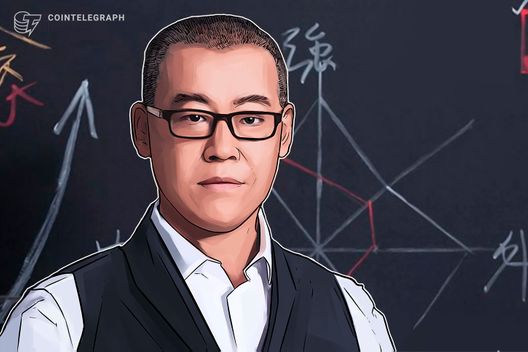

Dutch regulator says crypto not yet suitable as means of payment or investment

Paul-Willem van Gerwen from the AFM believes the retail investors should forbear the crypto derivatives trade .

258 Total views

85 Total shares

A Dutch regulator stated that the crypto derivatives market should be restricted to wholesale trade. The reasons are not unfamiliar — lack of transparency, market manipulation and “other forms of criminal activity.”

On May 12, the head of Capital Markets and Transparency Supervision at the Dutch Authority for Financial Markets (AFM), Paul-Willem van Gerwen, shared his opinion on the crypto derivatives trade at the Amsterdam Propriety Traders Managers Meeting.

Van Gerwen highlighted, that despite (or perhaps because of) the market’s rising interest in crypto derivatives trading, the AFM “do regard such trade as entailing risks” and consider this market to be not as mature as the other derivatives markets. A specific problem arising from the volatility of the crypto products, according to van Gerwen, leads to a question of whether “the parties to the derivative transaction will be in a position to fulfill their promises.”

Hence, the AFM believes that operations with crypto derivatives should be restricted to the wholesale trade. The official acknowledged that, unlike its British counterparts from the Financial Conduct Authority (FCA), the AFM has not banned such trade, but alluded that it surely might do so:

“Don’t get caught up in the excitement of this trading, don’t let yourself be tempted into retail trading.”

He also added, “Cryptos and derived tools aren’t yet suitable as a means of payment and/or investment.”

Another topic van Gerwen mentioned in his speech was the distributed ledger’s impact on clearing. At this he sounded much more optimistic, acknowledging the advantages of using the blockchain in clearing operations, but, yet again, was cautious while commenting on the industry’s possible role:

“In principle proprietary traders don’t get involved in clearing. And yet the technological developments could lead to a situation in which a peer-2-peer model arises, with proprietary traders possibly starting to engage in clearing themselves.”

Further reading: Binance reportedly halts crypto derivatives service in Spain

The speaker encouraged the attendees to take part in DLT pilot cases that the Dutch financial authorities are managing in a sandbox environment.

In August 2021 the central bank of the Netherlands issued a warning to Binance for offering crypto services without the required legal registration.