ETH Price Analysis: Ethereum Reclaims $1,000 But is The Worst Over?

Ethereum is struggling at a significant support zone. So far, all attempts for an uptrend in the lower timeframes have been rejected.

Technical Analysis

Technical Analysis By Grizzly

The Daily Chart

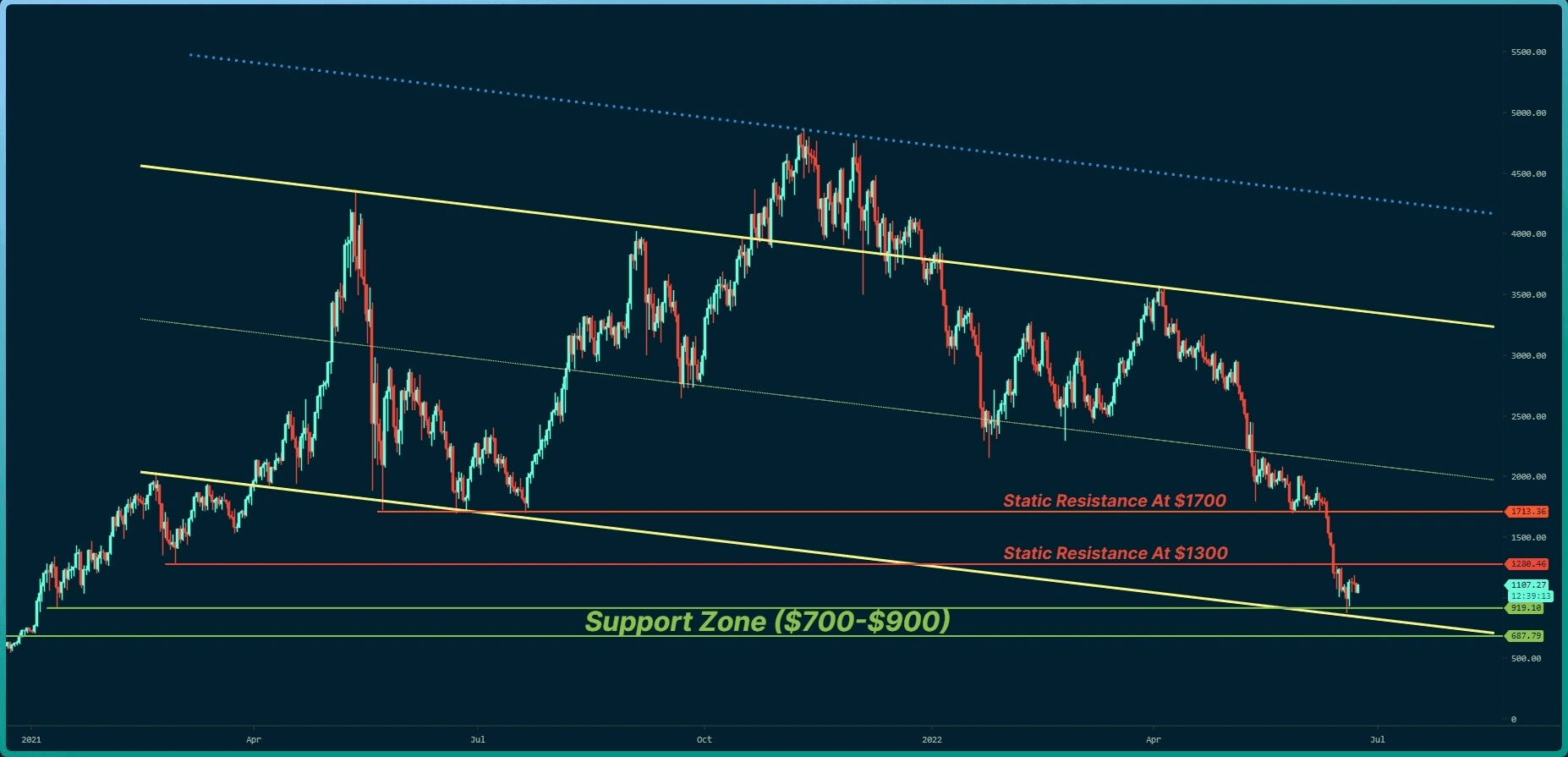

On the daily timeframe, the bulls have defended the support zone at $900. This level can be extended to a range between $900 and $700 (in green). The price is moving in a descending channel (in yellow) and has touched the low band.

It should be noted that if sellers increase their pressure, it is possible that, in the coming weeks, ETH will move to the bottom of the channel again (~$700). On the other hand, starting a bullish trend requires breaking the horizontal resistance at $1300 and moving towards $1700. Breaking that last level would also be required to reverse the trend.

Key Support Levels: $900 & $700

Key Resistance Levels: $1300 & $1500 & $1700

Moving Averages:

MA20: $1392

MA50: $1793

MA100: $2432

MA200: $3044

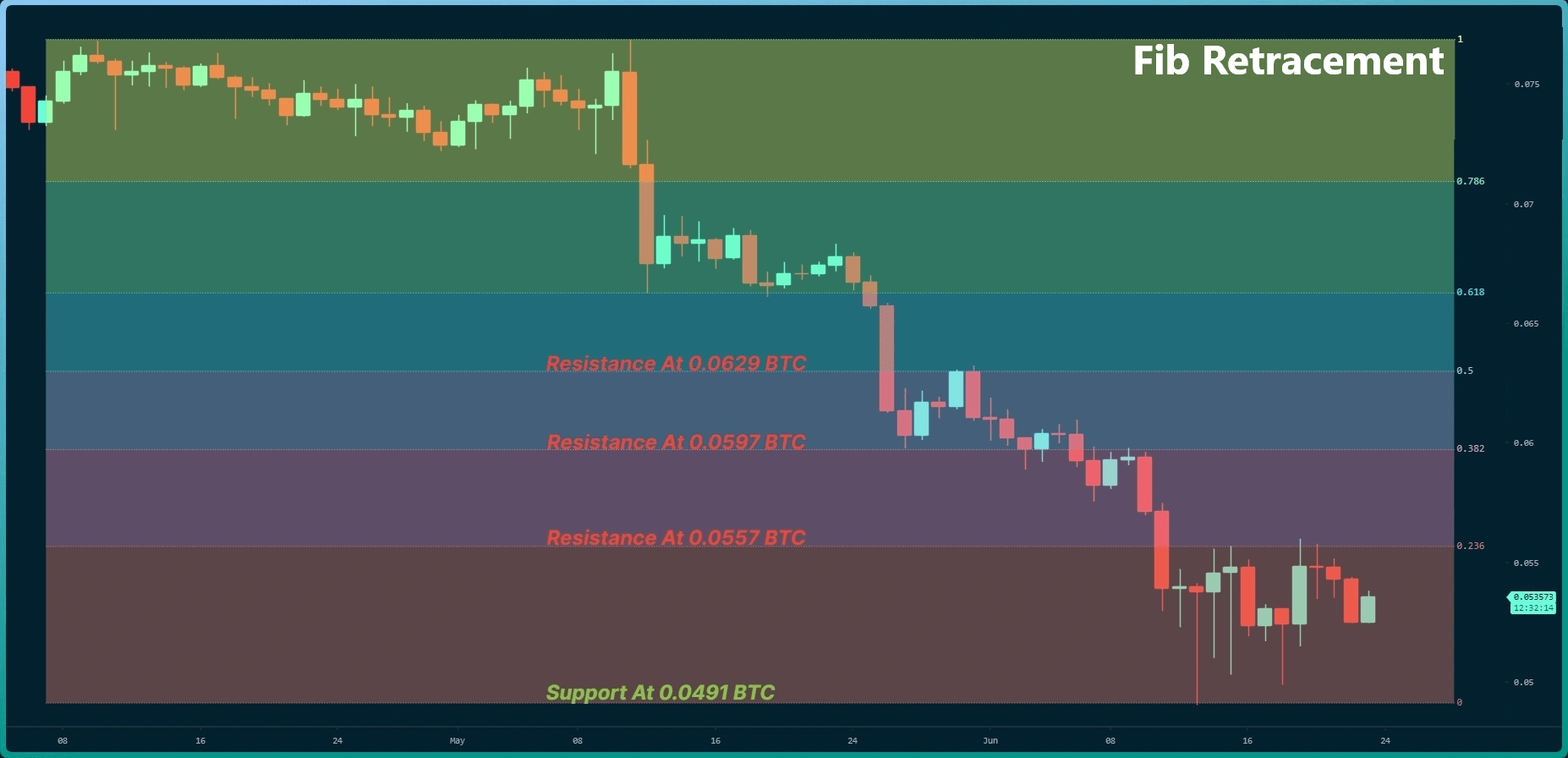

The ETH/BTC Chart

Against BTC, the price is currently struggling with the first Fibonacci level at 0.236, which lies at 0.0557 BTC. The support zone is considered in the 0.05 to 0.045 BTC range. The release of fundamental news such as the Merge event could likely convince buyers to enter the market, but until then, it’s challenging to see the cryptocurrency advancing considerably.

Key Support Levels: 0.050 BTC & 0.0.045 BTC

Key Resistance Levels: 0.055 BTC & 0.06 BTC

On-chain Analysis

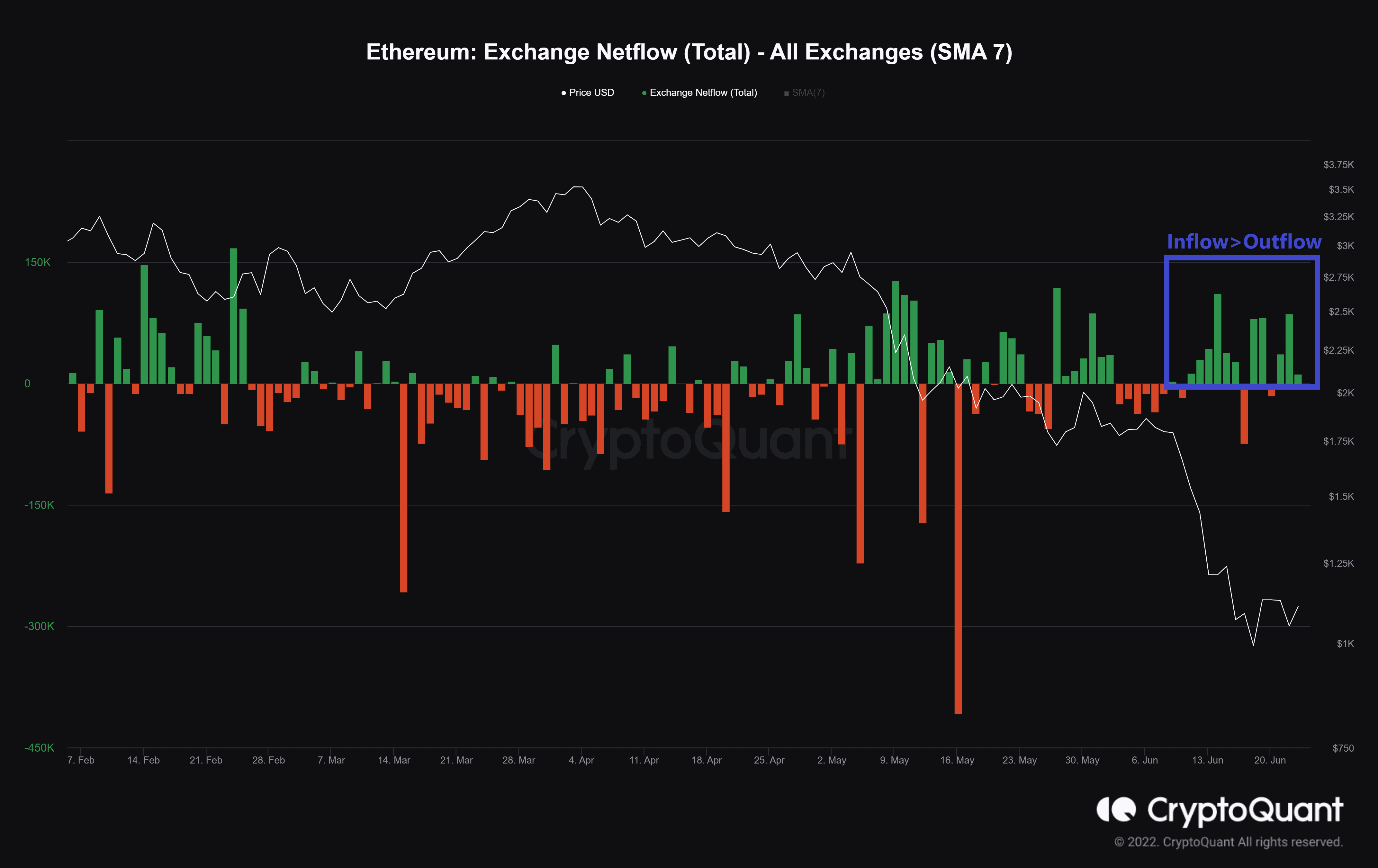

Exchange Netflow (Total)

In this chart, it is clear that buyers can not yet dominate the market. Inflow to the exchanges is still at high levels, which has caused the exchange reserve to increase, which consequently is accompanied by selling pressure. When consecutive red histogram bars are seen in the chart, it can be expected that the bulls have taken control of the market.