Early Unibot Investors Sit on 200x Gains as UNIBOT Bucks Bitcoin Lull

-

UNIBOT prices have been on a tear since Telegram-based bots gained popularity in the past months.

-

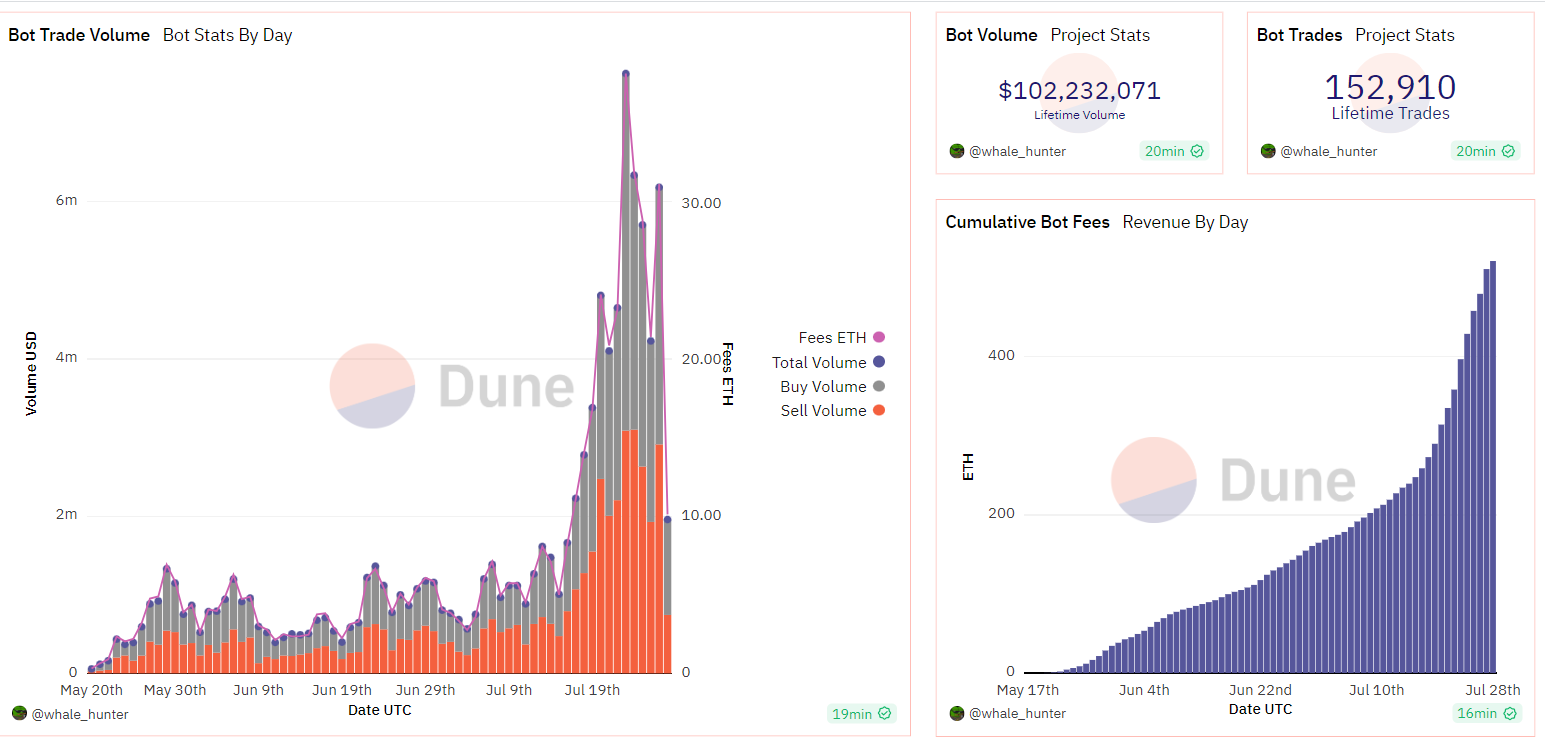

Revenues and users for Unibot have surged in the past month, according to Dune Analytics.

It’s not a bear market in some crypto circles.

Early holders of the Telegram-based exchange Unibot (UNIBOT) are sitting on nearly 200 times their initial capital as the niche sector token quickly gained favor among investors.

The Unibot platform connects user wallets to the decentralized exchange Uniswap and lets them punt on tokens just as easily as they would send messages to each other on the popular messaging app by using Telegram-based tools.

UNIBOT prices have spiked 40% in the past 24 hours – hitting the $200 level – and have more than tripled since the start of July. As of Friday, the token has a market capitalization of $180 million.

The draw is unique: Unibot, which allows sophisticated on-chain trading, pays out spot ether (ETH) to its token holders based on the revenue generated on the platform.

On-chain data shows Unibot has garnered 3,600 ether in fees since the platform went live in May, paying out a portion of this straight to token holders. Users have also steadily increased – touching 6,500 on Thursday compared to just over 2,000 at the end of June.

Average daily volumes on Unibot stand at just above $5.5 million, the data show, still a long draw from volumes of $900 million a day on market-leading DEX Uniswap.

The appeal for such products is likely due to the ease of usage compared to a decentralized exchange, such as Uniswap, where users have to continually log in to their wallet, cross-check if all token information is correct, and encounter high fees to ensure their trades go through.

Such a conflux of utility and fee-sharing is likely to amp up demand for UNIBOT tokens in the future, especially during bullish conditions when traders are likely to search for projects that offer passive payouts.

Edited by Parikshit Mishra.