EigenLayer and EigenDA Launch on Ethereum Mainnet

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

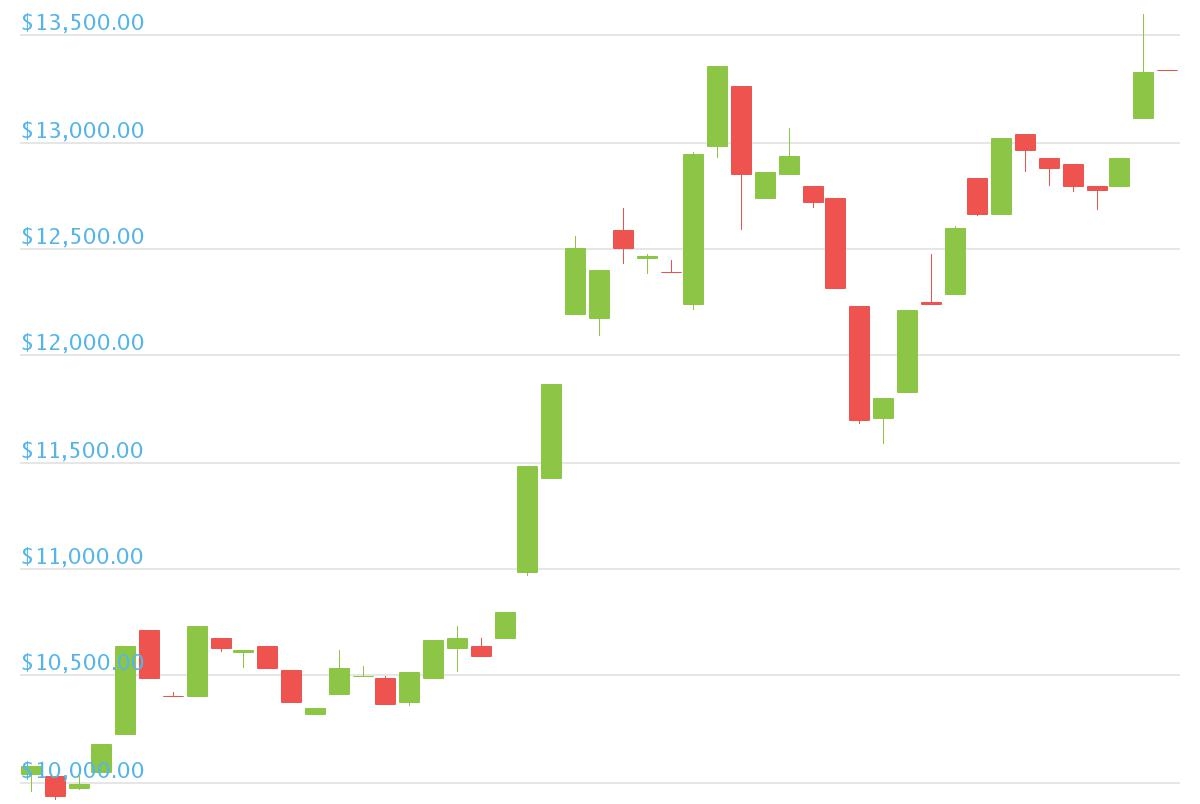

EigenLayer, a “restaking” service for Ethereum that has already racked up $12 billion in user deposits, announced today that it is officially launching to the blockchain’s mainnet. The launch comes alongside the release of EigenDA, a data-availability (DA) service from the team behind EigenLayer.

Even before EigenLayer launched, it had already become one of the most popular destinations for crypto inflows – a hot ticket partly because of its highly touted innovation of pooled security, a technology that could fundamentally reshape the industry landscape by extending Etheruem’s security apparatus to other crypto protocols.

Eigen Labs, the development firm behind EigenLayer, announced the launch on Tuesday on EigenLayer’s X account.

EigenLayer’s pitch is that it lets upstart blockchain protocols borrow Ethereum’s security – allowing users to take ETH they’ve staked with Ethereum, and then “restake” it with a much larger pool of ETH from other users.

That restaked ETH is used to collectively secure auxiliary networks, called actively validated services (AVSs), which can be anything from blockchain bridges to exchanges or oracles.

EigenDA, the first AVS to launch, is built by Eigen Labs as a way to help other blockchain protocols store transaction data and other information. It will compete with similar protocols, like Celestia, that have quickly become critical pieces of blockchain infrastructure as the industry has expanded.

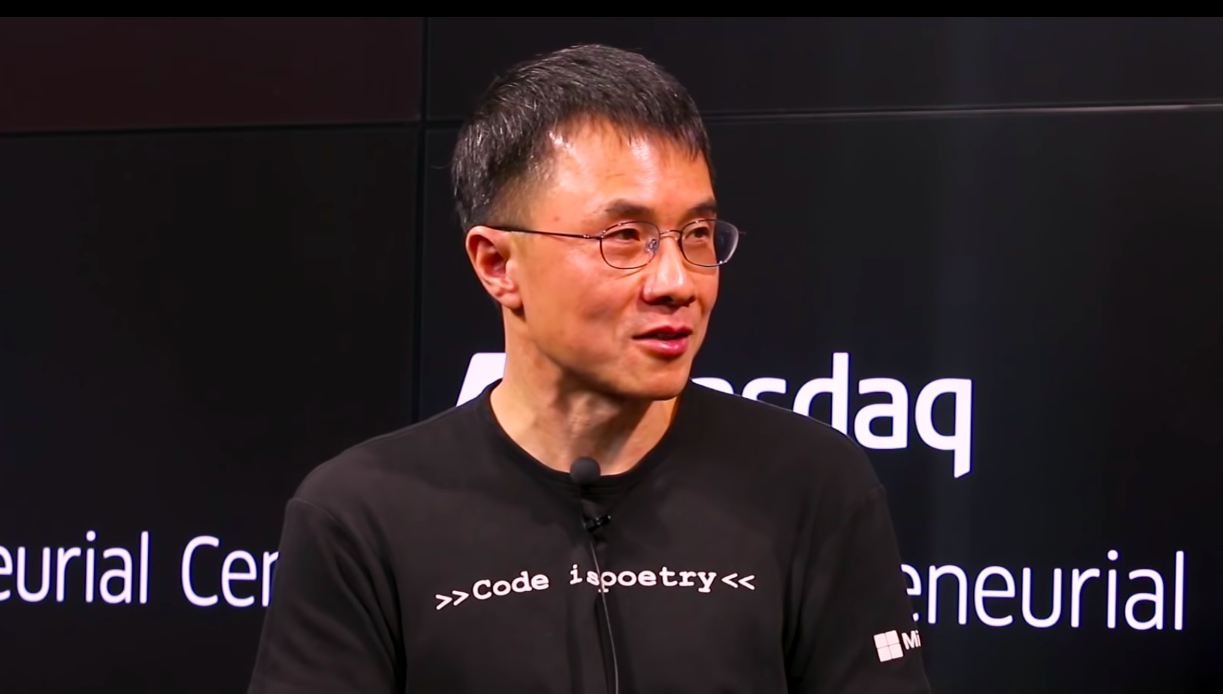

EigenLayer’s initial launch will have a restricted feature set for now, and Eigen Labs CEO Sreeram Kannan referred to the protocol’s first release as a “beta” version in a conversation with CoinDesk last week.

Notably, AVSs outside of Eigen Labs’ EigenDA will be able to “register” with the protocol, but they will not be able to deploy in-full just yet.

Additionally, “this mainnet launch does not include: (1) in-protocol payments from AVSs to operators; and (2) slashing,” EigenLayer said in its X thread. “We are allowing the EigenLayer marketplace to develop and stabilize before introducing in-protocol payments and slashing to mainnet later this year.”

“Slashing” refers to the method that EigenLayer will use to keep AVS operators honest: The protocol will rely on a proof-of-stake system similar to Ethereum’s, where AVS operators (also called validators) are at risk of having their stake revoked if they act maliciously. EigenLayer will ultimately pay out interest to restakers, but that function, too, will remain in progress until Eigen Labs works out kinks with its “in-protocol payments” system.

Eigen Labs raised $100M last year from Andreessen Horowitz (a16z), and the project’s points system – loyalty scores that users expect might be attached to future token airdrops – have helped fuel billions of dollars worth of deposits into the protocol.

EigenLayer’s rise has also fueled a cottage industry of “liquid restaking” protocols like Ether.fi and Puffer, which funnel money into EigenLayer on behalf of users and offer their own points systems as incentive.

UPDATE (Apr. 9, 18:26 UTC): Adds information throughout.

UPDATE (Apr. 9, 18:41 UTC): Adds information throughout.