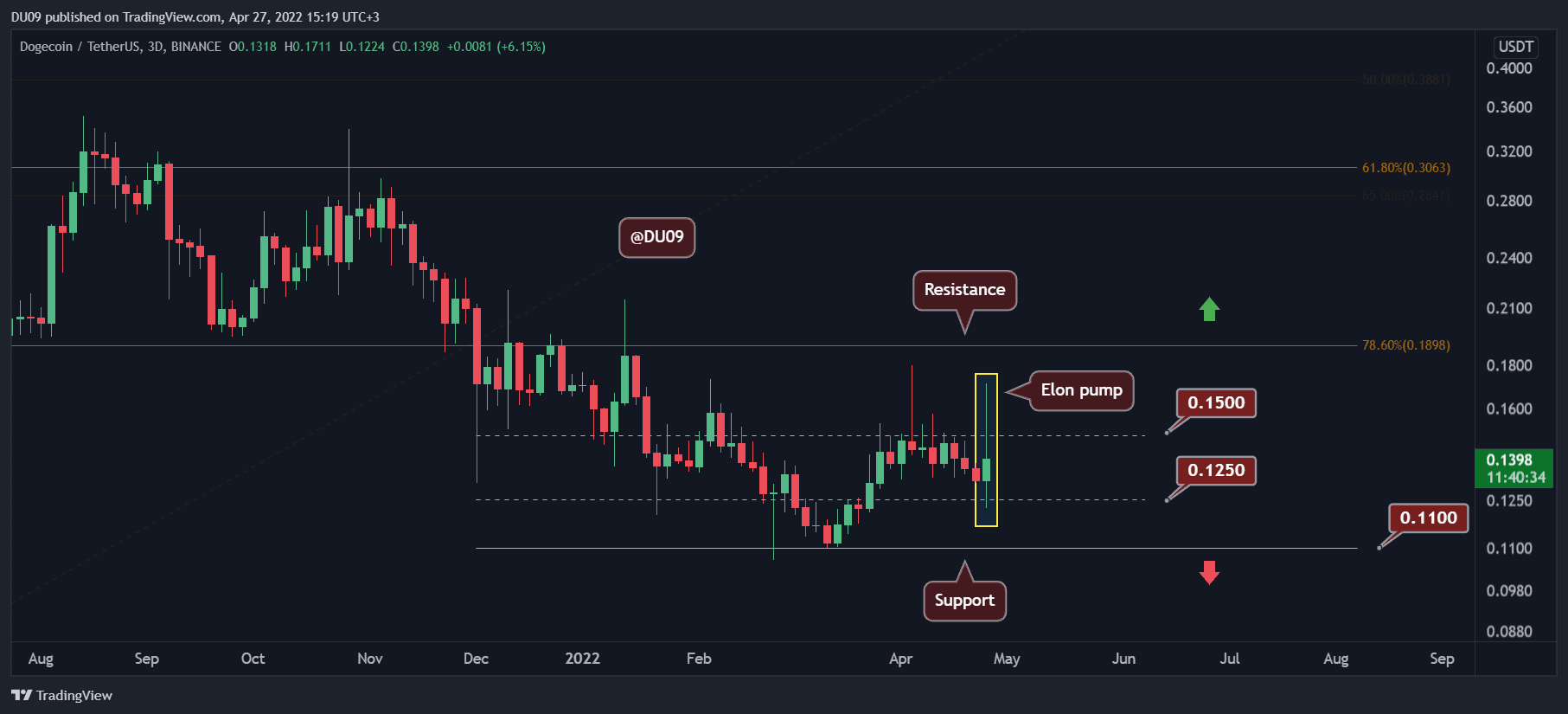

Dogecoin Volatility with 40% Surge and Retracement, Where to Next? (DOGE Price Analysis)

Dogecoin rallied 40% this week when the news that Elon Musk has bought Twitter was confirmed. Elon hinted in the past that Twitter could use Dogecoin for payments.

Key Support levels: $0.125, $0.11

Key Resistance levels: $0.15, $0.19

DOGE was an outlier on Monday, exploding in price and increasing by 40% before bears took over the price action. Since then, the cryptocurrency has fallen back into a range between $0.125 support and $0.15 resistance. This indicates a flat trend.

Buyers could not sustain such a rally, particularly when most of the market remains bearish. Therefore, a new push will be needed to break this range.

Technical Indicators

Trading Volume: The volume exploded similar to the price, but the excitement was short-lived. Since Monday, every day saw a lower high in volume.

RSI: The daily RSI continues to remain flat at around 50 points. The recent increase in price was not sufficient to change this trend.

MACD: The daily MACD remains bearish, and the Monday price action helped to speed up a possible crossover to the positive side. This is still pending, and a clean break of the resistance at $0.15 is needed to return to the uptrend.

Bias

The bias for DOGE is neutral.

Short-Term Prediction for DOGE Price

Dogecoin continues to be in the spotlight, and Elon Musk’s passion for this cryptocurrency gives hopes of future adoption on Twitter. Such fundamental changes could be bullish for DOGE, but right now, its price remains stuck in a flat trend. Turning the resistance at $0.15 into support is essential if DOGE is to move higher from here.