EigenLayer Outflows of $2.3B Signal Restaking Sector Slide

-

Total value locked on EigenLayer has dropped by 13% to $15.1 billion in the past 30 days, even though ether is trading at a similar level to June.

-

Outflows can be attributed to the fickle nature of points farming and the limited returns on restaking protocols.

-

Ether.fi has bucked the trend, experiencing growth in the period.

01:08

Ether Sees Strongest Bull Momentum in 3 Years

12:10

Former SEC Senior Trial Counsel on Spot Ether ETF Approval Outlook

12:10

Former SEC Senior Trial Counsel on Spot Ether ETF Approval Outlook

02:22

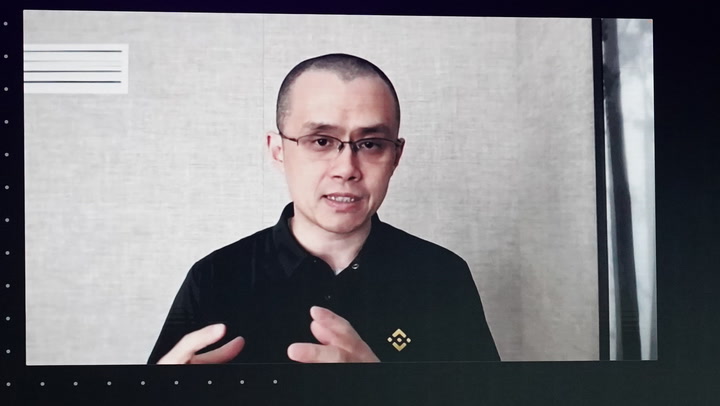

CZ’s ‘Good Guy’ Reputation; Money Laundering Risks of Crypto

Billions of dollars worth of ether (ETH) has been withdrawn from restaking protocols over the past month as the once trendy sector gets its first taste of the fickle nature of crypto investors.

On June 25, ether (ETH) was trading at $3,300, a shade higher than Thursday’s price of $3,200. During that period, however, the total value locked (TVL) on EigenLayer – a protocol that links restaking protocols – slumped by $2.28 billion to $15.1 billion. Restaking protocols like Renzo and Kelp have lost 45% and 22% of their TVL, respectively, data from DefiLlama shows.

A portion of the outflows can be attributed to depositors looking to harvest points that will eventually be converted to airdrops subsequently moving on to another project to maximize returns.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/VMMYEDF675GBZGTT2KYWJPVV7M.png)

For others, the yield is too low when compared with specific yield-generation protocols like Ethena. Renzo offers an annual yield of 3.43%; Ethena offers more than 10%.

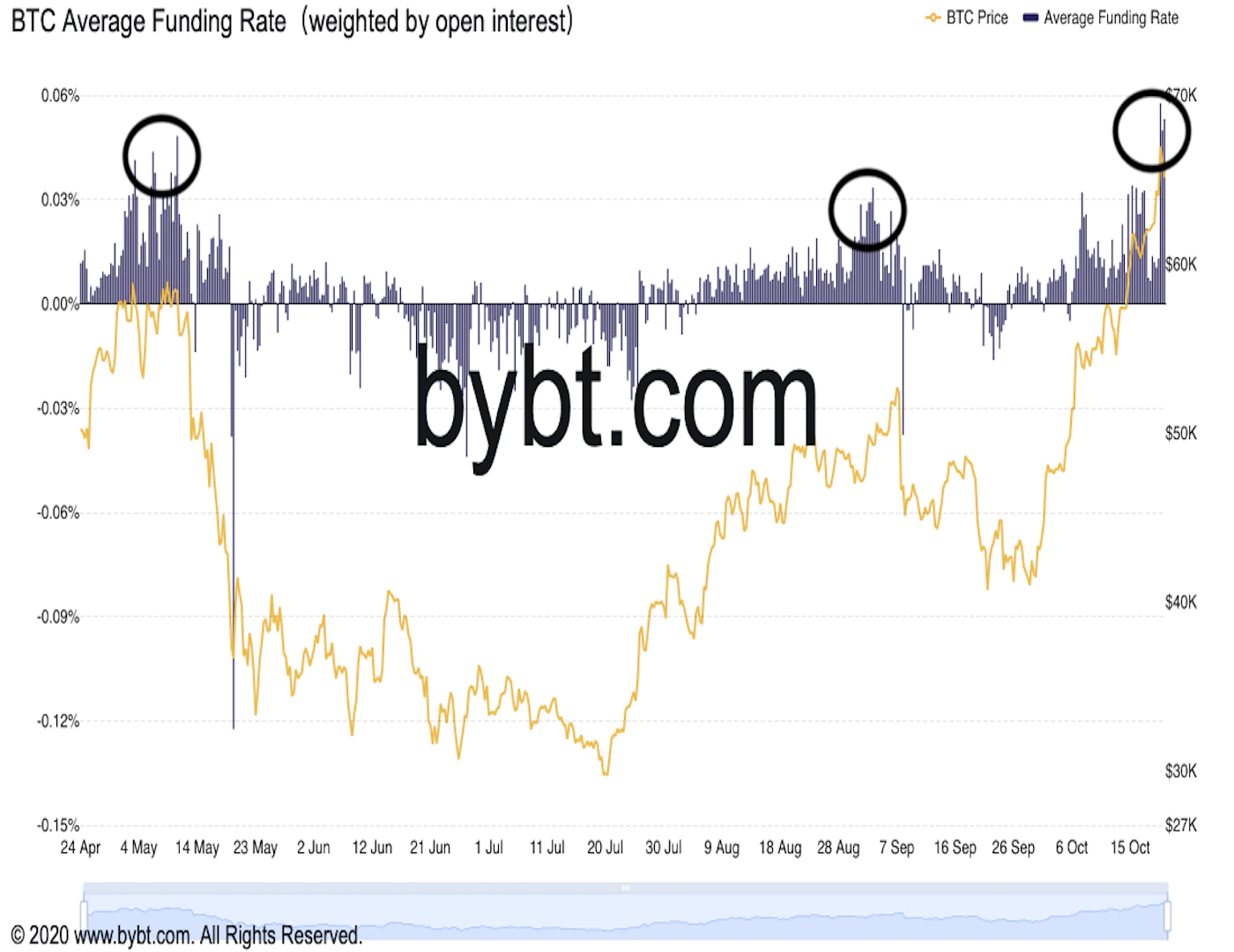

Restaking is a strategy that investors use to secure an additional yield on ETH that is already staked on the main Ethereum blockchain. Protocols like Ethena generate a yield by harvesting funding rates, which can be more volatile.

One restaking project that has managed to buck the trend is ether.fi, which has seen a $100 million increase in TVL.

Edited by Sheldon Reback.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

:format(jpg)/www.coindesk.com/resizer/fczAGHsWLFXiMV23oZZmkW19Ots=/arc-photo-coindesk/arc2-prod/public/D4HEG34XFVFVJHPXEEJAEFZ3SI.jpg)