ETH Shaky at $1.6K but This Bullish Sign Gives Hope (Ethereum Price Analysis)

Ethereum’s price has been consistently making lower highs and lows over the last few months. The current key area will determine the mid-term market trend.

Technical Analysis

By Edris

The Daily Chart

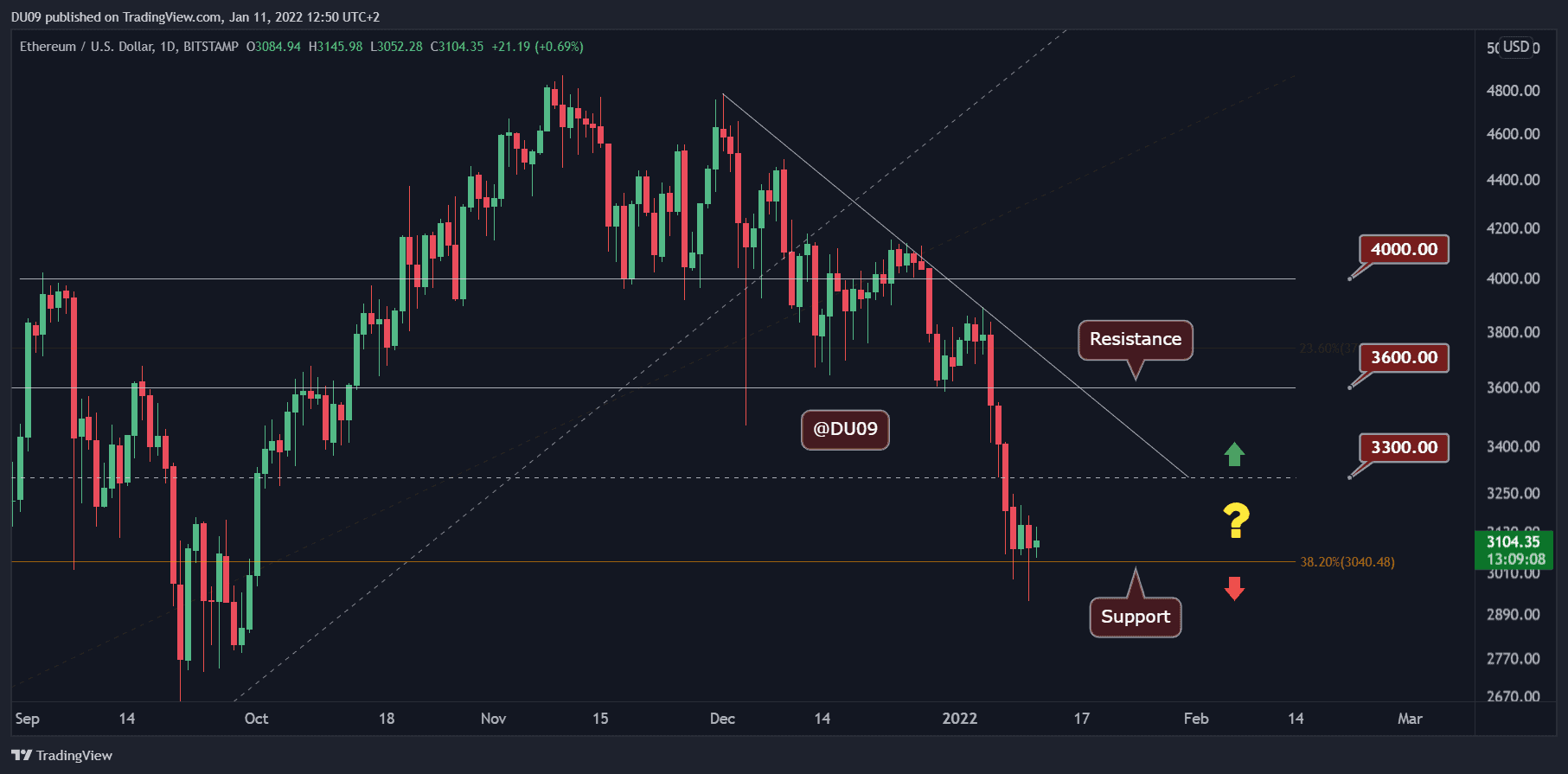

On the daily timeframe, the price has broken below multiple support levels, including the 50-day and 200-day moving averages. These moving averages have shown a recent bearish crossover, further suggesting a negative trend. However, ETH is currently testing the $1,650 resistance level.

A breakout would lead to a potential retest of the 50-day moving average around $1,700 and even the 200-day moving average around $1,800. On the other hand, a rejection would likely result in another drop toward the $1,400 support zone.

The 4-Hour Chart

On the 4-hour timeframe, a large falling wedge pattern forms, with the price currently testing the upper boundary. If a bullish breakout occurs, ETH could surge toward the $1,750 resistance level and potentially retest the key $2,000 area mid-term. However, the RSI indicator is below 50% in the short term, indicating bearish momentum.

As long as the lower boundary of the wedge pattern and the $1,550 support level hold, investors can remain optimistic.

On-Chain Analysis

By: Edris

Ethereum Taker Buy Sell Ratio

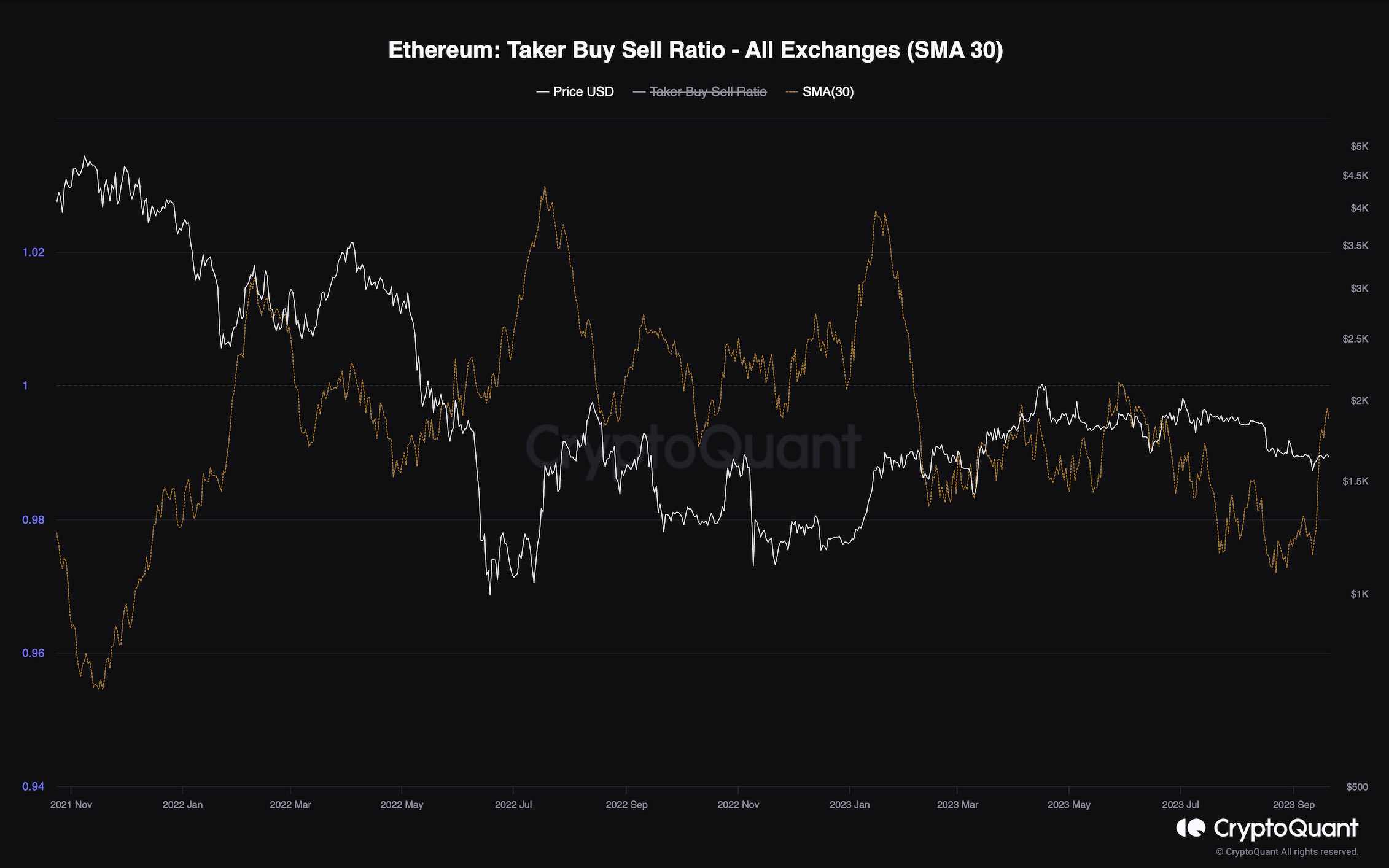

Ethereum’s price has been trending down over the past few months, failing to break above the $2,000 resistance level. However, the futures market is showing a bullish signal.

This chart represents the taker buy-sell ratio, a useful metric for evaluating futures market sentiment. It indicates whether buyers or sellers are executing more aggressive market orders. Values above 1 are considered bullish, while values below 1 are bearish.

After a decline, the taker buy-sell ratio has recently spiked, trending towards 1. If the metric rises above 1, it could lead to a new bullish trend, potentially pushing ETH’s price above $2,000 per coin in the coming months.

The post ETH Shaky at $1.6K but This Bullish Sign Gives Hope (Ethereum Price Analysis) appeared first on CryptoPotato.