Driving Bitcoin Donations, Ukraine-Russia Conflict Showcases Separation Of Money And State

As the conflict between Ukraine and Russia propels social media reports and donations made in bitcoin, it underscores our decentralizing world.

“There’s a problem with bank accounts, something happened… the transactions are being stopped, for whatever reason.”

–Ukrainian activist Walter Lekh, in a Twitter Spaces conversation discussing avenues of donation in support of Ukraine.

Developments in Eastern Europe have taken center stage for much of the world in the past few days. Aggressive and consistent flows of reporting from the ground in Ukraine as the country sees Russian troops invade are dominating social feeds and headlines.

Coming out of these updates of conflict and bloodshed have been reports of non-governmental organizations (NGOs) that have been working directly with the Ukrainian government since 2015 now taking donations in bitcoin.

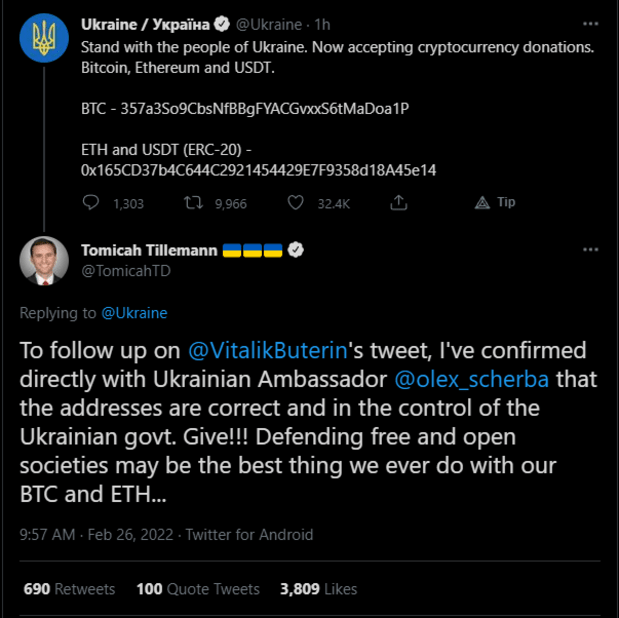

Before this article goes any further, I would like to expressly advise that nobody donate any bitcoin funds until significant effort has been dedicated to verifying addresses as best as can be done. This article is not meant to be a political admission of support, nor a call to action. There are significant efforts being undertaken by multiple parties engaging in deception and confusion of information and traffic at this time. Also, for those who are partaking in any live streams of footage and/or social media postings of this conflict: Do not click on links provided by parties that you do not know or trust.

This is an extremely volatile situation, and these areas have become a battleground for intelligence organizations, with hacker groups such as Anonymous joining in efforts. Taking part online in these areas may actively insert you into the digital crossfire.

One such NGO is “SaveLife,” an organization that is claiming to be distributing funds on a 50/50 basis between supporting veterans and casualties of war, and equipping Ukrainian elements with necessary equipment such as body armor. SaveLife recently had its Patreon account frozen — echoing similar events around the Canadian Freedom Convoy, as well as many other tangentially-related scenarios that have occurred over the past two years with regards to centralized organizations actively working to limit freedoms of information as well as money transmission.

This NGO, also known as Come Back Alive, was taking BTC donations leading up to the launch of this most recent escalation of aggression in Eastern Europe. At the time of writing, the address for SaveLife has received a total of 152 BTC (about a $6 million dollar value), up nearly 30% in a 48 hour period, with the Ukrainian government’s donation address accruing a total of 15 BTC at the time of writing.

What The Ukraine-Russia Conflict Says About Money And State

This ongoing, volatile situation highlights a multitude of concerns in the modern era.

First, the obvious: money the world over needs to be separated from the State, if not entirely at least in partial/parallel to current systems.

Ukrainians (of particular note is Walter Lekh, a Ukrainian who is currently in the U.S. but has been spreading word online of developments for weeks as his family remains in Ukraine as events continue to escalate) have been sharing frustration with attempts to conventionally transfer funds internationally to support their families, as well countrymen. As these fiat rails provide too many points of friction to get funds where they are most needed, and in a timely manner.

Secondly, the bureaucracies and radically-outdated systems of financial organizations continue to prove impotent when dealing with real world developments as they include the rapid transmission of information in the Modern Era.

Technology’s rapid advancement continues to provide significant bottlenecks for effective distribution and dissemination of information. As mainstream media have proven to be a general farce on developments over the past two years in particular, these centralized entities continue to fall short of legitimate and high-quality information as it is happening. Decentralized groups, affectionately referred to as open-source intelligence (OSINT), are being actively sought-out as reputable sources by trusted reporters such as Mark Goldberg, as well as politicians, ambassadors and active-duty S2s — proving the effectiveness, reach and efficiency of decentralized operations beyond that of the Bitcoin network.

Thirdly, these events also expose how increasingly dangerous much of the activities online are becoming. This dynamic also means that vulnerabilities of centralized financial systems (which most of the developed world rely on) are becoming increasingly more grave. The reason for this being that a centralized entity, while acting as a digital fortress, also provides a single point of attack — allowing for aggressors and bad actors to focus efforts towards breaching their defenses. It is very important to acknowledge that while some systems benefit from a blockchain, not all systems and mechanisms benefit, let alone require, a blockchain mechanism.

I have written previously for Bitcoin Magazine on the value of separating money from the state, which you can find here. Part of the reasoning for that article was to announce the launch of a Declaration Of Monetary Independence, which is a digital product that allows for signing, operating similarly to a petition, which will be sporting a physical display at the Bitcoin 2022 conference in Miami this April.

This is a guest post by Mike Hobart. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.