Earn.com Founder Balaji S. Srinivasan Is Leaving Coinbase

Balaji S. Srinivasan, founder of Earn.com and CTO of Coinbase, publicly announced his exit from the company in a pair of Tweets last night.

“Coinbase was fun and it was energizing working with so many great people. I’ll be taking a bit of time off to get back in shape — and up to speed on everything happening while I was heads down,” he wrote. “More soon!”

“The Earn integration was successful and we’ve closed ~$200M in deals for the new Coinbase Earn. Was also my privilege to help with shipping new assets, launching USDC, & getting staking/voting going.”

Coinbase bought Earn.com in 2018 and made Srinivasan CTO after months of rumors. Earn started as the secretive and well-funded 21E6 aka 21.co which released a mining product before pivoting to a service that paid users for answering questions.

Srinivasan is Stanford graduate who holds a Ph.D. in Electrical Engineering and a master’s in Chemical Engineering. A rumored misfit in the organization led to the exit.

“We are very grateful to Balaji for all of his contributions to Coinbase,” wrote a Coinbase PR spokesperson. “His efforts over the past year have had a major impact on the trajectory of the company. He’s on to his next challenge and we wish him well.”

2/2 Coinbase was fun and it was energizing working with so many great people. I’ll be taking a bit of time off to get back in shape — and up to speed on everything happening while I was heads down. More soon!

— Balaji S. Srinivasan (@balajis) May 4, 2019

Srinivasan’s exit is one of many that happened after the company’s $300 million raise.

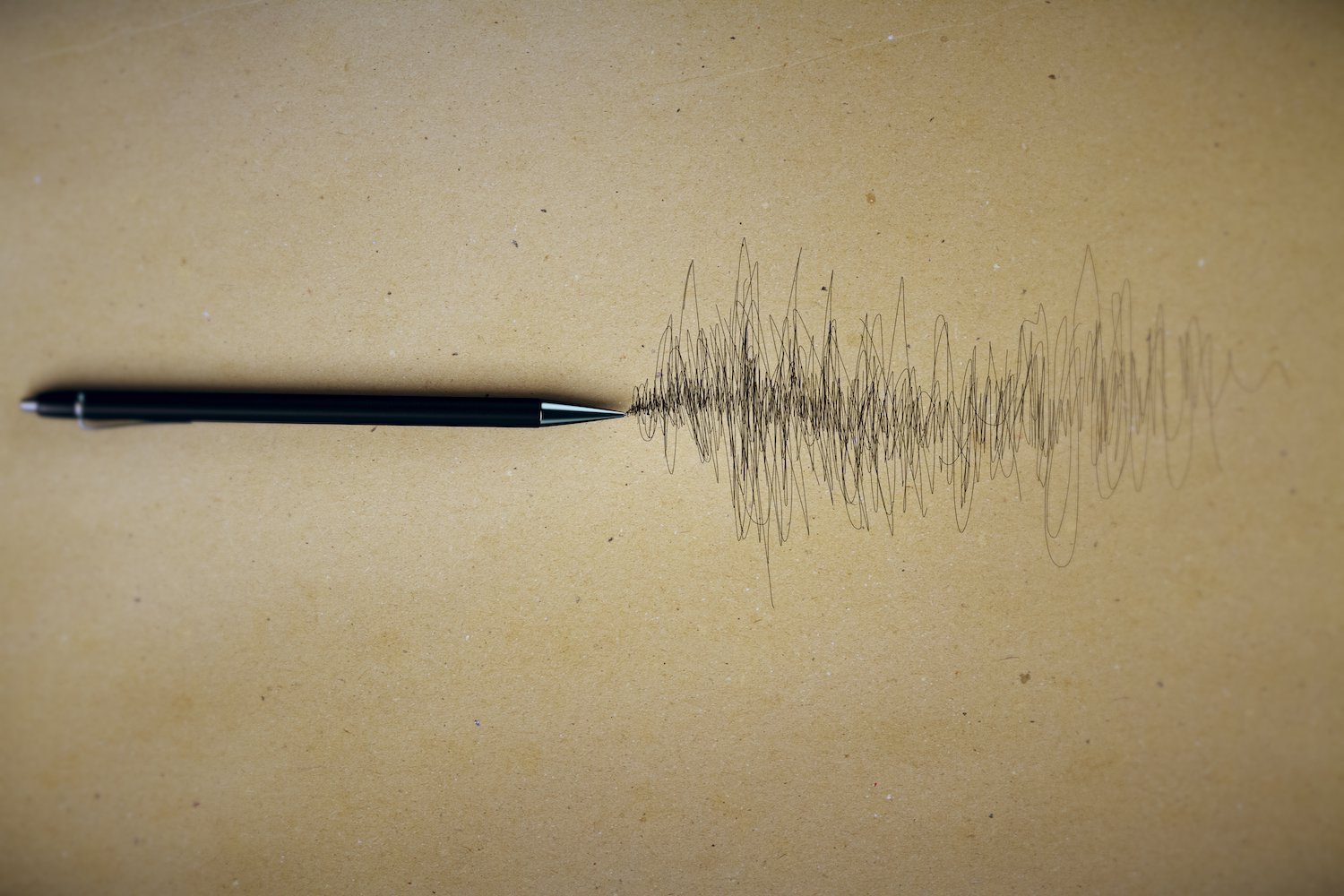

Balaji Srinivasan image via CoinDesk archives