ETH Gas Fees Skyrocket As Ethereum Price Paints New ATH

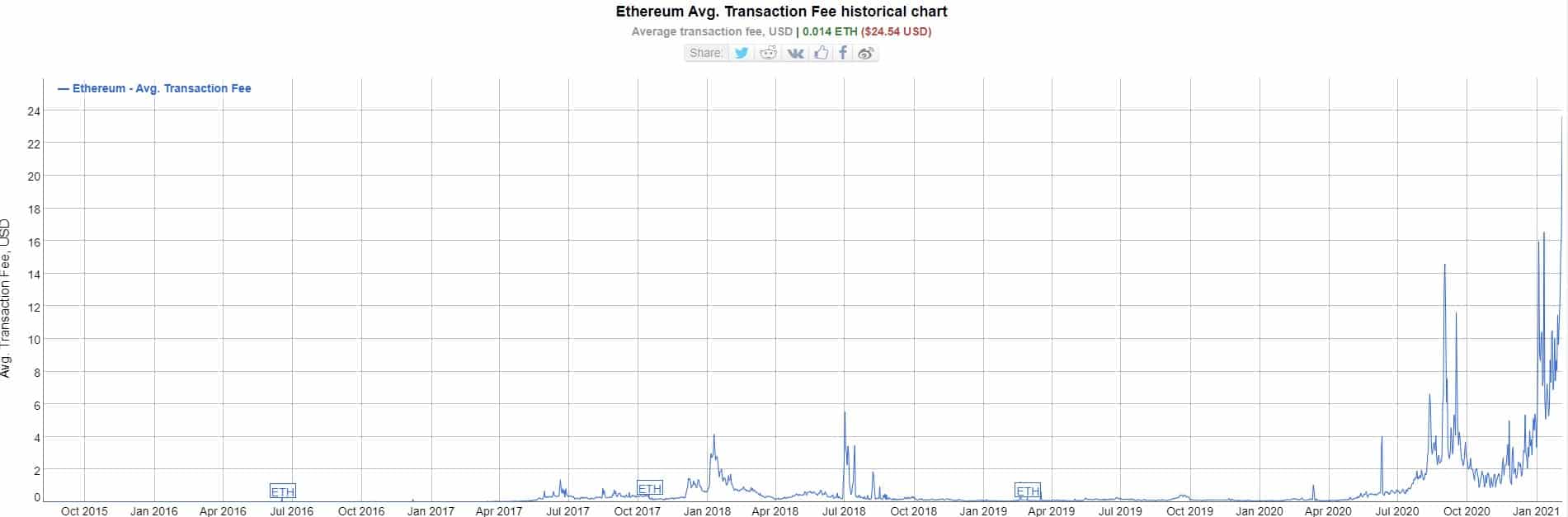

ETH’s increasing price is not the only Ethereum-related featured that has been skyrocketing lately. The transaction costs paid on the network (gas fees), prompted by DeFi and stablecoins, have surged to new average highs of over $20.

Gas Fees Through The Roof

It’s no secret within the community that arguably the most utilized blockchain, the Ethereum network, has struggled with scaling issues for a while.

Until the long-anticipated ETH 2.0 arrives, numerous projects have offered Layer-2 solutions to reduce the load and ultimately decrease the transaction costs. However, to no avail so far as the gas fees have skyrocketed lately again.

According to data from BitInfoCharts, the average transaction fees on the Ethereum network have reached all-time highs of above $22. This is a whopping increase by more than 10x since earlier this month when they were below $2.

While the average fees may be “only” $22, the community has exemplified on Twitter numerous situations of “absurd” gas costs per transaction. Others have presented even more compelling cases with up to $5,000 (3.09 ETH).

Almost 5k is the price to accept a bid on @rariblecom now!! 😂 Is it because of ETH high gas fees⛽️ or some type of bug 🐜 ? 🤔

Thoughts ? pic.twitter.com/tYoV1ilB85— Olive Allen (@IamOliveAllen) February 3, 2021

Additionally, the transactions have experienced substantial delays as the Ethereum mempool currently has nearly 180,000 pending transactions.

DeFi’s The Main Driver

Somewhat expectedly, Uniswap accounts for the largest share of the network congestion and paid fees. Users who have swapped coins on the popular decentralized exchange (DEX) have spent 26,400 ETH in the past 30 days. From a USD perspective, this amounts to about $33 million.

The most widely-used stablecoin, Tether (USDT), comes in second place with 19.2k ETH (or $24 million).

Other DeFi projects follow, including 1inch Exchange – 5K ETH ($6 million) and SushiSwap – 3K ETH ($3.8 million).

The positive outcome here is that the infamous scam – SmartWay Forsage, which had a leading spot until recently, has fallen to 16th place with 1,200 ETH spent in the past 30 days.

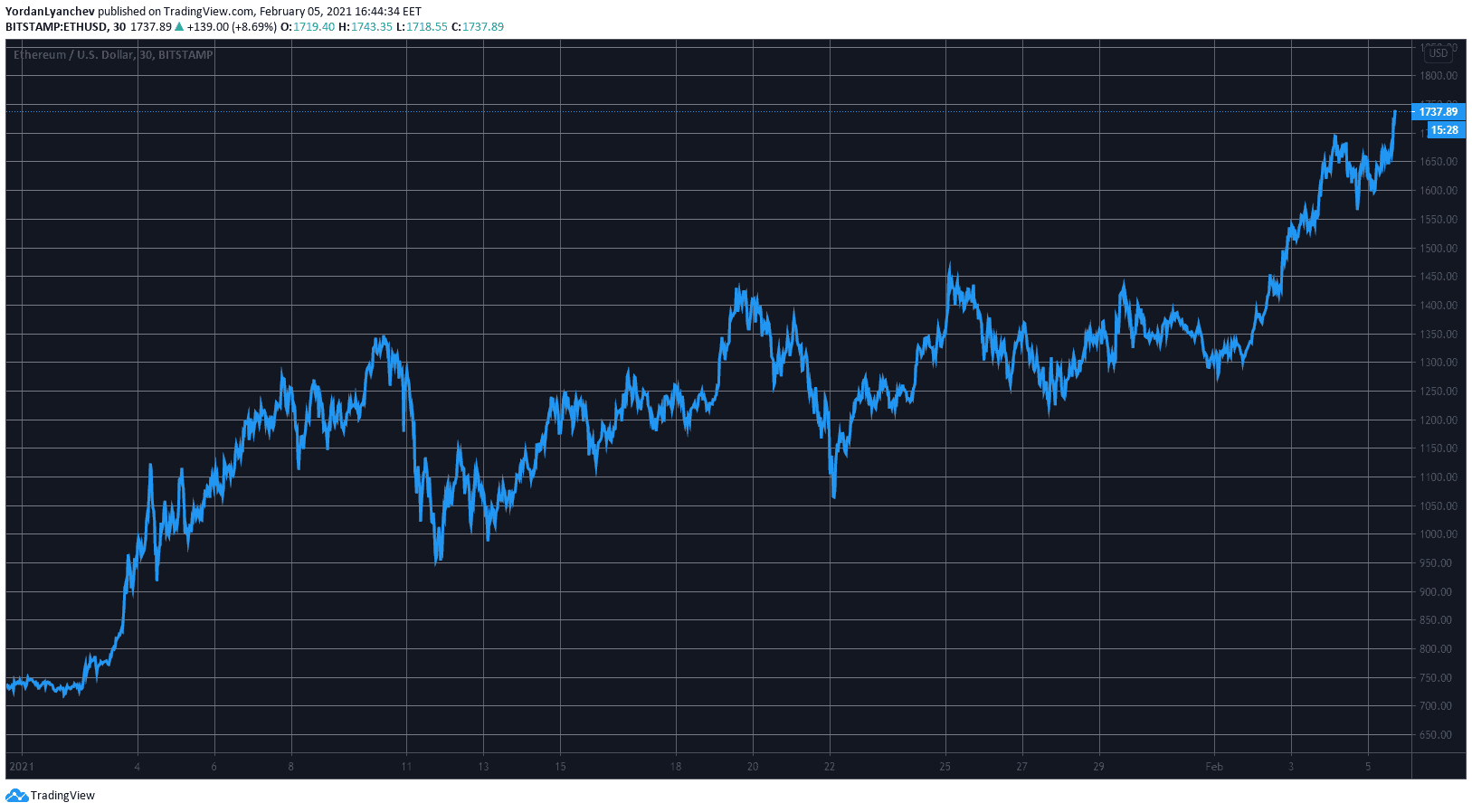

ETH Overcomes $1,700 For A New ATH

Mimicking the network fees, the price of the native token, ETH, has also gone for record levels. Earlier today, the second-largest cryptocurrency topped $1,700, and its latest all-time high came at over $1,740.

This means an increase of almost $500 (36%) since the brief drop to $1,250 on February 1st. On a year-to-date scale, ETH is even more impressive after surging by 130% in about five weeks.

Consequently, Ethereum’s total market cap has risen to $200 billion, which places the cryptocurrency as the 45th largest asset by this metric, according to AssetDash data.