ETH Price Analysis: This is The Next Important Resistance for Ethereum

The cryptocurrency market did not react significantly to the interest rate hike despite all speculations. The Federal Reserve announced an interest rate increase of 0.25 percent. Contrary to popular belief, high-risk assets did not show any reactions.

This could indicate investors’ confidence in rising inflation. US stock Indices and the cryptocurrency market, which have been highly correlated recently, are all green, and the DXY index is retracing.

Technical Analysis

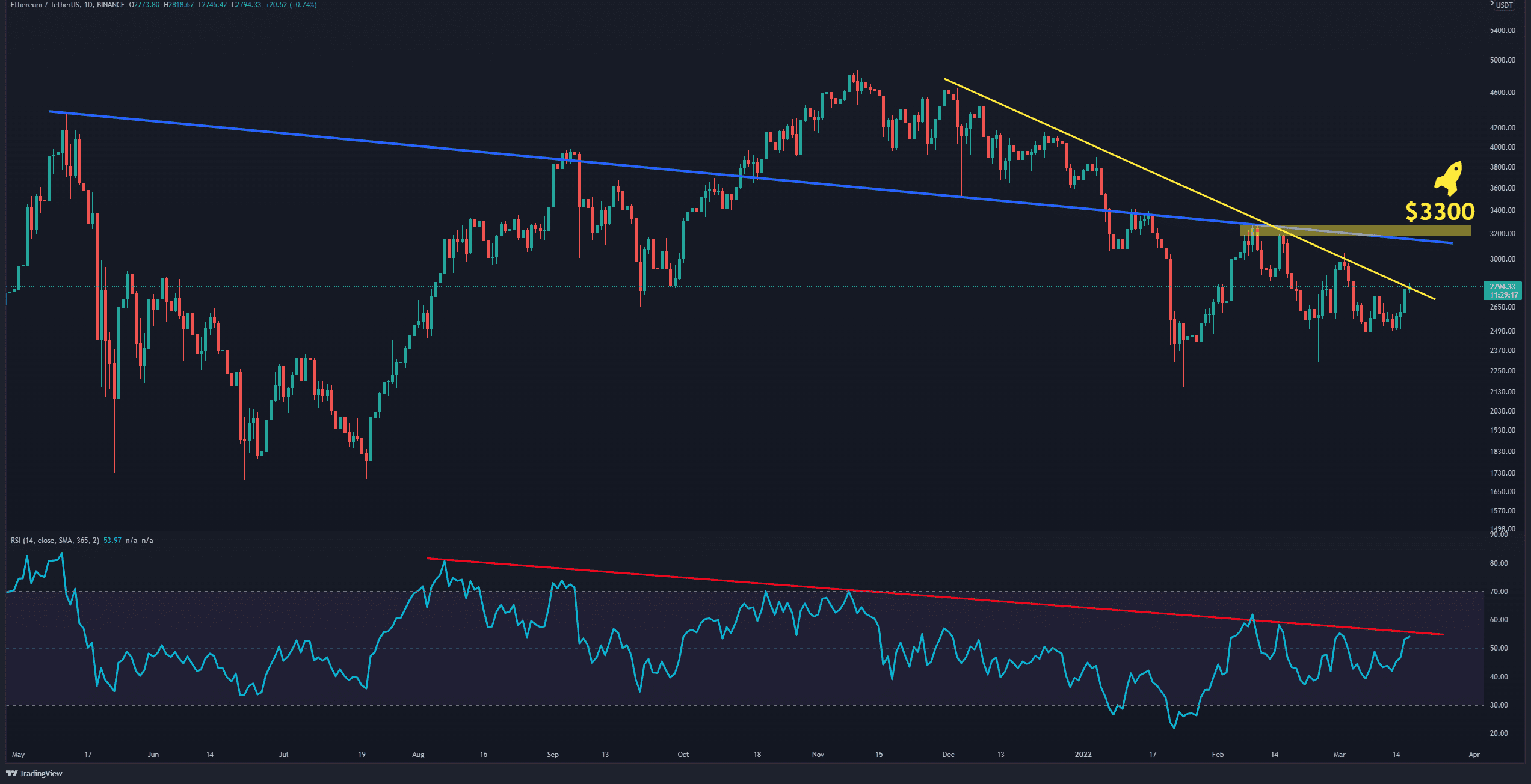

The Daily Chart:

Technical Analysis By Grizzly

The bulls stepped up their game, and ETH crossed the resistance at $2650 on the daily timeframe. It is currently struggling with its dynamic resistance (marked by yellow). The RSI-14D is also below the downtrend line (shown by the red line). Crossing these dynamic resistances and staying above them can be a strong positive signal for an uptrend.

The most important level to look at is $3300, and breaking it can confirm the end of the downtrend.

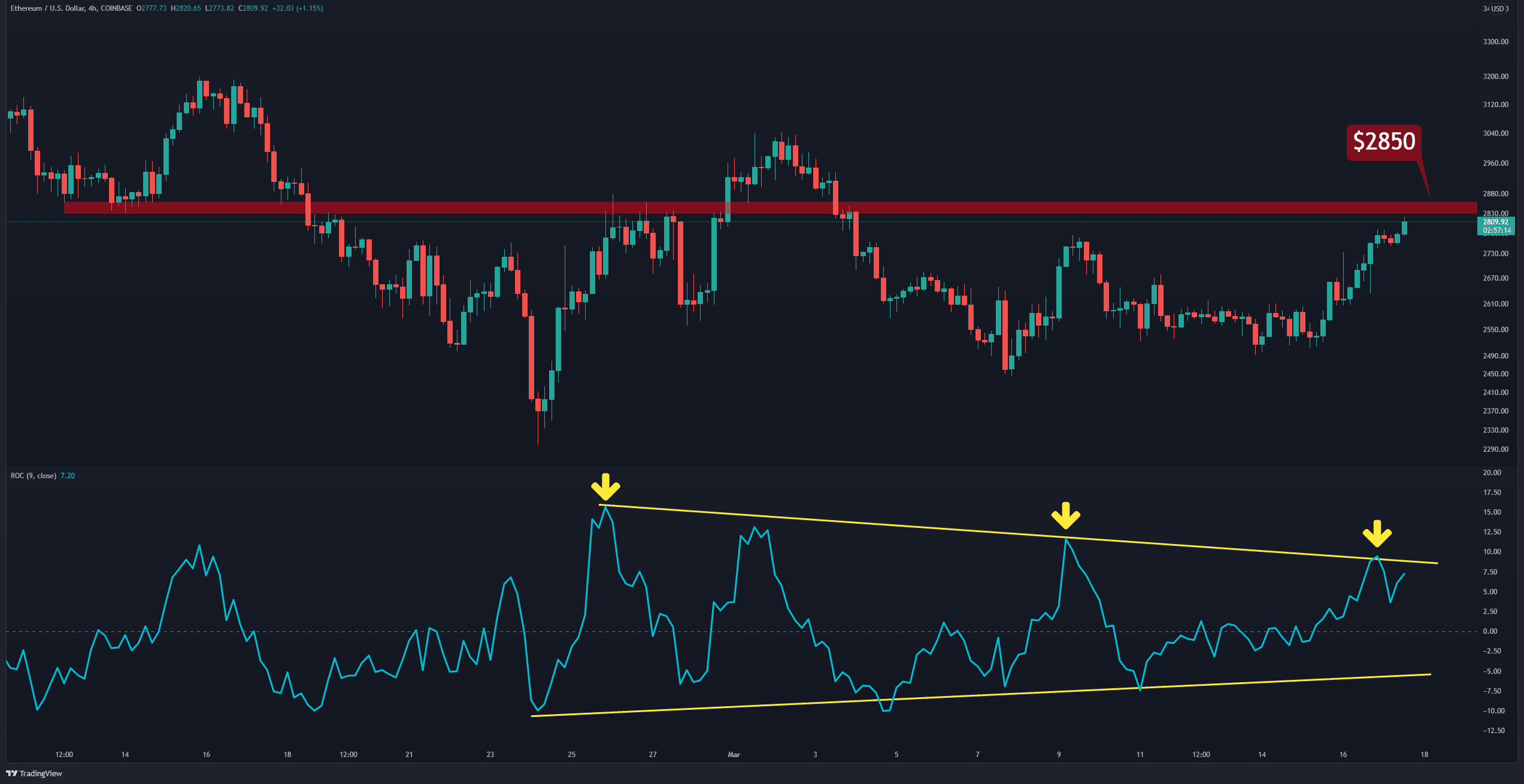

The 4-Hour Chart:

On the 4-hour timeframe, Ethereum has reached resistance at $2850, which has acted as a short-term barrier in the past month. It failed the first attempt to break above the triangle formed in the ROC-9 and is now testing it again. If the mentioned resistances are crossed, the path above $3000 becomes smoother.

Conclusion

Despite the recent green days in the market, there is still no confirmation of the end of the bear market, and the upward trend can be simply mid-bear cycle bounces. It is always recommended to avoid emotions in trades to reduce risk or dollar-cost-average during tumultuous periods.