DWS, Galaxy Digital List Exchange-Traded Commodities Offering BTC, ETH Exposure in Germany

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

-

DWS and Galaxy Digital have listed investment products tracking BTC and ETH on the Deutsche Boerse.

-

The two firms teamed up a year ago to develop crypto exchange-traded products (ETPs) for listing in Europe.

02:16

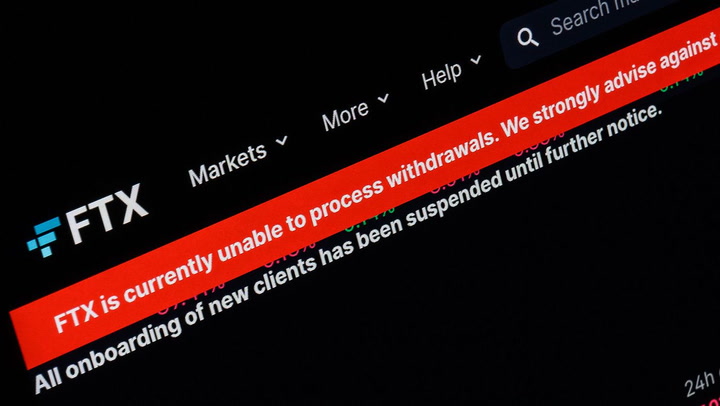

FTX Bankruptcy Claims Deadline; UK Crypto, Stablecoin Rules Passed Into Law

06:29

US Sanctions Russian Darknet Marketplace Hydra

07:10

The State of Crypto in South Africa

05:10

Germany’s Central Bank Is Testing Blockchain-Based Alternatives to CBDCs

Asset manager DWS (DWS) is offering exchange-traded commodities (ETCs) that provide exposure to bitcoin (BTC) and ether (ETH) in Germany.

The ETCs, which carry the Frankfurt-based company’s Xtrackers branding, were developed in conjunction with digital asset financial services firm Galaxy Digital (GLXY). They were listed on the Deutsche Boerse on Thursday, according to a DWS statement.

The products, the Xtrackers Galaxy Physical Bitcoin ETC and Xtrackers Galaxy Physical Ethereum ETC, track the performance of the two largest cryptocurrencies by market value and carry a fee of 0.35%. That’s cheaper than rivals such as 21Shares Bitcoin ETP (ABTC), listed in Switzerland and Germany, which charges 1.49%, and Amsterdam-listed Jacobi FT Wilshire Bitcoin ETF (BCOIN) with 1.5%

While spot crypto exchange-traded products (ETPs) have been available in Europe for several years – CoinShares’ Physical Bitcoin ETP, for example, was listed in 2021, and Zurich-based 21Shares says it introduced the world’s first physically backed ETP in 2018 – they’ve come more into focus since the U.S. Securities and Exchange Commission approved a bunch of exchange-traded funds (ETFs) for the world’s biggest economy in January. The U.S. funds have attracted a net inflow of about $12 billion in less than three months, according to BitMEX Research.

DWS, which has 896 billion euros ($970 billion) under management, and Galaxy Digital teamed up a year ago to develop exchange-traded products (ETPs) for listing in Europe. Leon Marshall, CEO of Galaxy’s European operations, said in a conference appearance last month that such products would be available shortly.

Edited by Sheldon Reback.