ETH Remains Relatively Stable at $3.5K but Bears Target $3,000 Next (Ethereum Price Analysis)

Ethereum’s price has failed to break above the $4,000 resistance level once more and is yet to create a new all-time high.

However, the market is showing resilience compared to other coins during the current correction phase.

Technical Analysis

By TradingRage

The Daily Chart

As the daily timeframe shows, ETH’s price has dropped back to $3,500 after getting rejected from the $4,000 resistance level once again. Currently, the $3,500 mark is holding and preventing the price from a further decline toward $3,000.

Yet, if the $3,500 level is broken to the downside, the market will most likely move quickly toward the $3,000 support zone and the 200-day moving average nearby.

These coinciding elements would make the $3,500 level key, and the price’s reaction to it would likely decide how the market will move in the coming months.

The 4-Hour Chart

The price has been hovering around the $3,500 level in the 4-hour timeframe. A classical chart pattern has also been forming around this zone, which the price has failed to break to either side.

So, the direction of the upcoming move depends on the direction of the potential breakout from this pattern.

The RSI also oscillates around 50%, so not much can be drawn from it, as it shows that the momentum is approximately in equilibrium.

Sentiment Analysis

By TradingRage

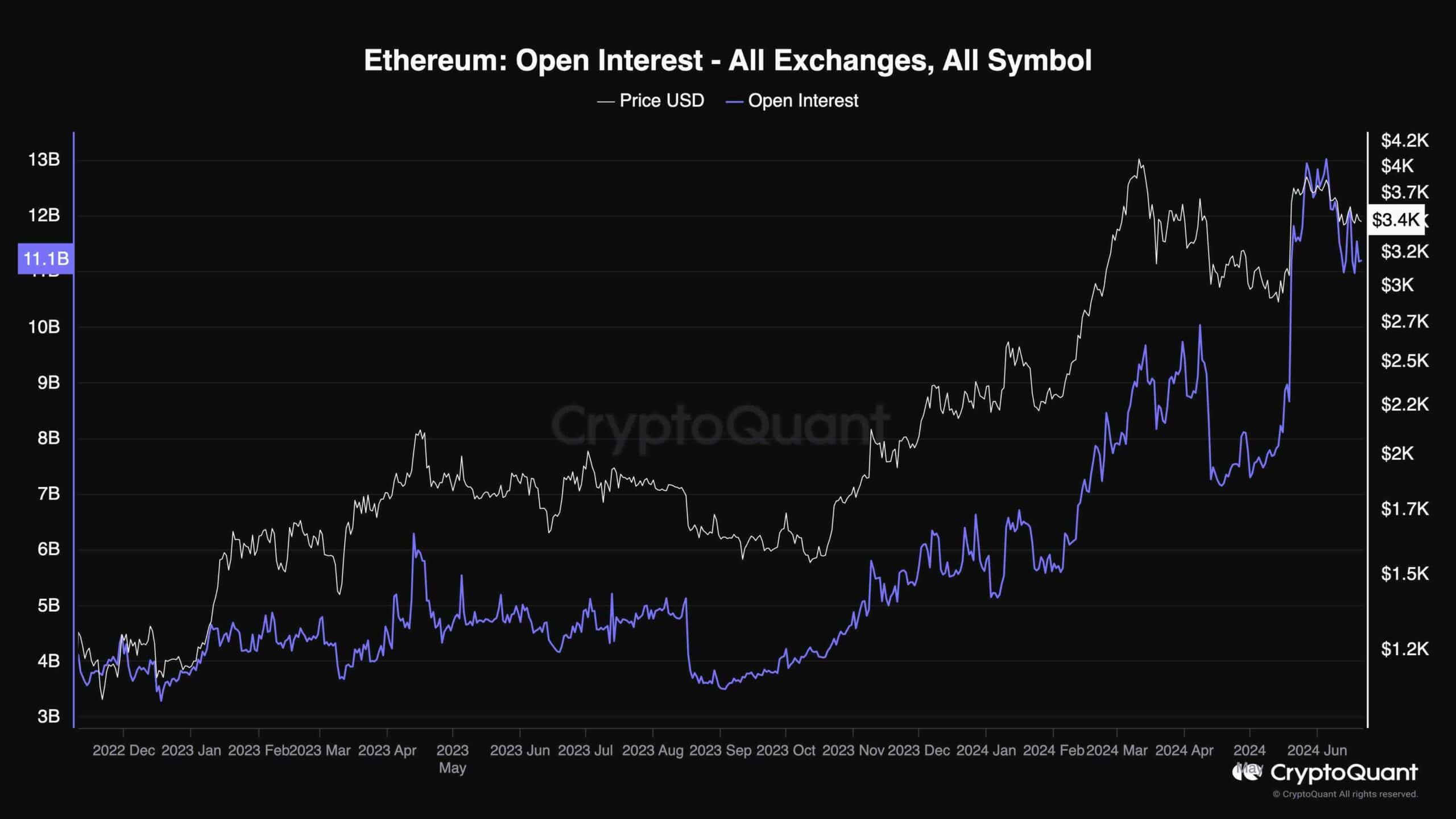

Open Interest

This chart demonstrates the Ethereum open interest on all exchanges, which is the value of all futures contracts. High values typically lead to volatility due to potential liquidation cascades.

Since ETH’s price has recovered from the $3,000 support level, the Open interest has massively spiked from around 7 Billion to almost 13 Billion.

This increase has probably led to the recent recovery, as some of these over-leveraged positions have been liquidated and have applied selling pressure on the market. Meanwhile, more downsides are possible, as the Open Interest is still much higher than in March when ETH was trading around the same prices.

The post ETH Remains Relatively Stable at $3.5K but Bears Target $3,000 Next (Ethereum Price Analysis) appeared first on CryptoPotato.