ETH Fundamental Analysis: The ICOs sell-off hasn’t ended yet

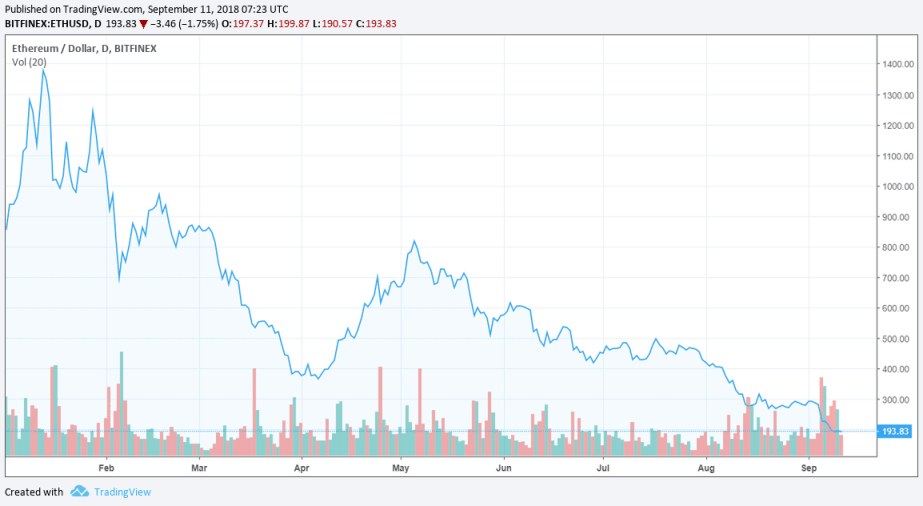

For months now, since January 2018, the crypto markets have been experiencing significant declines in price. Bitcoin has lost 70% of its value since December and Altcoins have lost an average of 90%. However, the most recent decline of Ethereum has got many people in the crypto space concerned that there is something fundamentally wrong that goes beyond the industry’s bearish sentiment.

Cryptocurrencies function under the economic principles of supply and demand. As cited by Vijay Boyapati, a crypto analyst; “The price level of all monetary goods is determined by (and only by) reservation demand. More precisely, the duration that the average unit of the monetary good is held in reserve”.

Examples of high reservation demand include assets like gold, which are stored in vaults because of a belief that it will retain its value long into the future. This high reservation demand is the reason why gold has a market cap of over $7 trillion.

An example of a low reservation demand is the Venezuelan peso. This national currency is being devalued so fast, that most who are unfortunate enough to be holding it, try to spend it as quickly as possible.

When it comes to Ethereum, their main value proposition is to be a highly liquid token used for executing smart contracts. Smart contracts were used for ICOs to create reservation demand because they lock up supply as ETH is held in reserve by companies raising capital to fund operations.

Reservation demand for ETH increases when ICOs raise funding but decreases when the same ETH is sold on exchanges to provide funding for company operations.

During last year’s bull market, many companies sought to hold onto their ETH in the hope that the value would go up and they could then expand their operational capital. In today’s bear market, companies have been selling their ETH to preserve what operational capital they have left from being further devalued. This, along with the significant decline of the ICO market, has probably led to the extensive crash in ETH prices.

If the bear market continues, we can expect the panic-sell of ETH to continue, and ETH might even be valued a lot lower than the current value of around $200.

On the other hand, Bitcoins reservation demand remains intact because its primary use case is as a store of value, which means buyers have a greater incentive to hold it for long periods of time.

Many ICOs are still holding

Ultimately, the economics of ETH as a token does not bode well for its price in the short term. However, if through improvement in the Ethereum networks, or a resurgence of the ICO market, the token’s reservation demand can be restored. Then we may start to see a steady price recovery over the next few months. In the meantime, ETH holders should hope that none of the remaining ICO companies that raised large amounts of ETH decide to sell to preserve their operational funding. The following Google Doc displays a list of featured ICOs with complete stats about their public funding wallets and how much of it they still hold.

What is interesting to see, is that there are ICO companies whose market cap is lower than the amount of funds they are holding.

The analyst Larry Cermak has recently tweeted some interesting points regarding the above issue:

1/ There is a big misconception that ICO companies have liquidated most of their ETH holdings. In today’s issue of Diar, we looked at all the publicly available ICO treasuries and analyzed the numbers. https://t.co/EryLsW9Ouj pic.twitter.com/j2DYajcwzQ

— Larry Cermak (@lawmaster) September 10, 2018

The post ETH Fundamental Analysis: The ICOs sell-off hasn’t ended yet appeared first on CryptoPotato.