Dogecoin Registers Biggest Single-Day Gain in 4 Months, Futures Open Interest Tops $500M

Meme cryptocurrency dogecoin (DOGE) jumped 10% on Tuesday, registering its biggest single-day gain since April 3, according to Binance data tracked by charting platform TradingView.

The cryptocurrency has gained 25% in two weeks amid speculation that the cryptocurrency could be used as a payment mechanism on the rebranded Twitter platform.

As crypto is entering the summer lull that we initially expected for August, DOGE might be the summer’s highflyer as other crypto themes are taking a backseat. Musk is on a marketing tour in re-inventing Twitter,” Markus Thielen, head of research and strategy at Matrixport, said.

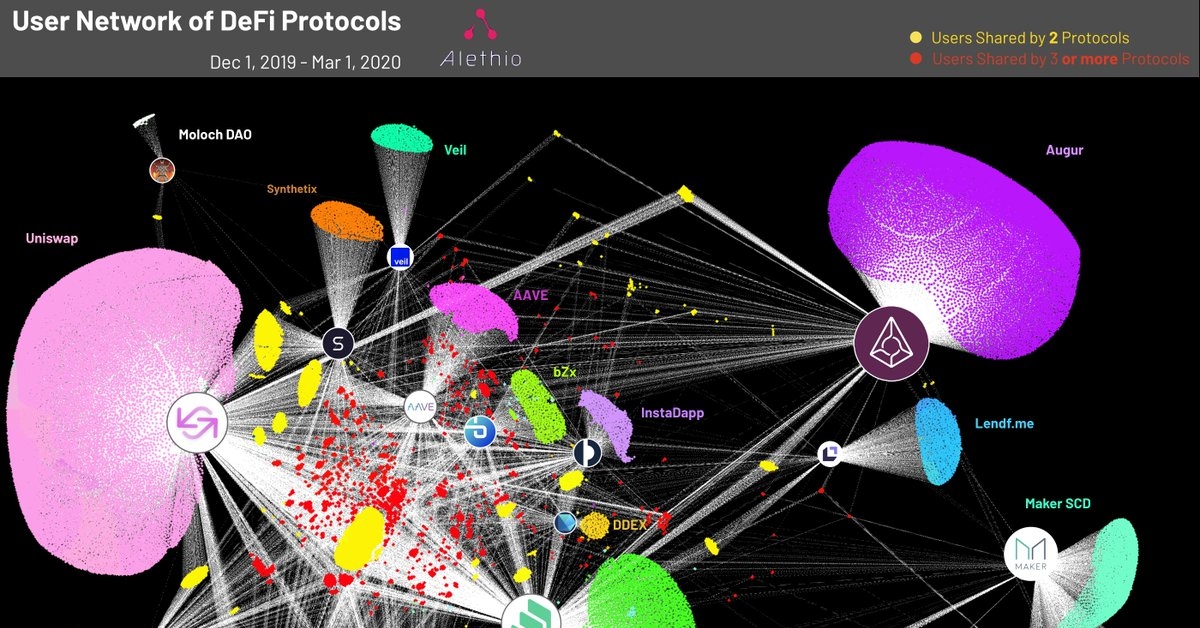

Traders seem to think the same, as evident from the pick-up in the perpetual futures market tied to DOGE.

The notional open interest, or the dollar value locked in the number of active perpetual futures contracts, has topped the $500 million mark for the first time since April 19, per data tracked by Coinglass. The tally has more than doubled in two weeks. In DOGE terms, open interest has surged to 6.2B, nearing the peak of 6.43B reached on April 8.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/CH5VYRAXLVDDRKHVTR3T2FSQQE.png)

A combination of an increase in open interest alongside a rise in price suggests an influx of new money into the market and is said to confirm an uptrend.

However, at press time, the open interest weighted-funding rates have dropped to zero, suggesting a balance between bullish long and bearish short positions.

Perhaps, DOGE may see a bull breather after the recent market-beating performance. Funding rates refer to the costs of holding long/short positions, with positive readings implying a dominance of longs.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/5SWAPDQ76NFD7OJALEA3T52SZU.png)