ETH Price Unable to Break Rrange but Can Bulls Extend to $1,400? (Etherum Price Analysis)

Up until now, ETH has managed to remain above $1,200 despite the increased selling pressure, but the price clearly shows that the downward trend is weakening after the Merge. However, this doesn’t mean that bullish momentum is underway.

Technical Analysis

By Grizzly

The Daily Chart

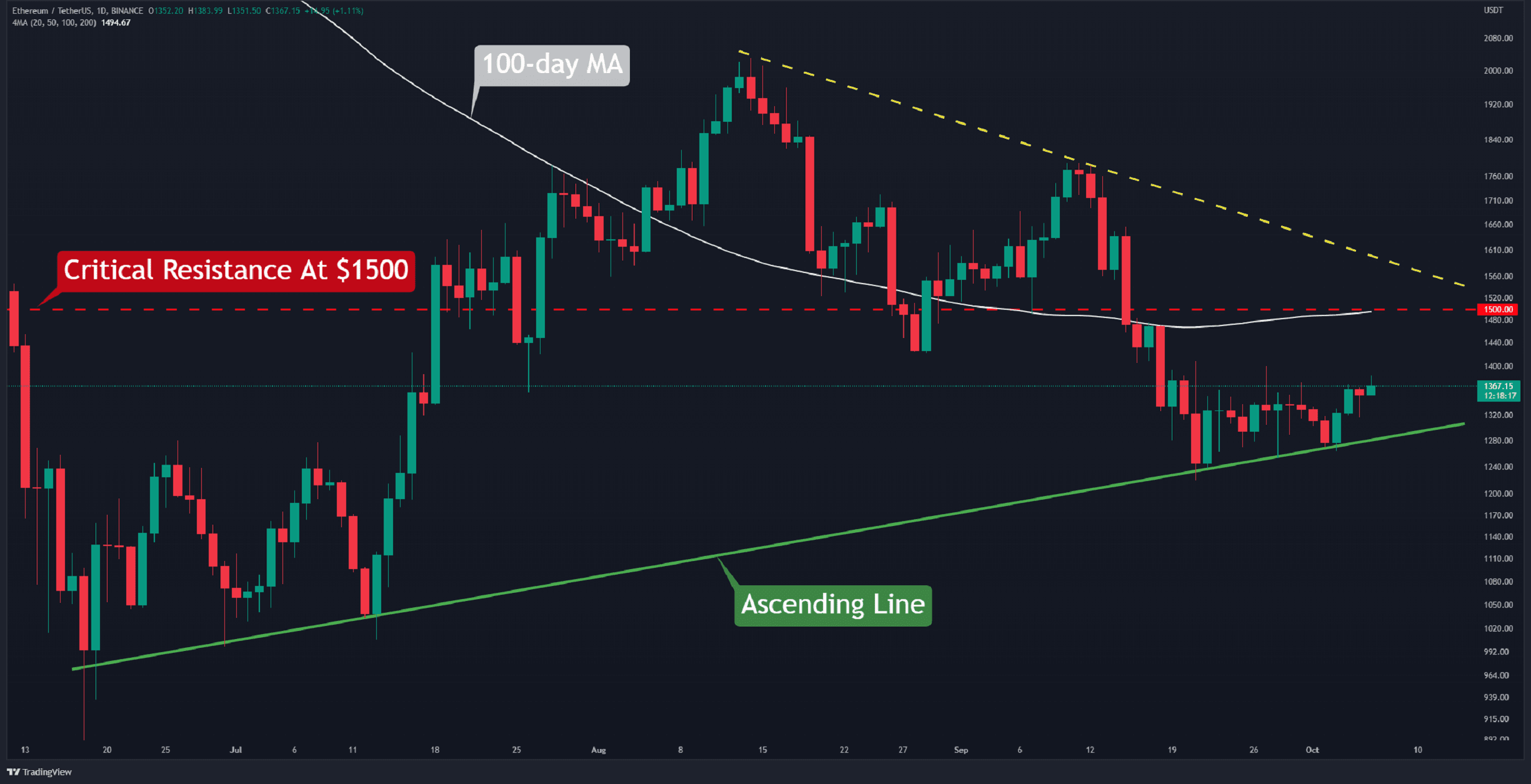

ETH was supported by the ascending line (in green) again, and increased investor confidence prevented the price from closing below it. The chart currently shows no notable signs of bullish momentum as the sideways trend continues for a second week.

The first obstacle is to break $1,500. (in red). This resistance results from the descending line (in yellow) and the 100-day moving average line (in white) colliding. If the ETH can clear this hurdle, the path to $2000 will be clearer.

As long as Ethereum trades below $1,500, a retest of the green support is not ruled out. Closing below this level may take the asset to the next support level at $1,000.

Key Support Levels: $1240 & $1000

Key Resistance Levels: $1500 & $1800

Daily Moving Averages:

MA20: $1333

MA50: $1497

MA100: $1494

MA200: $1921

The ETH/BTC Chart

Against Bitcoin, the bears seem to be expanding the momentum, resulting in an 18% correction following the Merge.

This trend is likely to continue toward the horizontal level at 0.065 BTC (in green), which appears to be solid support. To even consider some sort of bullishness, the price would first have to start charting higher highs and higher lows.

Key Support Levels: 0.065 & 0.06 BTC

Key Resistance Levels: 0.073 & 0.08 BTC

Sentiment Analysis

Funding Rates

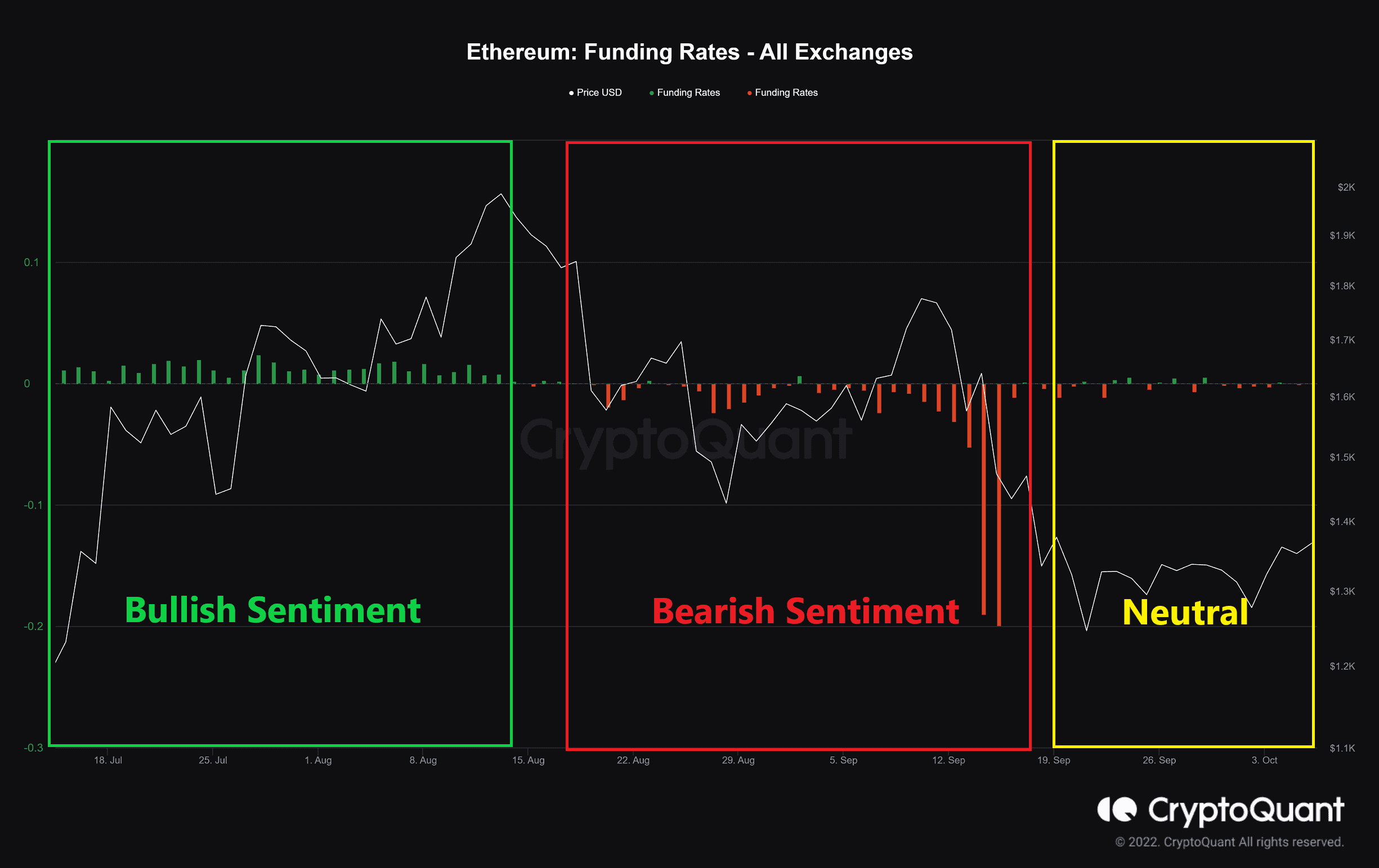

Definition: Periodic payments to traders that are either long or short, based on the difference between perpetual contract markets and spot prices.

Funding rates represent traders’ sentiments in the perpetual swaps market, and the amount is proportional to the number of contracts. Positive funding rates indicate that long positions are dominant and are willing to pay funding to short traders.

According to CryptoQuant data, there is still uncertainty among investors and traders in the derivative market. This overall doubt contributed to the establishment of the sideways trend stated in the technical analysis.

Bullish and bearish momentum rises when market sentiments, particularly in derivatives, align with the trend’s direction. Presently, this behavior is not visible.

The post ETH Price Unable to Break Rrange but Can Bulls Extend to $1,400? (Etherum Price Analysis) appeared first on CryptoPotato.