DOT Price Analysis: Is Polkadot Due for Massive Volatility Around $6?

Polkadot’s price has seen a significant decline and found support around the critical $6 mark, exhibiting slight fluctuations indicative of low volatility.

However, it’s noteworthy that the cryptocurrency remains firmly within a pivotal range, hinting at an imminent breakout.

Polkadot Price Analysis: Technicals

By Shayan

The Daily Chart

An in-depth examination of the daily chart reveals a period of subdued price action and sideways consolidation near the $6 mark following a substantial drop below the 100 and 200-day moving averages. This pattern reflects an overall bearish market sentiment, with sellers currently in control.

However, Polkadot is presently contained within a decisive range, marked by the support at $6 and the significant 200-day moving average at $6.93.

A bullish surge above the 200-day moving average could pave the way for sustained upward momentum, targeting the pivotal $10 mark. Conversely, if the bearish momentum persists, a continuation of the downtrend toward the substantial $5 support level becomes increasingly likely.

The 4-Hour Chart

A detailed analysis of the 4-hour timeframe indicates that following a notable drop triggered by a significant long-squeeze event, the downward momentum was met with intensified demand, leading to a modest rebound near the critical $6 level.

Moreover, a visible bullish divergence between the price and the RSI indicator on the 4-hour chart also suggests the potential for corrective retracements in the short term. In this scenario, DOT will be more likely to continue its corrective movement, with the next targets lying within the price range between the 0.5 ($7.4) and 0.618 ($7.8) Fibonacci levels.

In summary, Polkadot remains within a pivotal range, bounded by $6 and $9 in the broader perspective, and is expected to oscillate within this range until a breakout occurs.

Sentiment Analysis

By Shayan

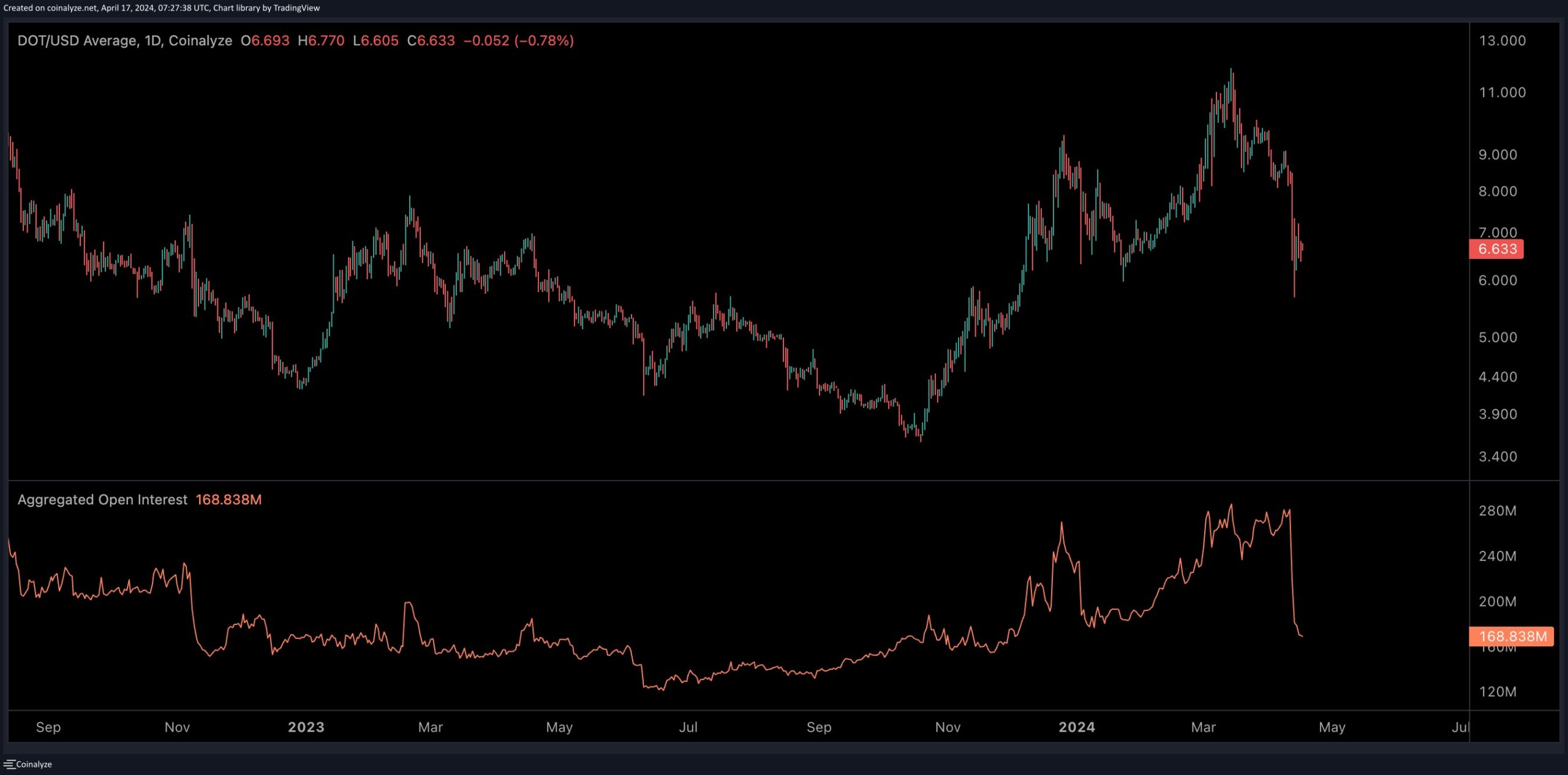

During the recent movements, the perpetual futures segment has exerted considerable influence over crypto prices. When this market becomes overheated, characterized by aggressive long and short positions, it tends to spur heightened volatility and sudden price shifts. Thus, gauging the futures market’s state is a valuable tool for predicting incoming dynamics.

A relevant metric in this evaluation is Polkadot’s Open Interest (OI) chart, which tracks the sentiment within the futures market alongside price movements. It quantifies the number of open perpetual futures contracts across various crypto exchanges. Typically, higher OI values correlate with increased volatility, and conversely, lower values signify calmer market conditions.

Examining the following chart reveals a notable downturn in both the OI metric and the price of Polkadot. This decline coincides with recent geopolitical tensions in the Middle East, which have exerted downward pressure on market sentiment. The substantial drop in Open Interest primarily stems from the liquidation of a significant number of long positions in the perpetual markets.

Consequently, the market appears to be undergoing a period of cooling off, potentially setting the stage for a renewed influx of both long and short positions in the futures market. This, in turn, could catalyze a fresh surge in market activity and raise the possibility of intensified volatility.

This post is powered by Polkadot.

The post DOT Price Analysis: Is Polkadot Due for Massive Volatility Around $6? appeared first on CryptoPotato.