Early To Bitcoin — How To More Effectively Orange-Pill Your Friends and Family

Sharing Bitcoin with people can sometimes be difficult, so here are some tips on how to do so.

As a diehard bitcoin maximalist, I find myself evangelizing for bitcoin every day. The last 24 months (wow) of money printing and government overreach have really proved out a lot of the truths Bitcoiners hold. Separating money and state will likely be the most important development for human freedom in the history of the world. Once you’ve fallen down the Bitcoin rabbit hole, it is hard not to start talking about it constantly to your nocoiner friends and family.

You’re trying to save them. There’s a flood coming and there are only 21 million seats on the ark. Luckily, the seats are infinitely divisible.

Reliance on state-issued currencies means your protest can be defunded with the stroke of a pen.

7.5% inflation means the average price of everything will double in 10 years, although the All-Transactions House Price Index for the United States pegs markups closer to 16.4% in the last year.

This part of the conversation usually goes well, everyone realizes prices are rising. At the least, it’s annoying them at the grocery store. At its worst, it has significantly impacted their quality of life. There are seldom rebuttals to sound money being a potential solution to these problems, but often I hear the following concern: “I’m too late to bitcoin. There’s little to no opportunity left to increase the purchasing power of my money by saving in bitcoin.”

This is a flawed perspective on why we use bitcoin and it’s also just false. Bitcoin is not a get-rich-quick scheme, it’s a solution to the get-poor-slowly scheme of government-issued fiat currencies. However, it is also so early that there is likely tons of upside to bitcoin, aside from being censorship-resistance sound money. While impossible to predict, there’s a strong case to be made that the long-term purchasing power of bitcoin could settle as high as $10 million, and then grow at the rate of global gross domestic product (GDP) growth forever thereafter. I wrote a pretty technical piece on one of many valuation frameworks that suggests that price. If you’re in the middle of orange-piling a newbie, that article might be too highbrow for them, so here are some ideas on how to rebut the “it’s too late” argument.

The first step is local, the second global. First, use yourself as an example. “If it’s too late, why would I be actively converting all excess cash flow I have on hand into bitcoin for savings?” This helps make it clear to your audience that, yes, despite the unbelievable run up in dollar price bitcoin has had, the ones who truly understand what is likely to happen continue to accumulate bitcoin as fast as they possibly can. This puts you on equal footing with your newcomer audience and is also a great opportunity to shill your favorite dollar-cost-averaging service.

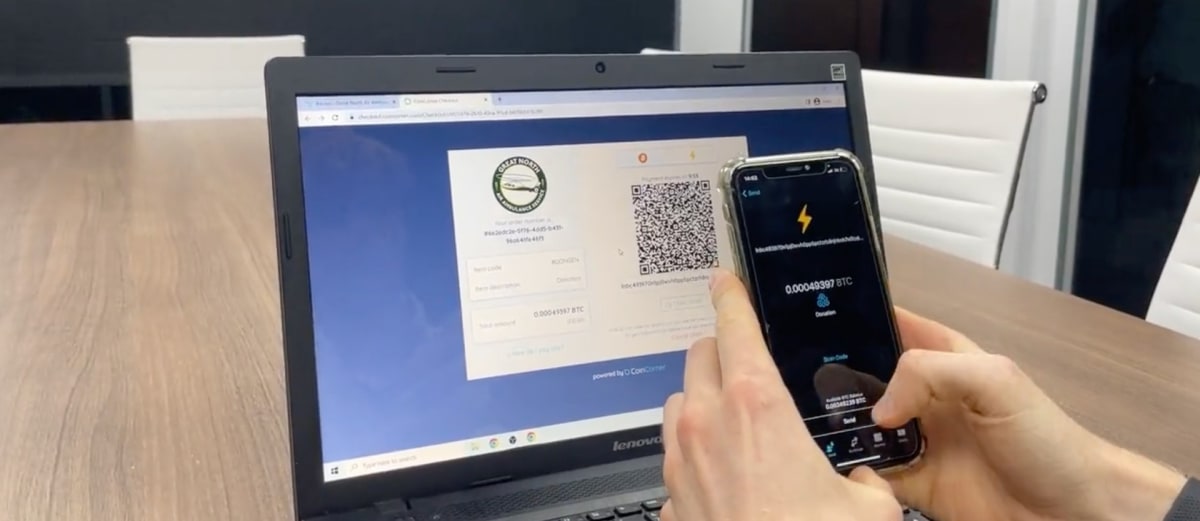

Help them understand that ANY dollar price for bitcoin is a good price. Because once you understand the one-way street that is bitcoin adoption, you realize that one day the price of bitcoin will go “no ask.” “No ask” is a wall street term for when a market for something has no price at which sellers will transact. There is no asking price at which sellers are willing to trade their asset for dollars. Just as there is no market today for exchanging U.S. dollars for the Zimbabwean dollar, Weimar German mark, Hungarian pengo, Chilean peso, Argentine peso, Preuvian inti, Angolan kwanza, Belorussian ruble, and many others, one day there will be no market for exchanging bitcoin for U.S. dollars. I’ve found this framework to be effective at helping people understand just how “early” we still are. There is still a dollar market for bitcoin. One day the only way to acquire bitcoin will be by selling your goods or services in exchange for it. Bitcoin is savings technology.

The second step is global, and is a great way to shill the upcoming conference in Miami. One analogy for future bitcoin adoption is the adoption of the internet. The internet went from 23,500 sites in 1995 to over 1.6 billion in 2018. That’s a 62% compound annual growth rate for 23 years for an open protocol on which virtually all forms of information exchange are built. Bitcoin is that same base protocol for virtually all forms of value exchange. As large as the internet has become, have you ever heard of an internet conference or meetup? Probably not. If you tell your audience you’re excited to be heading to Miami for the conference this year, they’ll probably laugh at you for heading to Miami for a nerd convention. Point your audience back to the analogy of the internet, and then draw this comparison. “Have you ever been to or even heard of an ‘internet conference’? No? Why not?” The reason why not is because when revolutionary technologies become a facet of our everyday lives, they fade into the background of our reality. There were probably some internet-focused meetups and conferences in the mid-to-late 1990s, but today the phrase “internet conference” sounds ridiculous. The internet is just there, everything information technology-related is built on it and we take it for granted. Most people are not attending conferences and meetups to discuss its potential impacts on society. It’s already here, ubiquitous in first-world countries, and has made a lasting impact on the world. Bitcoin is headed for the same destiny. The fact that there even is a “Bitcoin 2022” conference to attend, and that this conference is a mere three years old, is a testament to how early we still are. This technology will revolutionize how we express and transact value for goods and services, and usher in an era of human freedom unlike the world has ever seen. It is an open protocol on which the future of finance is being built, empowering its users to possess a trustless, permissionless, censorship-resistant money that cannot be debased by central planners. Bitcoin is savings technology and it is going to change the world. The fact that we are even talking about it as a novel concept tells you just how early we still are. Bitcoin is internet money.

If you aren’t paying attention, you probably should be.

See you freaks in Miami.

Bitcoin 2022 will be the biggest event in Bitcoin history, with an unprecedented range of technical, cultural and financial progress being made in the space. To secure your place at the event, use the discount code “MAGAZINE” for 10% off ticket prices at https://b.tc/conference/registration.

Bitcoin Magazine is operated by BTC Inc, which also hosts the Bitcoin Conference series.

This is a guest post by Scott Marmoll. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.