Don’t Overlook Tokyo and Hong Kong as Crypto Hot Spots

As CoinDesk publishes its list of global crypto hubs, there are two striking omissions. Tokyo and Hong Kong are very publicly welcoming crypto at a time when other jurisdictions, notably the United States, are sending a far less friendly message. So why didn’t they make the list? One possible reason is that even though neither are new to crypto, both retreated from the spotlight for some period of time. But now, Japan and Hong Kong are poised to become increasingly important players in the crypto world.

Emily Parker is CoinDesk’s executive director of global content.

Let’s start with Japan, which is actively trying to position itself as a Web3 powerhouse. To be clear, Japan is hardly a newcomer. But after the cryptocurrency exchange Coincheck was hacked in early 2018, the country went into something like hibernation. Regulators tightened the reins, and the mood in the crypto community was not particularly upbeat.

Now, Japan is clearly back. Regulators learned lessons from the Coincheck hack and that of Mt. Gox before it, and put in place safeguards to protect users. So when much of the crypto world was reeling from the collapse of FTX, FTX Japan users were relatively protected. Some politicians in Tokyo are actively seeking to lay out clear rules of the road for crypto.

Hong Kong is another hub that is hardly new to Web3, but in recent years its appeal may have been tempered by COVID-19 lockdowns and headlines about mainland China’s crackdown on the crypto industry. But now, Hong Kong is making a clear effort to position itself as a global crypto destination. Hong Kong began accepting licenses for crypto exchanges in June, and has reportedly pressured banks to take on crypto exchanges as clients.

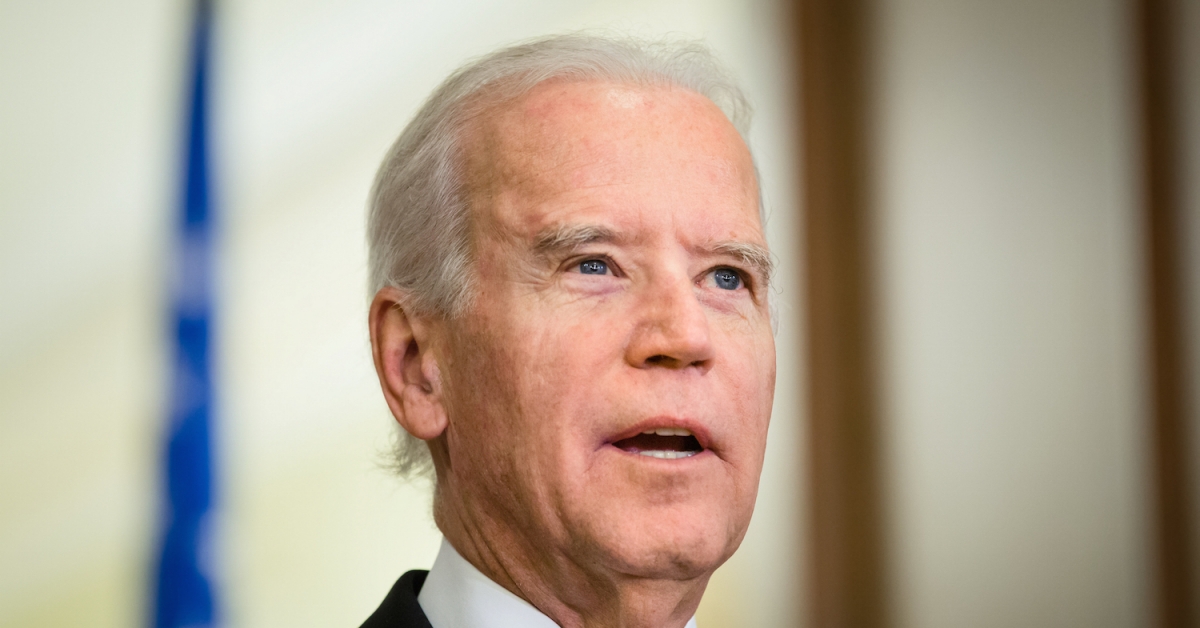

Where the United States sees risk, Hong Kong sees opportunity. In the midst of Coinbase’s battles with the SEC, a Hong Kong lawmaker invited the U.S.’ largest crypto exchange to apply to operate in the region. Hong Kong’s position is striking given the history of crypto crackdowns in mainland China, which appears to at least tacitly support Hong Kong’s welcoming stance. For now, at least.

This is not to say that it will be easy to operate crypto exchanges in Hong Kong or Tokyo. Operating in these jurisdictions comes with significant rules and restrictions, and some global companies may find it difficult to survive there. Both Kraken and Coinbase recently left Japan, for example.

Nonetheless, these two jurisdictions have made it clear that they are open for crypto business, and are thus likely to attract crypto businesses from around the world.