ETH Liquid Staking Coins Soar, Bitcoin Retraces Toward $22.5K (Market Watch)

Bitcoin dipped hard in the past 24 hours, charting a two-week low of under $22,500.

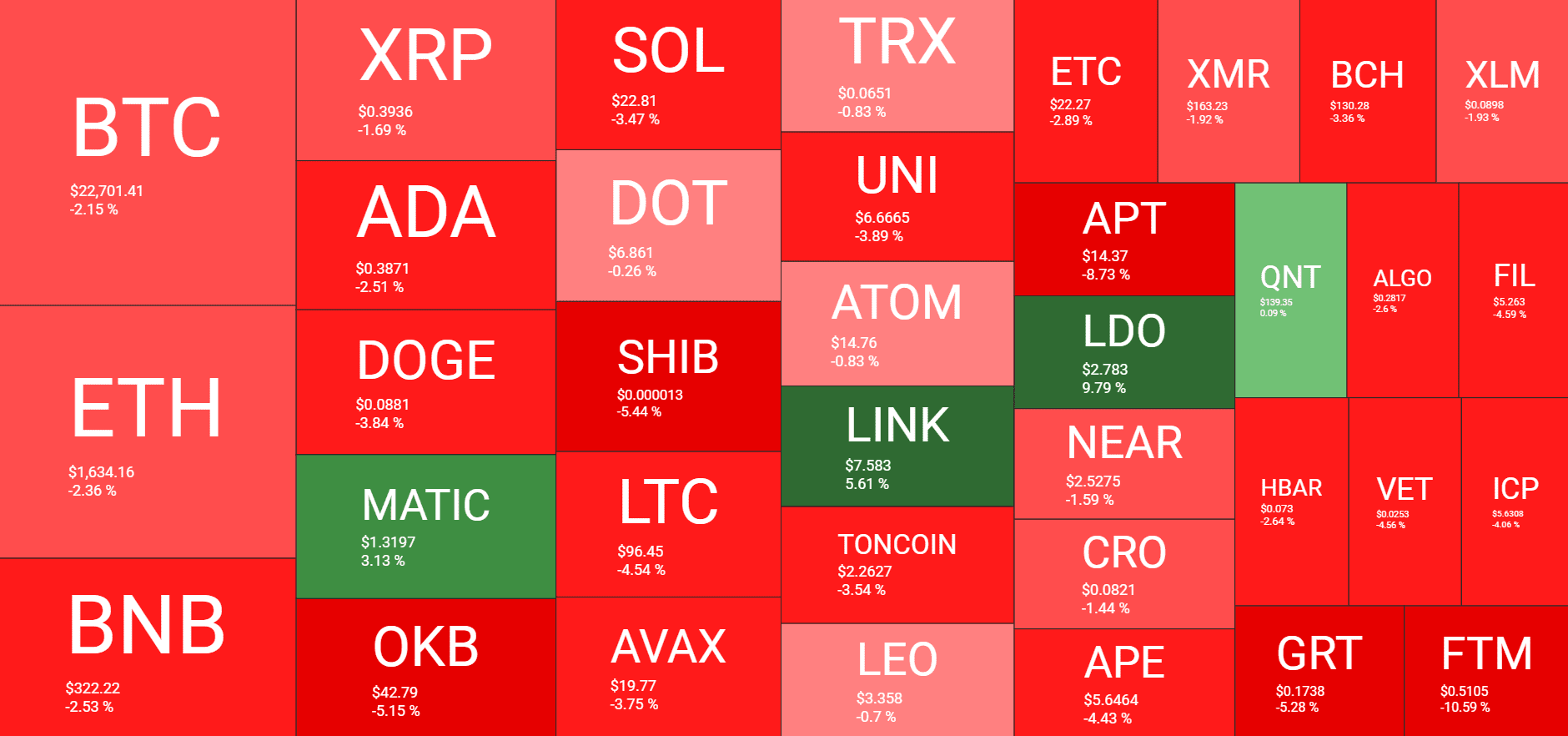

Most altcoins are also slightly in the red, aside from apparent exceptions coming from Ethereum liquid staking assets like LDO, RPL, and FXS.

ETH Liquid Staking Tokens Rise

The latest price frenzy comes just hours after the CEO of Coinbase – Brian Armstrong – addressed concerns regarding a potential clampdown from US authorities on staking. Several reps of the ETH liquid staking niche popped up with massive price increases, including LDO, which is up by almost 10%.

RPL and FXS have jumped by similar percentages as well. At the same time, ETH is down by over 2% in the same timeframe to under $1,650.

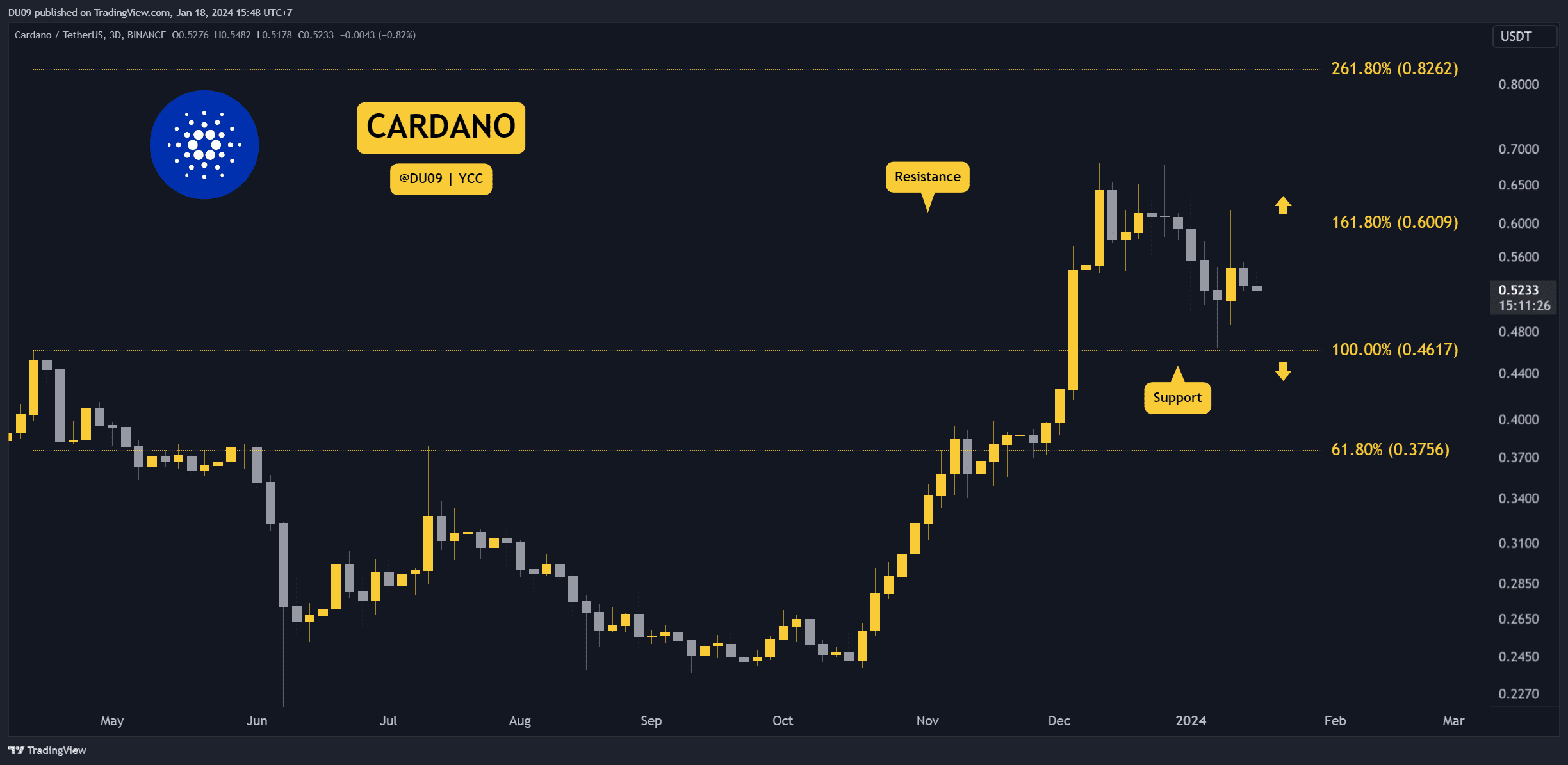

Most other larger-cap alts are in the red as well, including Binance Coin, Ripple, Cardano, Dogecoin, Solana, Polkadot, Litecoin, and Avalanche. Shiba Inu and OKB have lost over 5% in a day.

Polygon is the only exception from the top 10 crypto assets, with a 3% daily increase. Chainlink is also well in the green – 5.5% surge.

The overall crypto market cap is down by around $20 billion in a day to $1.060 trillion.

Bitcoin Sees 2-Week Low

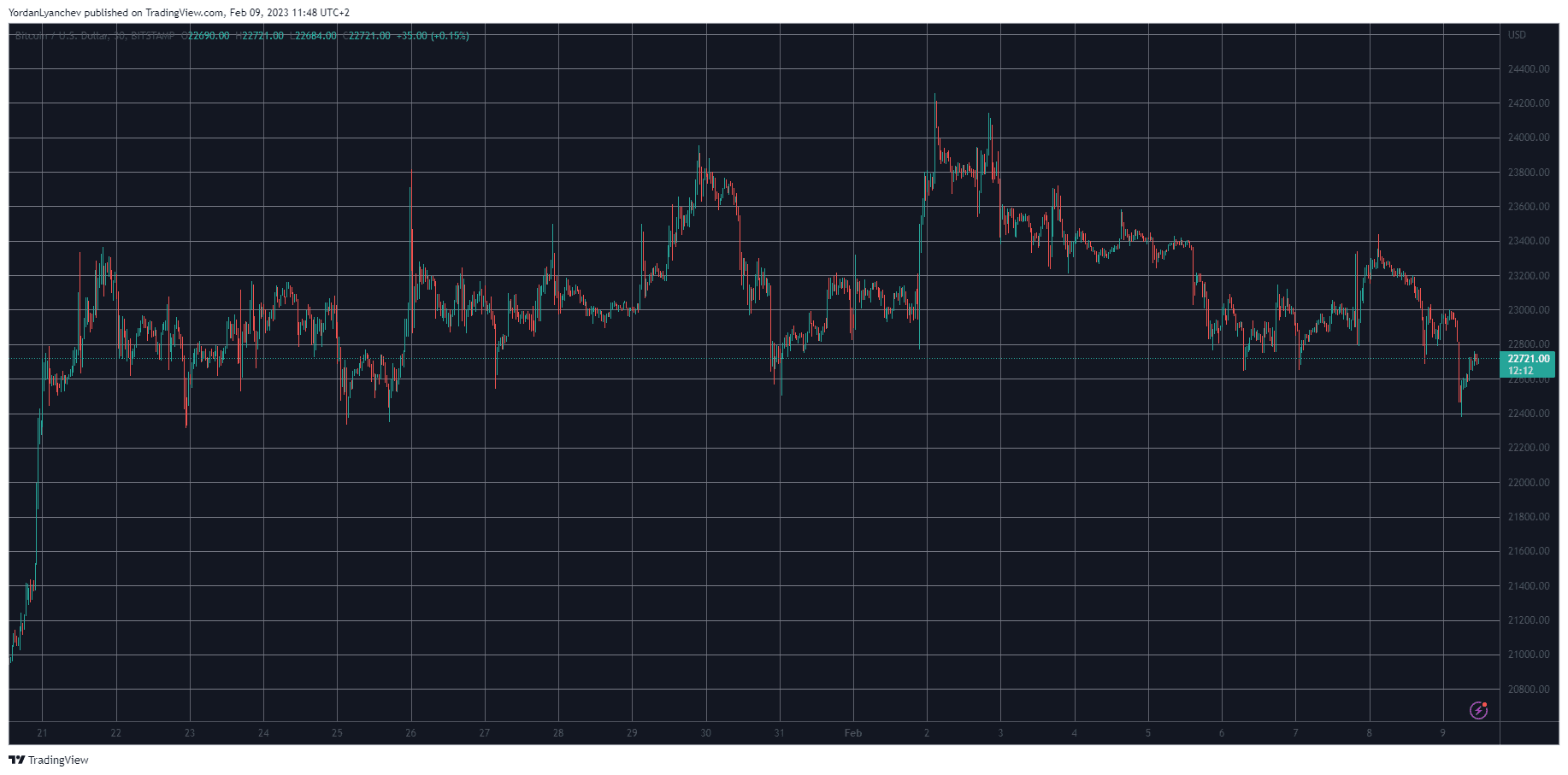

The primary cryptocurrency experienced enhanced volatlity last week when the US Federal Reserve increased the interest rates by another 25 basis points. This was rather bullish for the asset, which spiked to over $24,000 for the first time since August 2022.

However, that rally was short-lived as the bears came to play. They pushed bitcoin south hard, resulting in a price drop below $23,000 days later. Then came another speach from Fed Chair Jerome Powell that brought more fluctuations.

However, BTC failed at overcoming $23,000 and went on a downfall once more. This time, it dumped to a two-week low of $22,400 (on Bitstamp).

It has recovered some ground since then, but still stands beneath $23,000. As such, its market cap is just under $440 billion and its dominance over the alts is at 41.3%.

The post ETH Liquid Staking Coins Soar, Bitcoin Retraces Toward $22.5K (Market Watch) appeared first on CryptoPotato.