ETH Loses 16% in Three Days, Retest or a More Pain to Come? (Ethereum Price Analysis)

As mentioned in the previous analysis, traders realized profit when the price reached the resistance at $1,700. This caused ETH to witness a 16% downward correction. All eyes are on the FOMC meeting that’s scheduled to take place tomorrow. This week, the earning report of technology giants such as Meta, Alphabet, Amazon, and Microsoft can also affect the financial markets.

Technical Analysis

By Grizzly

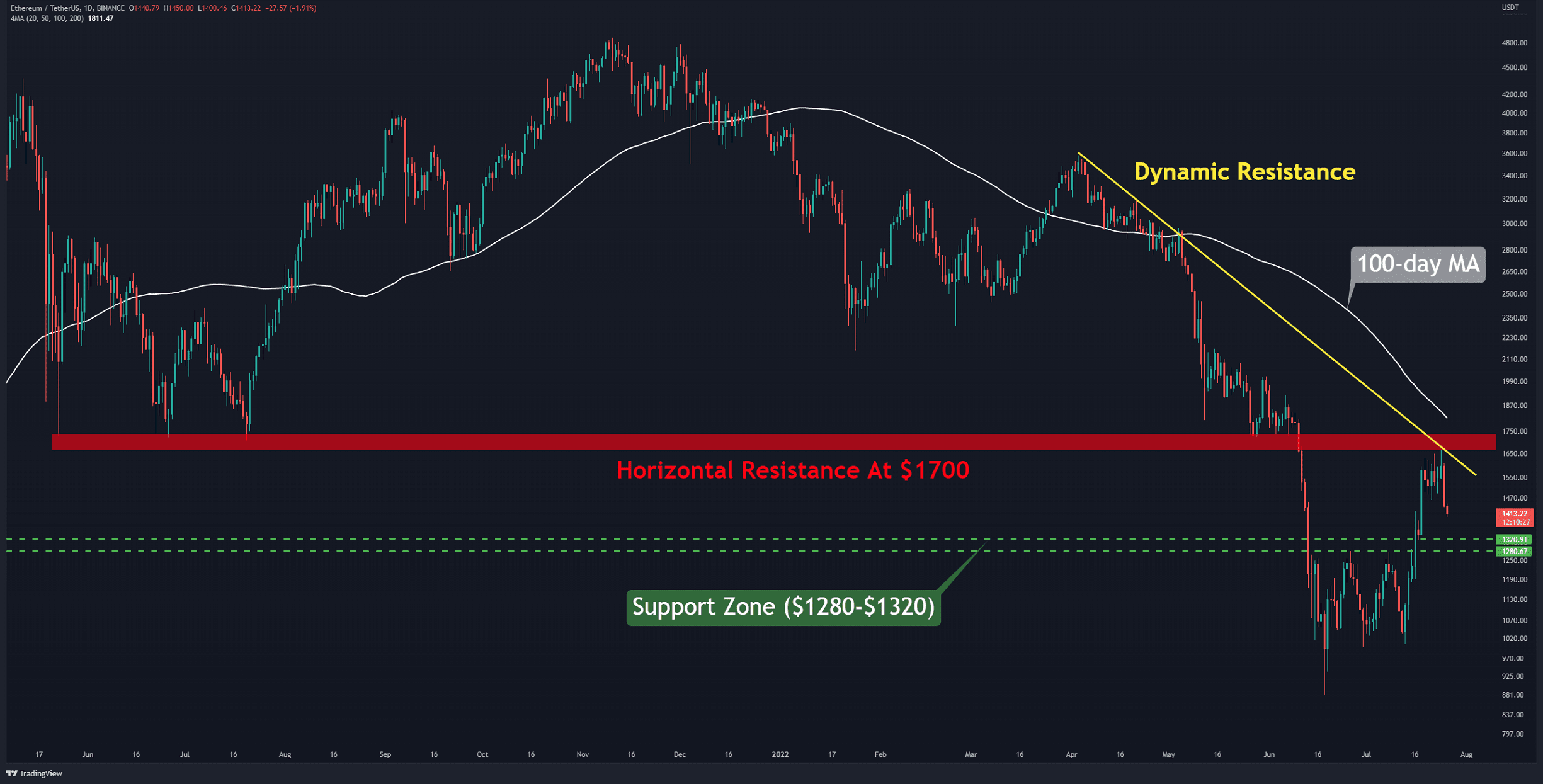

The Daily Chart

The bears defended the overhead resistance at $1700 (in red) and stopped the recent vertical rally in a daily timeframe. This caused the price to sink below the horizontal support at $1,420, which overlapped with the 0.5 Fibonacci level at the time of writing.

The following support ranges between $1280-$1320 (in green). It is crucial that the bulls can hold the price above this range. If ETH closes below it, the momentum will tilt in favor of the bears, and the cryptocurrency could miss a significant chance to advance before the Merge event.

On the other hand, if it bounces from the support level, it could be the case that when the 100-day moving average line (in white) reaches the resistance zone, the bulls will try their chance to clear this hurdle. If it happens, this could open the doors for a rally to $2000.

Relative Strength Index (RSI) 14d: this index is approaching the midpoint. It suggests the balance between supply and demand.

Key Support Levels: $1420 & $1280

Key Resistance Levels: $1700 & $2100

Daily Moving Averages:

MA20: $1347

MA50: $1284

MA100: $1811

MA200: $2372

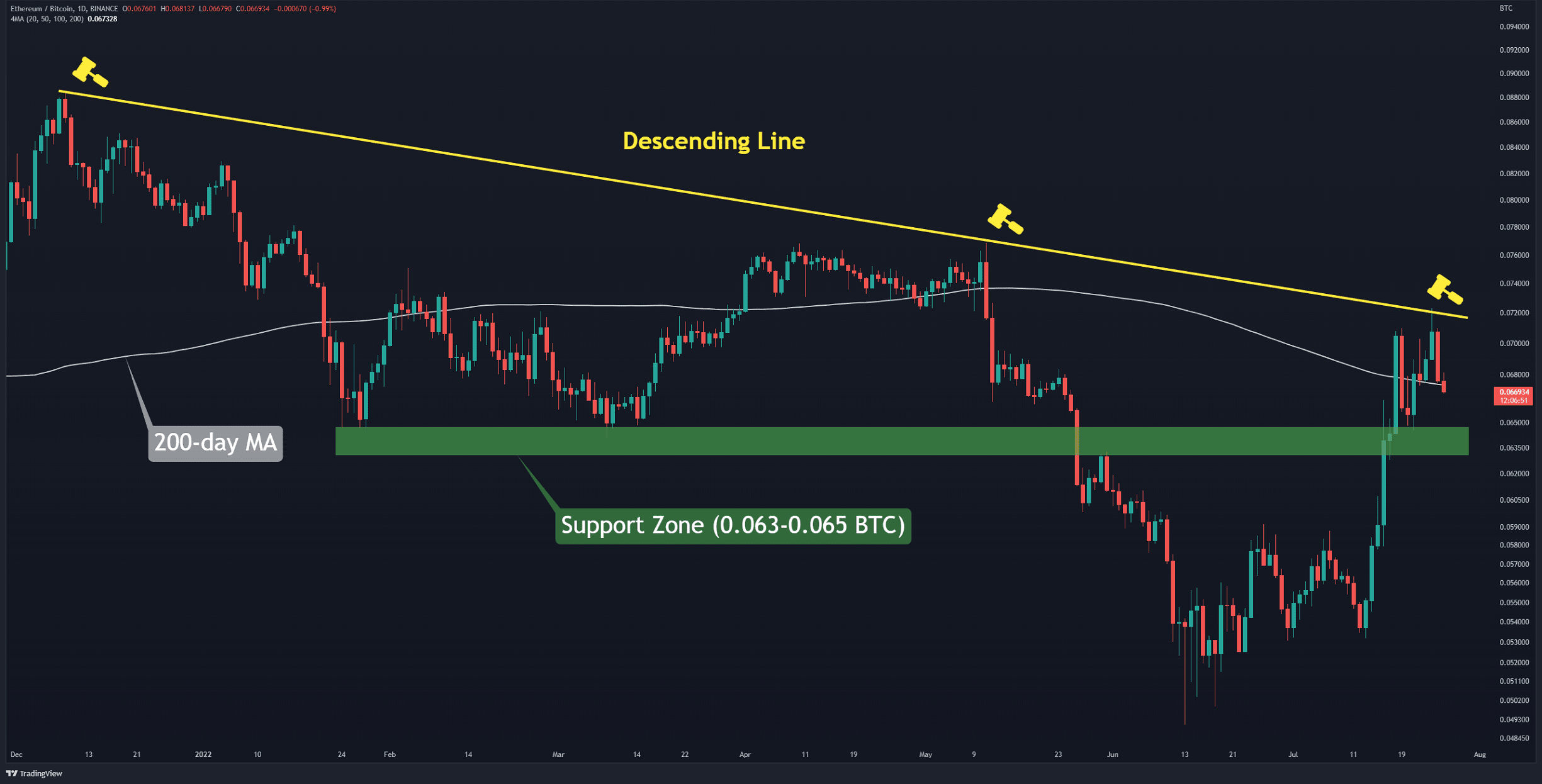

The ETH/BTC Chart

Against Bitcoin, the bullish momentum has stalled for now. The price, which reached the descending line (in yellow) by breaking above the 200-day moving average line (in white), returned to the MA after hitting the yellow resistance.

It seems likely that the recent sharp movement could be followed by a correction. If that’s the case, reaching the support zone in the range of 0.063 to 0.065 BTC is healthy. If this level fails, ETH/BTC market should prepare for selling pressure by forming a lower low pattern.

Key Support Levels: 0.065 & 0.06 BTC

Key Resistance Levels: 0.07 & 0.078 BTC