ETH and DeFi 1.0 Lead the Market as Ethereum 2.0 Merge Narrative Intensifies

The past week has seen the cryptocurrency market add some $150 billion to its total capitalization and reclaim the coveted $1 trillion mark.

At the same time, though, Bitcoin’s dominance – the metric that gauges its share relative to that of the entire market – has decreased by more than 1.5% in the past six days. This shows that altcoins are performing better than BTC.

ETH and DeFi 1.0 Outperform

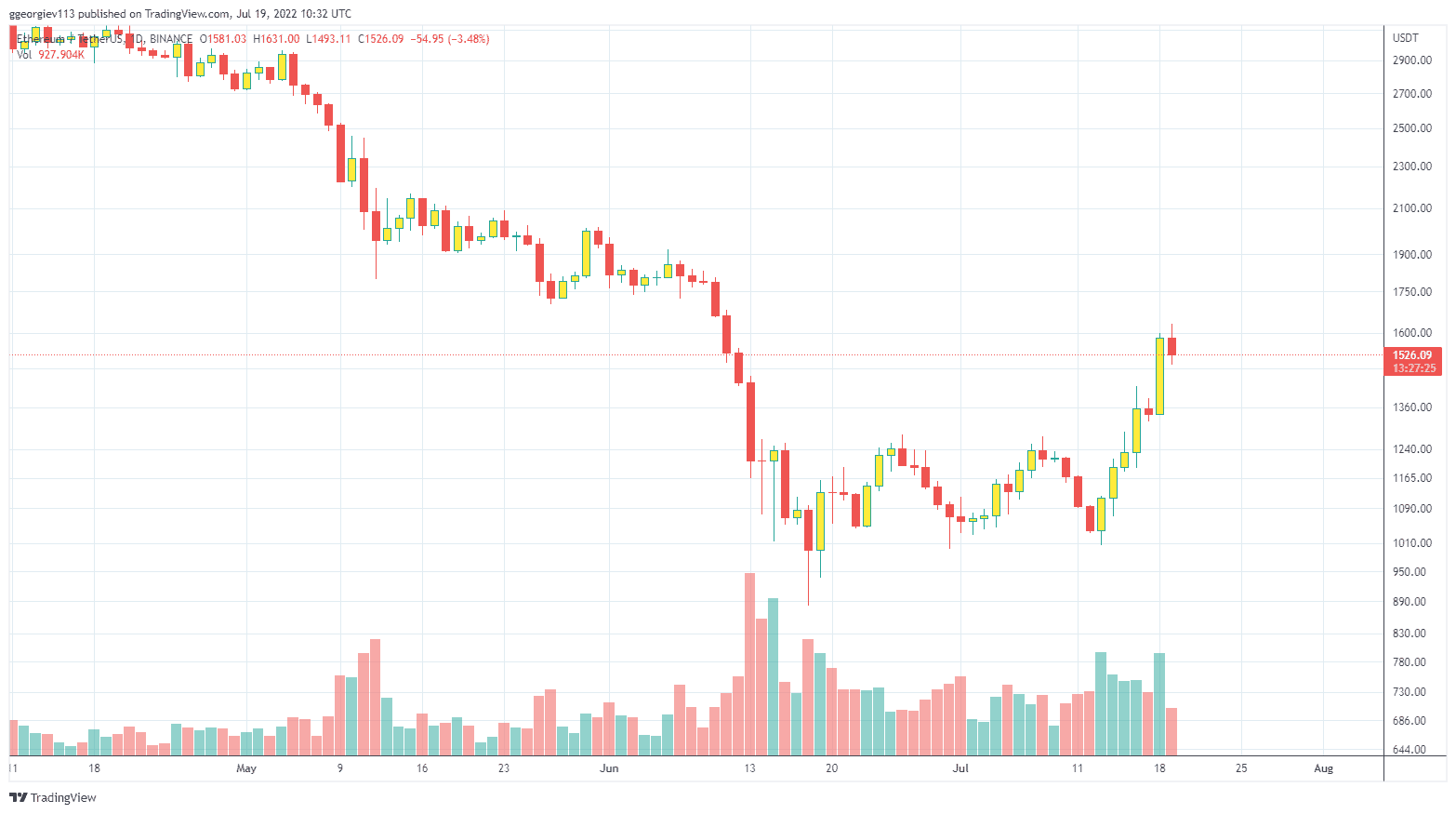

Ethereum is up over 50% in the past seven days. The cryptocurrency touched $1,000 on July 13th, and it’s been up only since then.

In today’s trading session, ETH even topped $1,600 (for a total of 60% increase in a week) but failed to sustain above it and retraced to where it’s currently at above $1,500.

To further highlight its dominance recently, it’s worth looking at the total liquidated positions. In the past 24 hours alone, they amount to about $600 million, and more than $365 million of that comes from ETH positions.

It also appears that the surge in ETH propelled other related cryptocurrencies to increase as well. Namely, these are part of the so-called DeFi 1.0 ecosystem and include projects like Polygon (MATIC), Synthetix (SNX), Curve (CRV), Uniswap (UNI), AAVE (AAVE), Maker (MKR), Fantom (FTM), and so forth. The following chart visualizes their surge in the past 30 days:

Ethereum 2.0 Merge Narrative Intensifies

As seen in the above charts, most of the mentioned cryptocurrencies started surging after Tim Beiko – a member of the Ethereum Foundation – projected that the Ethereum 2.0 merge might take place as soon as September 19th this year.

Speaking on the matter, Beiko said:

This merge timeline isn’t final, but it’s extremely exciting to see it coming together. Please regard this as a planning timeline and look out for official announcements!

The document he attached also warned that “all would be subject to Goerli Merge not blowing up.” The Goerli Merge is scheduled for August 11th.

It appears that this is the driving narrative behind the current increases, and it’s interesting to see how the Merge will impact ETH’s price, given that it’s slated to introduce a drastic change to the cryptocurrency’s supply dynamics, shifting it from a proof-of-work emission model to a proof-of-stake one.