ETH, BTC Prices Unfazed by the Massive Outflows From Grayscale’s Ethereum, Bitcoin ETFs

The two largest Grayscale funds operating on US stock exchanges – GBTC and ETHE – saw substantial net outflows on Monday.

Nevertheless, the prices of the underlying assets have remained stable and even managed to record some minor gains in the past 24 hours.

Ethereum ETFs in Bad Shape

CryptoPotato has repeatedly reported the lack of actual demand and interest in the spot Ethereum ETFs ever since they saw the light of day in July this year. Not only have they failed to attract significant inflows, but their overall numbers are in the red, and even BlackRock’s $1 billion product could not make up the losses from Grayscale’s converted private fund into an exchange-traded one.

In fact, ETHE has been in the red for almost all of its existence. Out of the 44 trading days since the July launch, ETHE has seen net outflows in 38 and has seen zero flows in the remaining six.

Last Thursday and Friday were slightly positive for all Ethereum ETFs, with minor net inflows of $5.2 million and $2.9 million, respectively. ETHE saw no withdrawals during both of those days, but the landscape changed yesterday as investors pulled out $80.6 million from the fund.

The overall net outflows stood at $79.3 million, the highest since July 29, as Bitwise’s ETHW saw $1.3 million in inflows.

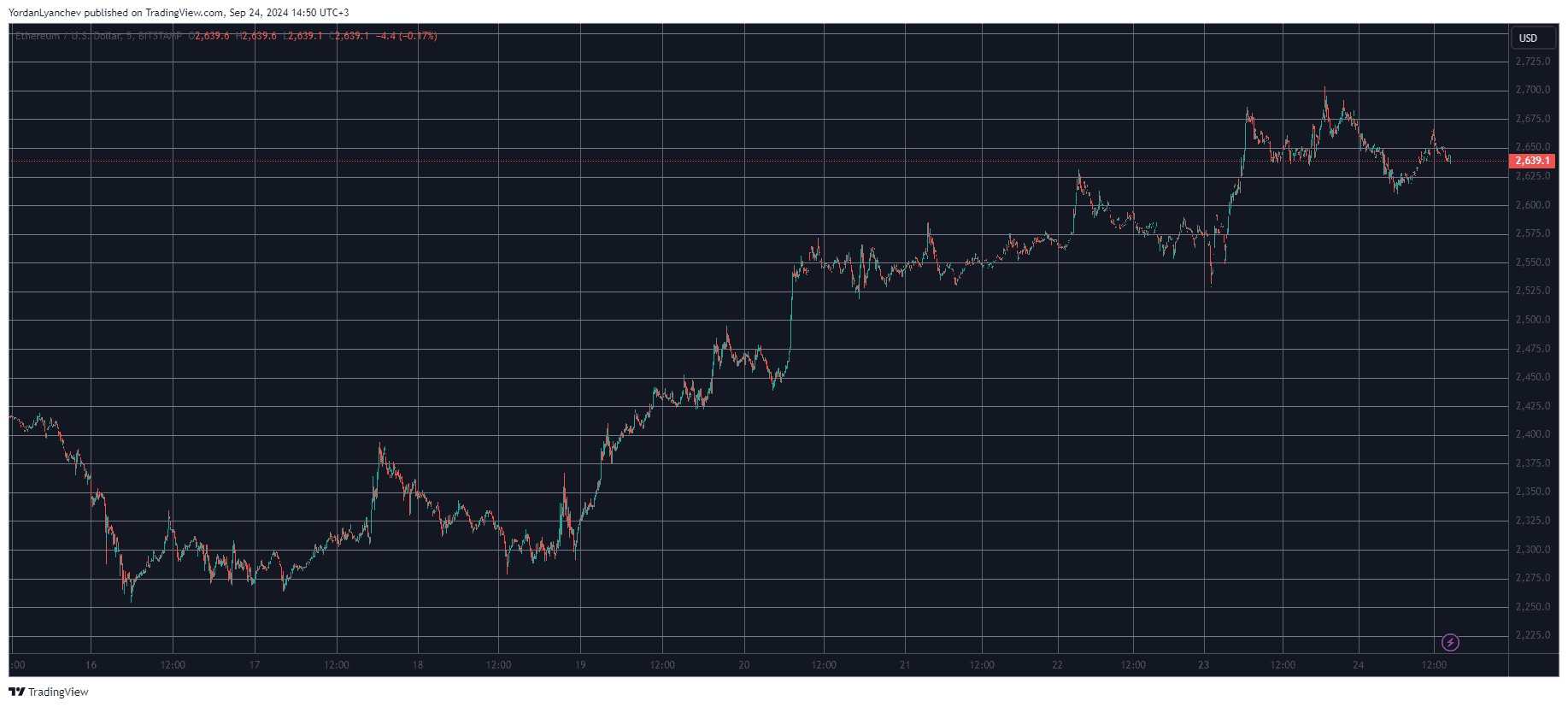

Interestingly, ETH’s price has remained unfazed by Monday’s big withdrawal. The second-largest cryptocurrency registered a four-week peak at almost $2,700 yesterday after surging by 14% in the past week.

Bitcoin ETFs Remain in the Green

Grayscale’s largest Bitcoin fund – GBTC, also saw noteworthy withdrawals yesterday, with $40.3 million taken out. However, its smaller fund – BTC, as well as BlackRock’s IBIT and Fidelity’s FBTC, managed to offset the losses.

The largest Bitcoin ETF attracted $11.5 million in net inflows, BTC saw $8.4 million poured in, and FBTC emerged on top with $24.9 million. Consequently, the final figure for the day for all spot Bitcoin ETFs was slightly in the green, $4.5 million.

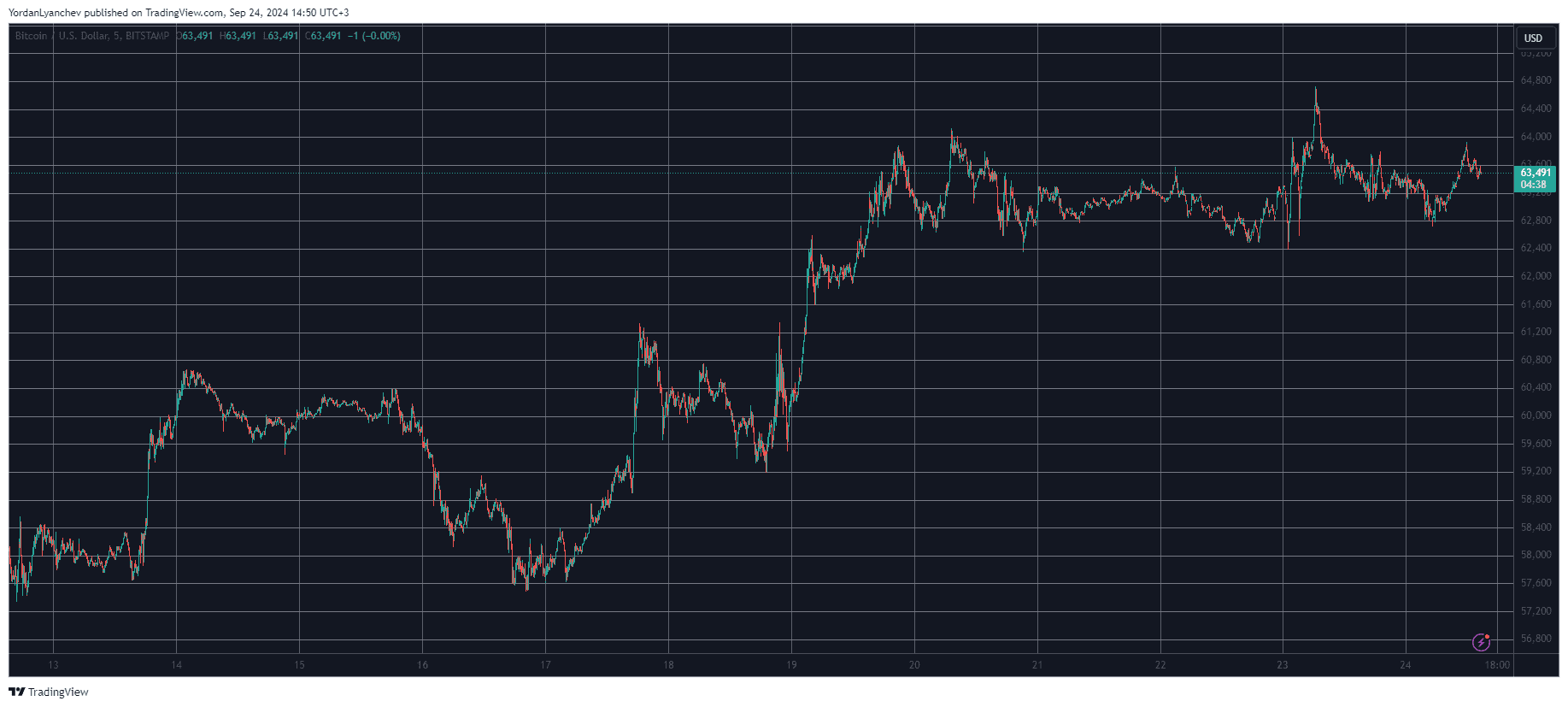

Bitcoin’s price has been relatively sluggish on a daily scale but has gained 7.5% in the past week. As a result, it now trades around $63,500, with experts and analysts speculating about an upcoming massive rally, which you can read more about – here.

The post ETH, BTC Prices Unfazed by the Massive Outflows From Grayscale’s Ethereum, Bitcoin ETFs appeared first on CryptoPotato.