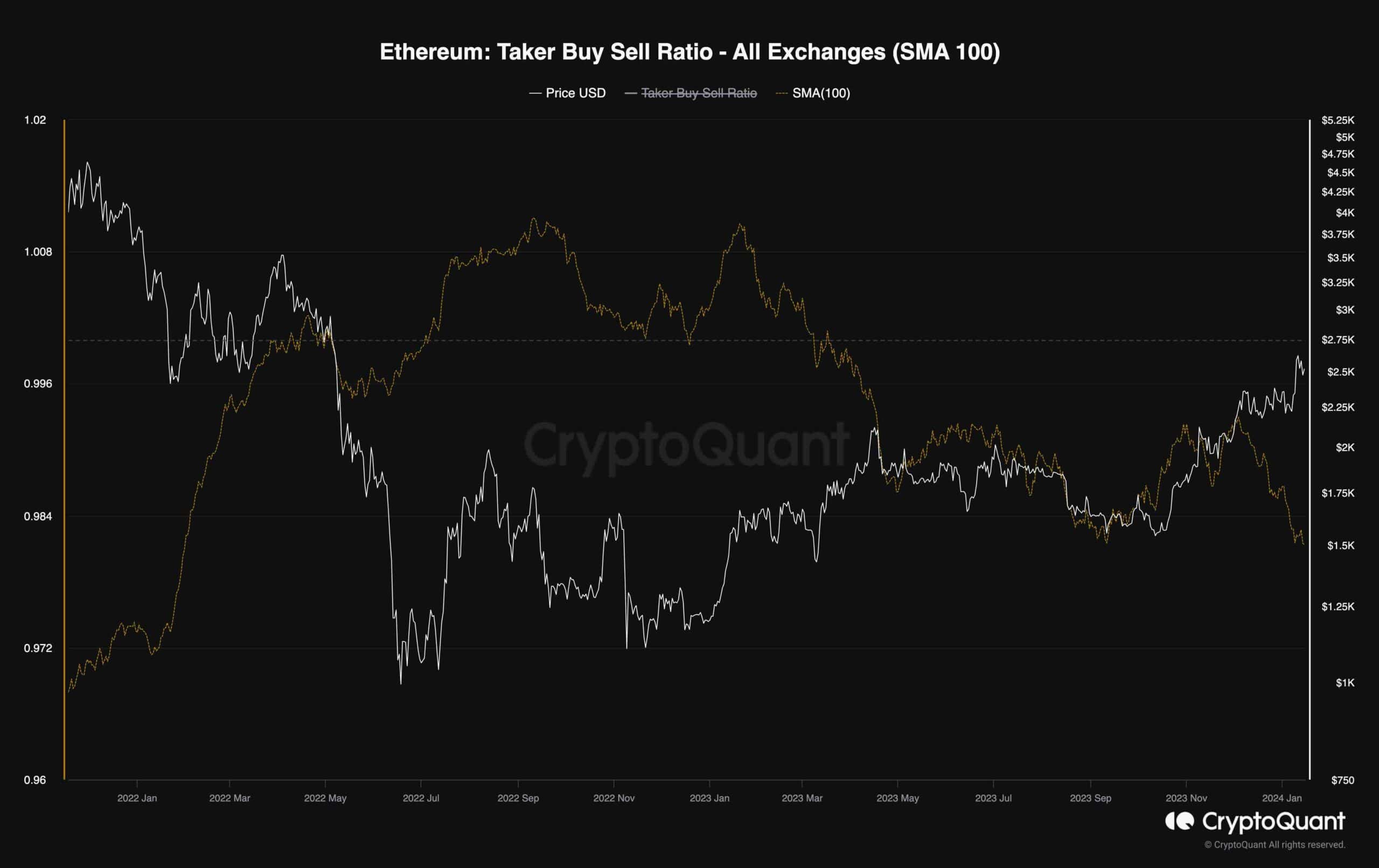

Ethereum Open Interest

While Ethereum’s price is still continuing its bullish trend, some worrying signs are arising from the derivatives market. It is beneficial to have a closer look to determine whether a bearish reversal can be expected or not.

This chart depicts the Taker Buy Sell Ratio, one of the most valuable metrics for futures market sentiment evaluation. Values over 1 indicate that the bulls are executing their orders more aggressively, while values below 1 point to the bearish selling pressure.

While the Taker Buy Sell Ratio has never recovered above one during the recent uptrend, the price has been rallying higher. However, it is currently dropping rapidly, making a new low. This cannot be interpreted well, and the subsequent aggressive selling pressure by the futures trader can soon cause a considerable decline in price.

The post ETH Still Bullish Despite Drop to $2.5K, What’s the Next Target? (Ethereum Price Analysis) appeared first on CryptoPotato.