ETH Price Analysis: Warning Signs for Ethereum as Bears Push Below $2,000

The cryptocurrency market is still in a state of uncertainty and fear. Ethereum is no exception, and any upward attempt is faced with immediate sell pressure. Will the bulls be able to regain control of the market?

Technical Analysis

By Grizzly

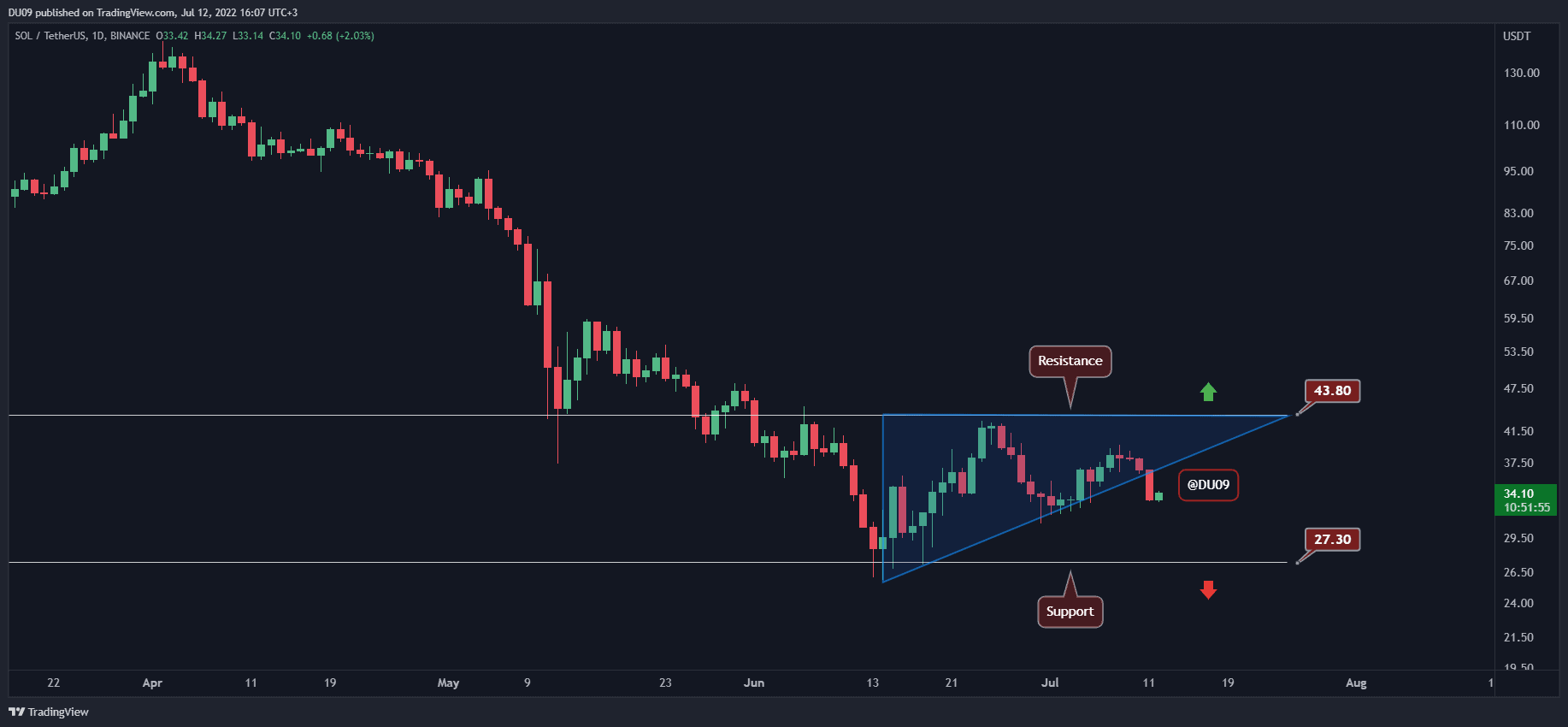

The Daily Chart

On the daily time frame, ETH is moving downward inside a falling wedge (in yellow). It is important to note that this wedge bottom is aligned with the horizontal support level of $1700 (in green), which can be a potential trend reversal point.

As a result, if the bulls can defend the green zone, the price will be more likely to move towards the static resistance at $2450. On the other hand, if the bears continue to suppress the market and break below the green support zone, the price is more likely to enter an extended regression phase.

Key Support Levels: $1700 & $1500

Key Resistance Levels: $2200 & $2450

Moving Averages:

MA20: $2376

MA50: $2818

MA100: $2835

MA200: $3301

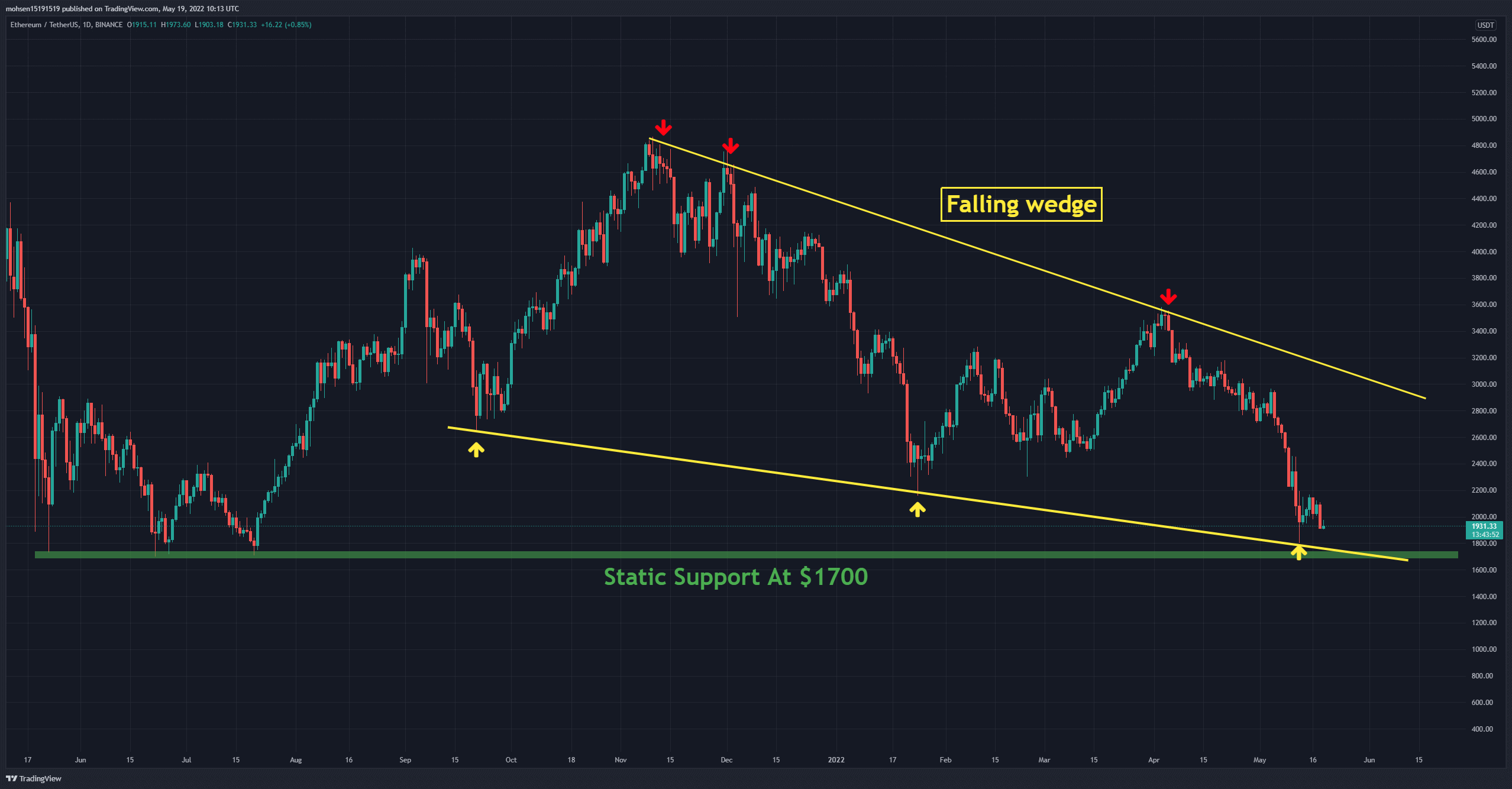

The ETH/BTC Chart

Against Bitcoin, ETH is trading on dynamic support (in green) that has prevented further drops in price four times in the past. The main concern is that the bears have managed to make an unconfirmed break and appear to be in control of the situation. On the other hand, horizontal support at 0.065 (in orange) can also be considered a level to withstand the increasing bearish momentum.

If the BTC price breaks below a major static level, the entire altcoin market is historically proven to follow with an amplified correction.

Key Support Levels: 0.065 BTC & 0.06 BTC

Key Resistance Levels: 0.07 BTC & 0.072 BTC

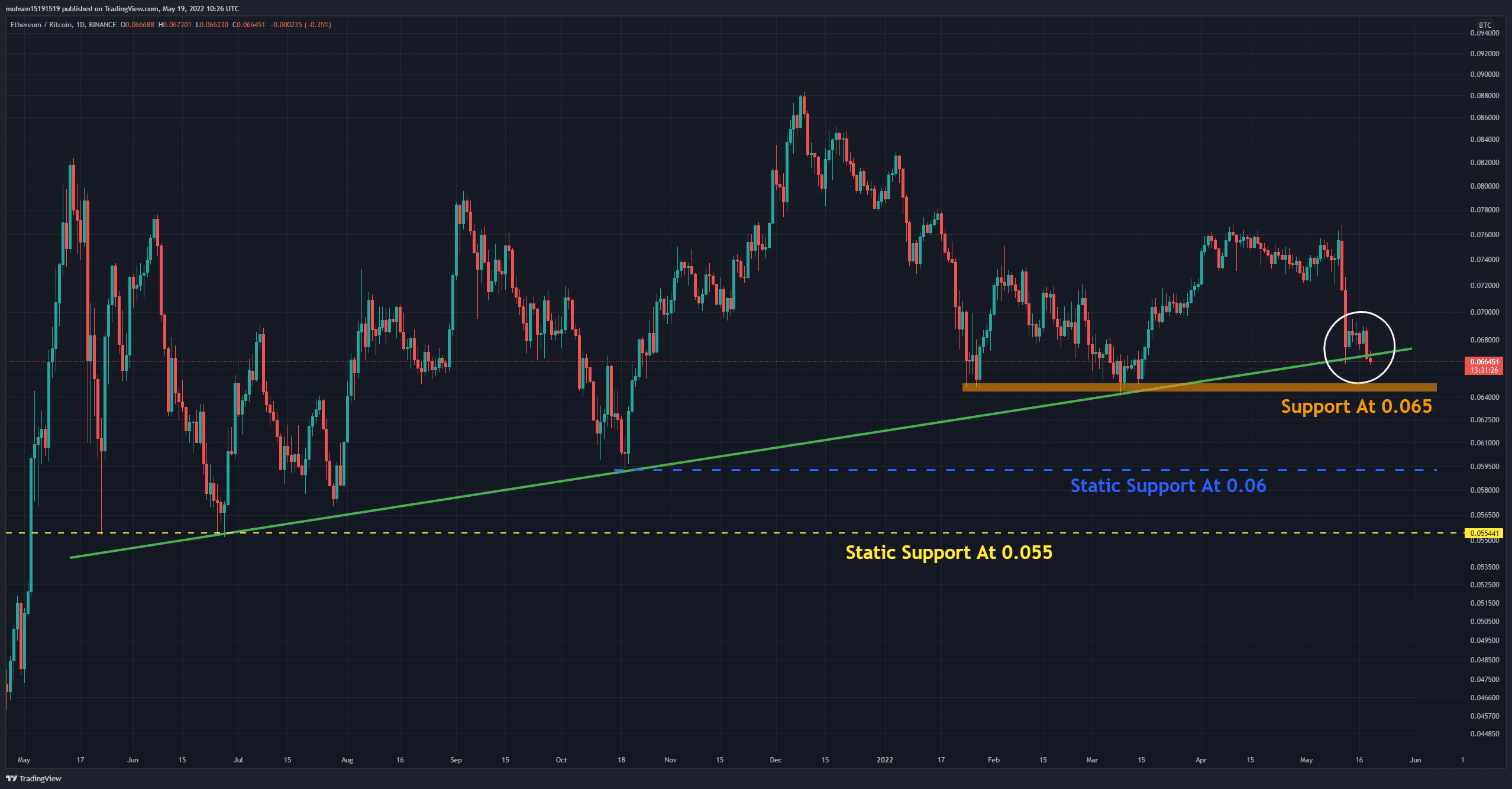

On-chain Analysis

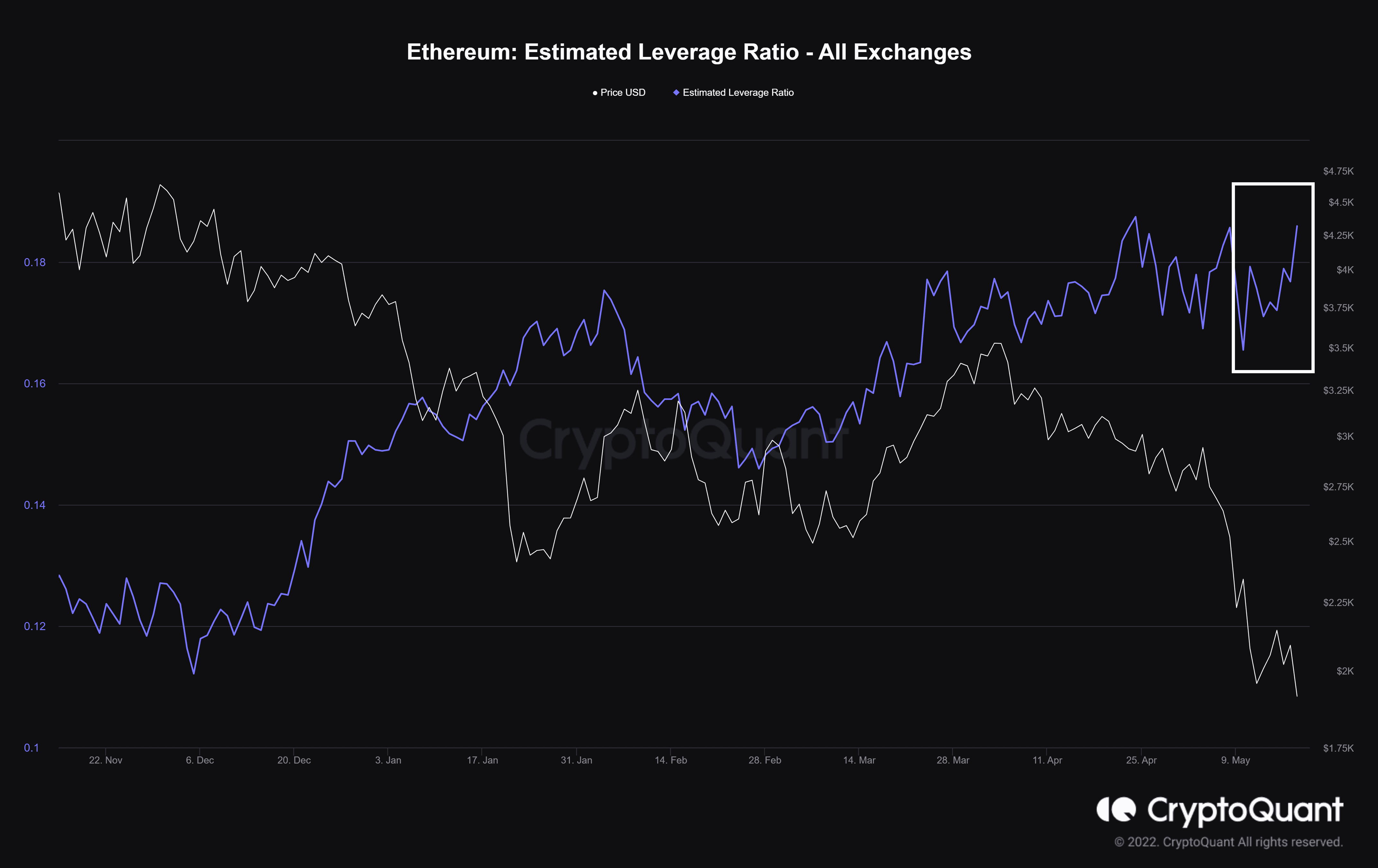

Estimated Leverage Ratio

Definition: The exchange’s open interest is divided by their coins reserve, which shows how much leverage traders use on average. Increasing values indicate more investors are taking high leverage risk in the derivatives trade.

On the chart, one can see that this metric has started moving upwards again, indicating that investors are taking more risks. The consequent outcome is probably significant volatility and then a cascade of liquidations. After all, throughout a bearish phase, a de-leveraging phase has frequently led to a bullish trend in the market.