ETH Liquid Staking Tokens Drop 8% Daily, Bitcoin Stalls at $28K: Weekend Watch

The low trading volumes during the weekend have resulted in a stalled bitcoin performance as the asset sits quietly at around $28,000.

Most altcoins are slightly in the red today, while two of the largest ETH liquid staking tokens – LDO and FXS – have dropped hard.

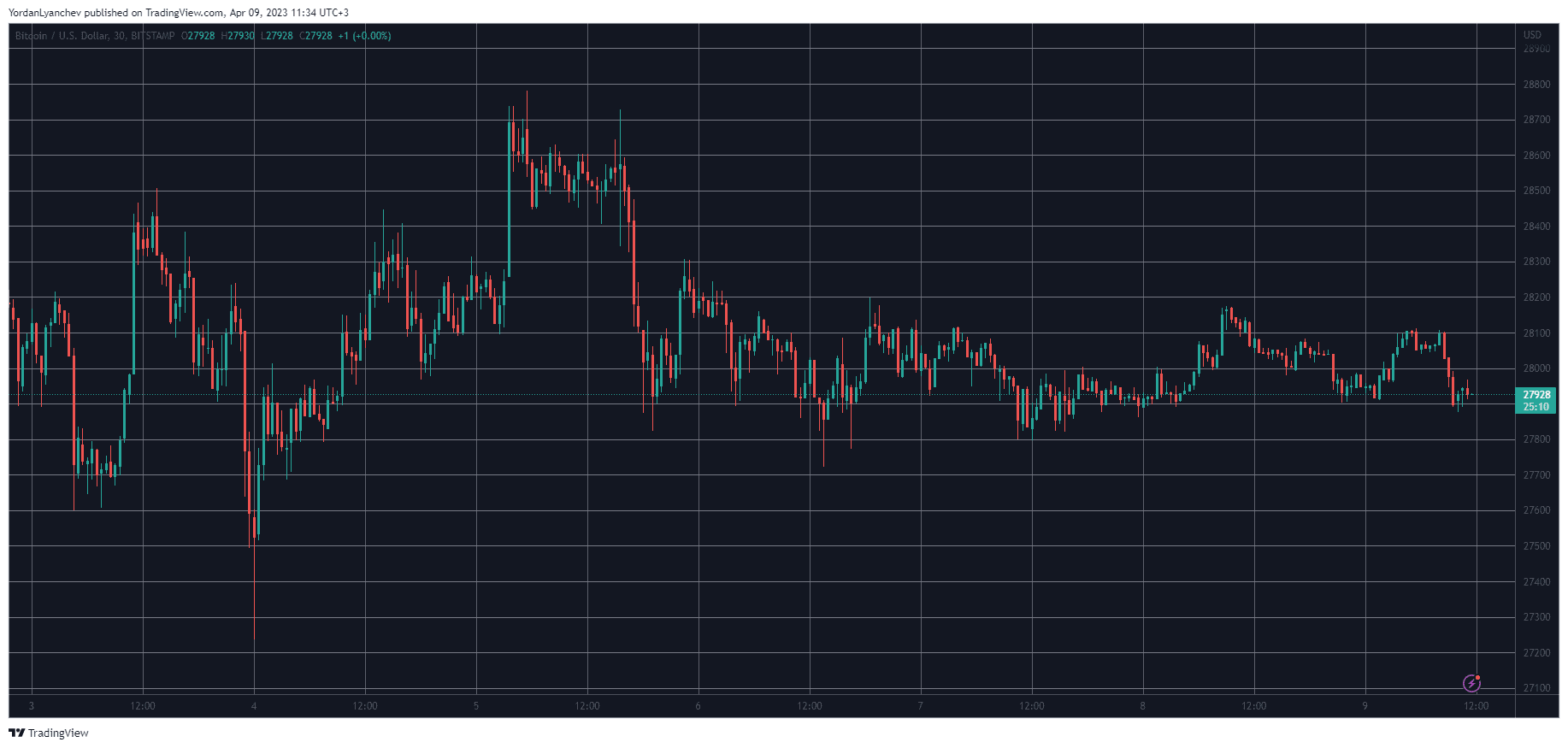

BTC Boring at $28K

The working week brought a lot of volatility, especially its start when BTC plummeted by roughly a grand following the fake news surrounding Binance and its CEO. As it turned out that Interpol had not actually issued a Red Notice on CZ, BTC recovered all losses and even went on the offensive toward $29,000.

However, the asset failed to challenge that level and was stopped $200 away from it. The subsequent rejection drove it further south, and BTC fell beneath $28,000 just a few days later.

Since then, it has been unable to bounce back up substantially and trades in a tight range between $27,800 and $28,200. The past 24 hours were no different, and BTC currently sits just below $28,000.

Its market capitalization has dipped below $540 billion, while its dominance over the alts has regained some ground and stands at just over 46%.

LDO, FXS Dump Hard

Ethereum was among the best performers during the week, which culminated in surpassing $1,950 for the first time in almost eight months. However, ETH failed to maintain that run and has declined by over $100 since then, currently trading below $1,850.

Two of the most popular ETH liquid staking tokens – LDO and FXS – have posted even more substantial losses today. Both assets are down by roughly 8% to $2.32 and under $9, respectively.

Most larger-cap alts are in the red as well, albeit in a less painful way. This includes BNB, XRP, ADA, DOGE, MATIC, SOL, DOT, LTC, SHIB, and AVAX – all of which have dropped by up to 3% in a day.

The total crypto market cap has lost about $15 billion in a day and is down to $1.170 trillion.

The post ETH Liquid Staking Tokens Drop 8% Daily, Bitcoin Stalls at $28K: Weekend Watch appeared first on CryptoPotato.